We have a special release this month for Sage 50 CA which does NOT include new tax updates. The next payroll tax update is scheduled to be released in June as usual.

Users (starting with those on the Quantum edition) can expect to see an install message April 24th. If the controlled release goes as planned, then all users will be notified by May 1st. The schedule may change based on server loads and other factors.

- CD's for users on shipping plans will be sent out on May 1st.

See this video or read on below to learn about the 3 new features:

The 3 New features in Sage50cloud release 2019.2 include:

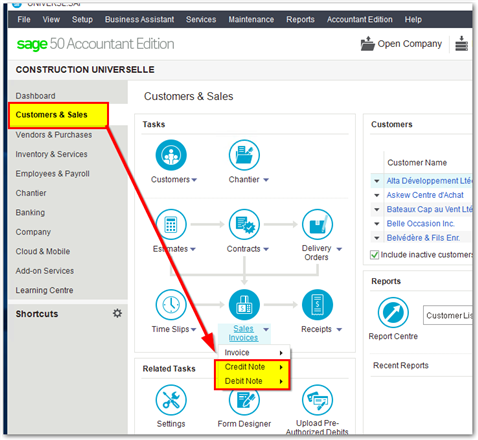

1. Credit Notes and Debit notes for customers and vendors

To locate this new feature visit the Customer & Sales or Accounts Receivable module, depending on your settings.

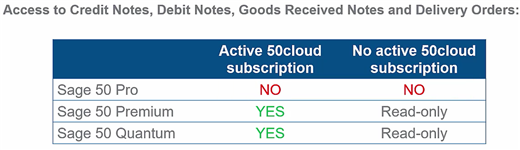

- Note: This feature was Included in release in 2019.1 but known issues are now resolved . Also note that this feature is only available in Premium and higher editions on an active subscription.

What are Sales Credit Notes?

Credit Notes allow to easily reduce the quantity or amount invoiced. It's useful to easily issue a credit to customers, or to record credit notes that you receive from vendors.

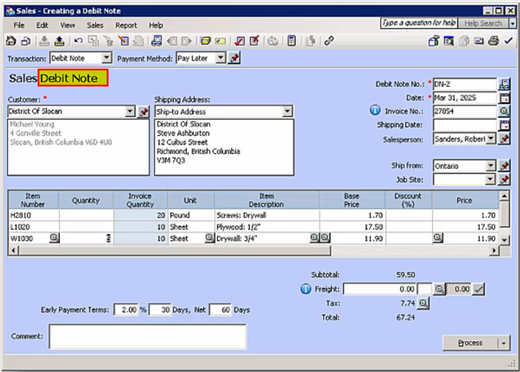

What are Sales Debit Notes?

Debit Notes allow you to increase the quantity or amount invoiced.

Where can you find Debit and or Credit Notes?

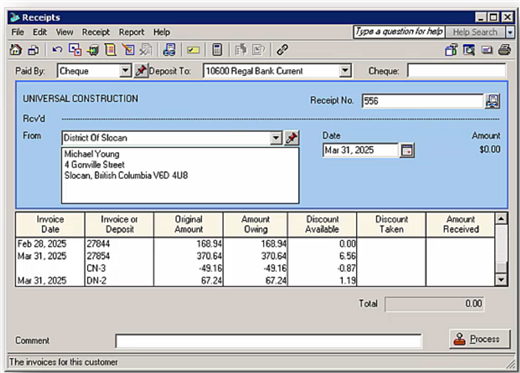

Outstanding customer credit notes and debit notes appear in the receipts journal, along with outstanding customers invoices:

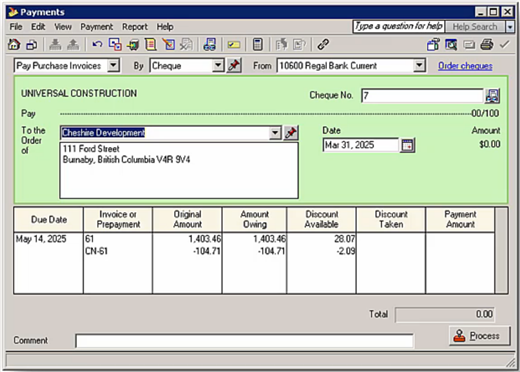

Outstanding vendor credit notes and debit notes appear in the payments journal, along with outstanding vendor bills.

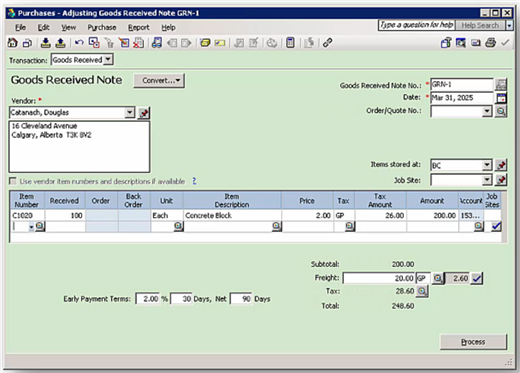

2. Goods Received Notes for vendors

If you've received goods from a supplier but received the invoice at a later date can be recorded using a Goods Received Note. This allows you to update your inventory quantity and value, making it easier to track stock levels and enables received goods to be available in other transactions.

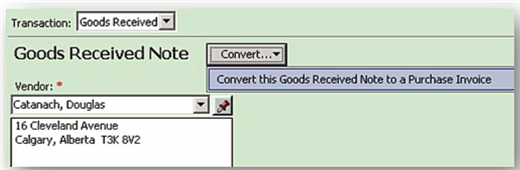

When the invoice is received at a later date, the Goods Received Note is converted into a purchase invoice in a few clicks.

3. Delivery Orders for customers

- Note: This feature was Included in release in 2019.1 but known issues are now resolved . Also note that this feature is only available in Premium and higher editions on an active subscription.

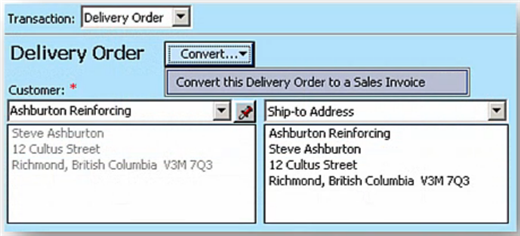

Delivery Orders are the equivalent of Goods Received Notes but for the Accounts Receivable (AR) module. It allows you to record the delivery of goods or services which have not yet been invoiced to your customers.![]()

When a Delivery Order is recorded, your inventory quantity and value are updated making it easier than ever to keep track of your stock levels.

When you are ready to invoice your customers, a Sales Invoice can be created in a few clicks from the Delivery Order.

For more details about the Sage 50 CA 2019.2 release please review the What's New PDF document (Click here for French) as it includes some other resolved issues.

Thanks for reading!

For more resources visit: Sage Product Support Resources for help with products in North America