In Sage X3 fixed assets module we have the option to setup an IAS/IFRS plan and generate entries against the IAS ledger. IAS stands for International Accounting Standards while IFRS refers to International Financial Reporting Standards.

To setup the IAS/IFRS plan we need make sure the Fixed assets is active and licensed.

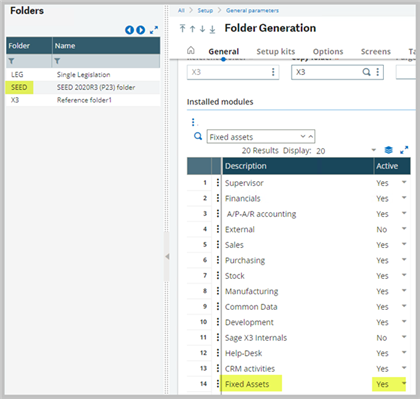

1. In Setup, General parameters, Folders select the folder where you are setting up an IAS/IFRS plan, under General tab find the Fixed assets module. It must be set to ‘Yes’.

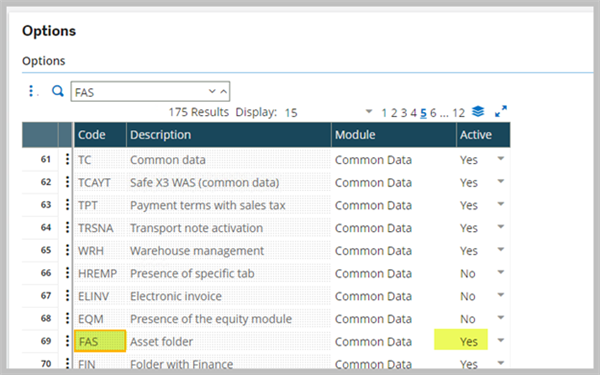

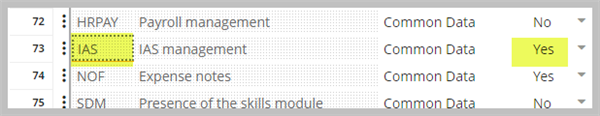

2. Activity codes FAS, FASNA and IAS are active (Options grid).

- IAS allows for the use of the IAS ledger

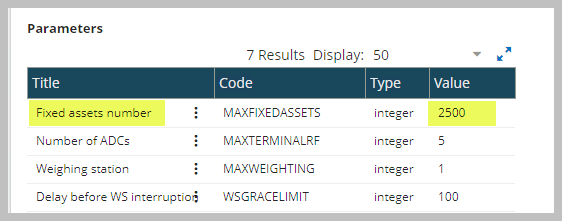

3. License authorizations are required for some or all the assets. Sage X3 base license includes up to 2500 assets. Additional licenses can be purchased separately.

- In Administration, Licenses, License data select Sage X3 product and all the way at the bottom of the page you can find the Fixed assets number MAXFIXDASSETS value.

4. Once you have verified that the Fixed assets module is active and licensed, next check the company that you are going to use to generate entries against the IAS/IFRS depreciation plan.

- Company account core model must have the IAS ledger type defined, IAS depreciations checked, and Main IAS general ledger is set to ‘IAS’.

- IAS ledger will have its own ledger and its chart code. Note, main IAS ledger cannot be identical to the main general ledger or to the main analytical ledger.

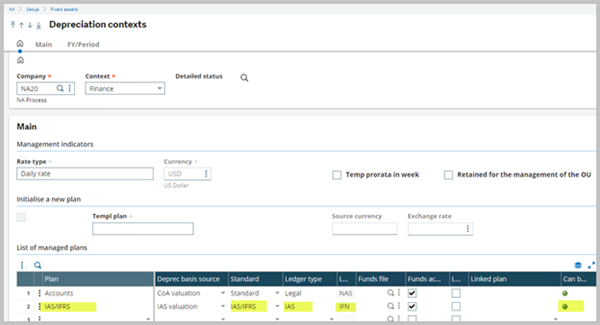

5. In Setup, Fixed assets, Depreciation context, add the IAS/IFRS plan to an existing depreciation context or generate a new context and assign the IAS/IFRS plan to it.

- Select ‘IAS valuation’ for Depreciation basis source, ‘IAS/IFRS’ for the standard column, and ‘IAS’ for the Ledger type.

- Once you assign a new plan to an existing depreciation context all the asset records will show the new plan after the Accounts plan.

On my next blog, I will show you how to generate a depreciation entry for an IAS/IFRS plan.