What happens if you've advanced your year too far into the future in Sage 50 CA and don't have the option of launching a backup and or don't have time to re-input all the current year entries?

In other words, say it's 2020, you've created the 2020 year in your Sage 50 CA software but realized too late that this meant that your 2018 year (which you're not done entering transactions for) is closed?

The tough part of this scenario, involves realizing that Sage 50 CA only allows you to work with 2 years of active data. Specifically, for the sake of our example, the 2020 (current year) and 2019 (previous year)'s data. Read more about this in articles KB10125 and 10506, see more resources below

|

Year End / New Year Creation |

EN |

FR |

|

Working in 2 years at once - How to post to the previous fiscal year? |

||

|

How to advance fiscal or calendar year? |

||

|

How to enter adjustments in a closed (historical) year |

|

|

|

My fiscal year (or calendar year) has advanced too far |

So, what are some options you have?

Support will advise that the only way to regain access to your Sage 50 CA 2018 data (or data that is now 3 years back) is to launch a backup. This works but then you'll be missing any recent data that's been entered into a more recent version of your company database. Do you have more options? (see below for Alternate Solutions*)

Is importing / Exporting transactions an option?

Historical data transactions cannot be imported into Sage 50 CA. In other words, it's not possible to bring in GL / journal transactions.

See the below resources for more information:

|

Export / Import of Files |

EN |

FR |

|

Importing sales invoices and other transactions in .IMP format |

||

|

How to import/export list of accounts, clients, vendors, employees, stock or projects? |

||

|

How to import/ export using a CSV file? |

||

|

Import/Export Inventory |

|

Alternate solutions

What Fiscal period end date should I set? Can I extend my year*?

Instead of having Sage 50 CA close the year for you, you can set the Fiscal Period end date to something far in the future.

Our Sage support colleague @Dmaster let us know that this means:

"You will need to manually close the current earnings to retained earnings on the last date of the fiscal end period."

Speak to your accountant before doing this. However, this is something that you can do manually which will allow you the flexibility of being able to input / update data that is 3+ years old.

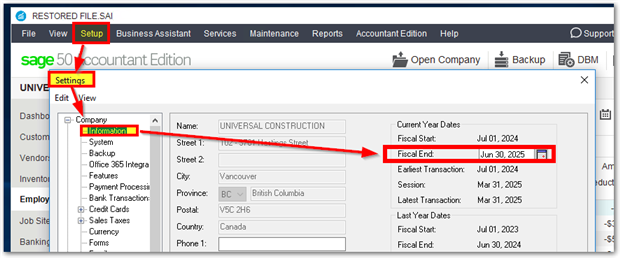

To locate your Fiscal End date go to the Setup > Settings > Company, Information screen and see the right hand size.

- Note that we are logged into the software in single user mode and in sysadmin (the default user)

What changes are coming or expected in Sage 50 CA version 2020?

The biggest change has to do with payroll.

Do you remember when you started the new year and you lost the ability to do payroll for the previous year with automatic deductions? This will now be a thing of the past, even if you start the new calendar year by accident! You will no longer lose the automatic payroll calculations feature. Find out more next week!

Thanks for reading!

For more resources visit: Sage Product Support Resources for help with products in North America