In my previous blog "How to setup an IAS/IFRS depreciation plan?" I have discussed how to configure an IAS/IFRS depreciation plan and in this blog, let me show you how to generate an entry against an IAS/IFRS plan.

Below some of the areas where you can identify the IAS/IFRS settings required when processing accounting entries.

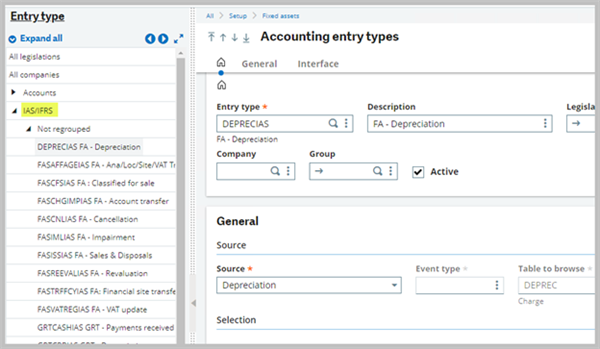

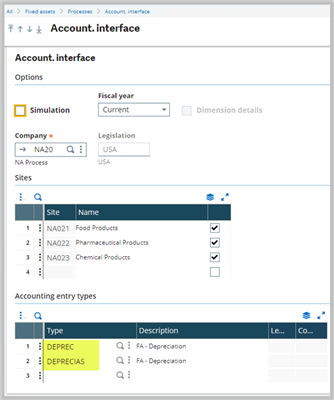

Accounting entry types:

Along with the standard Accounting entry types, IAS/IFRS accounting entry types are also available in Setup, Fixed assets, Accounting entry types, under IAS/IFRS group.

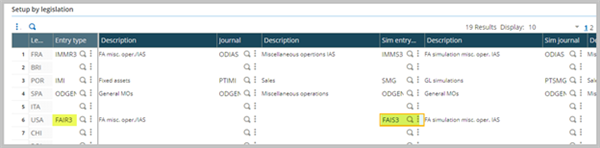

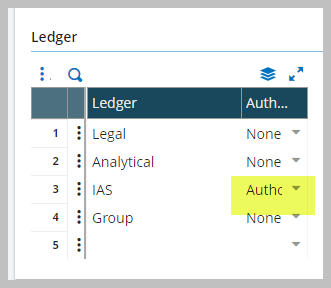

Document types:

You can tunnel into the document types specified on the IAS/IFRS accounting entry type and notice that the IAS ledger must be authorized.

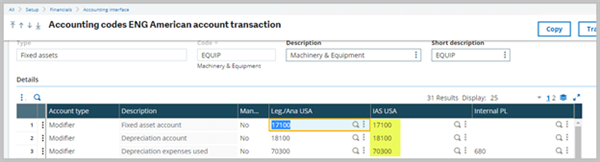

Accounting codes:

For IAS/IFRS posting we must specify the IAS COAs, add the IAS chart under accounting code entry transactions and list the GL accounts for the fixed assets accounting codes.

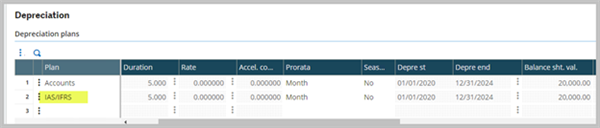

Fixed Assets:

When you create a new asset, the IAS/IFRS plan will show up after the Accounts plan under the depreciation tab.

Generation of Accounting entries:

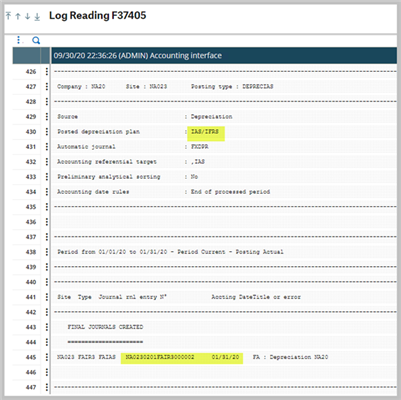

Generate a depreciation entry for Accounts and IAS/IFRS plan.

- Log file will indicate the depreciation entries posted against the IAS/IFRS plan.

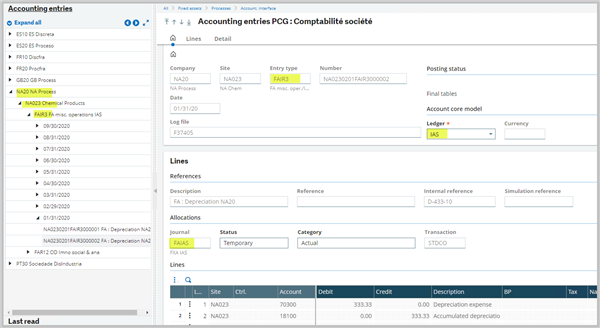

Accounting entries:

Accounting entries are listed under the company document type.

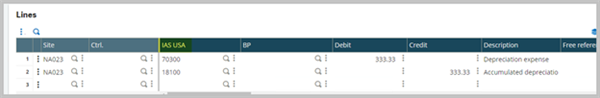

Accounting journal for the depreciation expense

Similarly you can use the other accounting entry types to generate entries against the IAS/IFRS plan.