Here's some quick tips on how to customize your employee's hourly rate of pay when handling payroll using Sage 50 CA's payroll module.

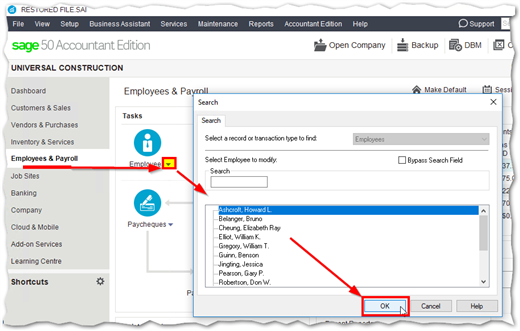

STEP 1: Go to the Employees & Payroll module, then open up the individual employee's profile by going to the Employees icon > Modify employee, select the employee and click OK.

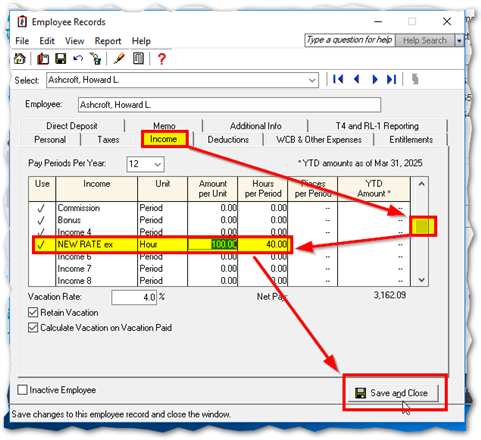

STEP 2: Once you select the employee and have their profile open, see the income tab. Scroll down in the table to the extra Income lines.

- Note you can rename Income to regular rate, overtime etc under the Setup menu >Settings > Payroll > Income.

Here's a screenshot ex of an employee profile with a NEW RATE ex row with updated amount per unit/ hour and hours per period of pay.

What does the add-on module for Payroll in Sage 50  include?

include?

Ensure that you're compliant and up to date with the latest federal and provincial payroll tax tables as soon as they are released by the CRA. As listed on our site here, the main features of the payroll module include:

- Easily preparing payroll cheques or issuing Direct Deposit (via add-on integration past 10 employees*) payments in batches.

- Paying employees salary or hourly pay rates. Easily creating multiple pay rates on-the-fly.

- Calculating withholdings on payroll advances.

- Deducting and remitting the appropriate taxes with certainty.

- Creating custom taxable and non-taxable benefits.

- Posting paycheques into future years.

Training Resources

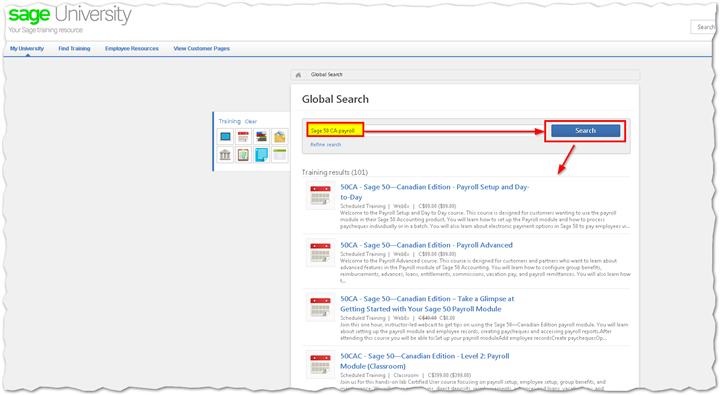

We have a wealth of training options and resources available at www.sageu.com

Once you create a profile and log on, search for "Sage 50 CA payroll" for English language for anytime learning, classroom or virtual classroom options that are scheduled. French language training options can be also be found by searching for "Sage 50CF paie."

More Resources

Thanks for reading!

For more resources visit: Sage Product Support Resources for help with products in North America