The original blockchain technology for tracking who did what and when. Why does it matter if your accounting software uses an audit trail or not? Did you know that if you are ever up for auditing by an official, an audit trail is what legitimizes your financial records? Sure you can buy insurance against the risk but why pay extra with a competitor for that service. An audit trail provides documented evidence of the sequence of activities relevant to activities. Auditors want to see everything, every line transaction, every modification by a user, every error, every correction, credit or refund. Accountability requires transparency.

Transparency also requires strong data management security practices.

(Hey officer, how did the hackers get away? … I don't know… ransomware).

What you want, is to make it extremely difficult for hackers to get your data. If you're using Sage to manage your customer records and transactions, your database is inaccessible unless the logon and password and software install is available to the criminal. It's not likely that they would be willing to invest 2 hours or so to learn how to install and restore a backup.

It would be extremely difficult if not impossible, to piecemeal together useable data by accessing your Sage database's folders which is a major benefit of using Sage software.

Top 3 benefits of having an Audit Trail:

- Maintaining a strong audit trail is critical in network forensics in order to provide accountability.

- Next is reconstruction. Network forensic specialists can piece together a series of related activities sequentially before and during a security incident.

- Anomaly detection is another benefit because log data provides raw materials for spotting any suspicious activities.

About Sage 50 CA's Audit Trail Report

How do you check who posted a transaction and more? KB 24794 tells us that you'll need to:

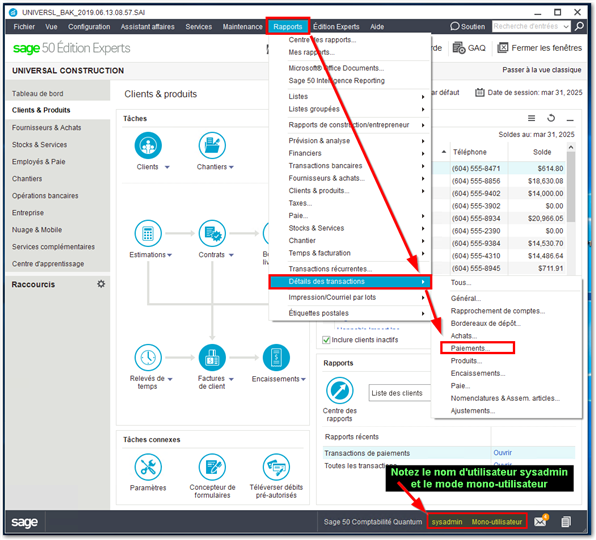

STEP 1: Sign into Sage 50 as the default user of sysadmin

STEP 2: Click Reports

STEP 3: Click Transaction Details or Journal entries

STEP 4: Select desired report

For our example we selected the payments report while logged in as sysadmin in single-user mode.

STEP 5: Put check mark in show User in All Transaction - Modify Report Window

STEP 6: Enter required dates and click OK

STEP 7: If you have other users with their own passwords and usernames to access Sage 50 CA's database set up, then the report will show Transaction entered by: xxxxx

How do I create other user access to Sage 50 CA?

To create a another Sage 50 CA user with their own password and perhaps restricted access to sections of data see this resource:

|

|

EN |

FR |

|

How do I setup multi-user mode |

What else to know?

If you press F1 on your keyboard when in Sage 50 CA you'll launch the help screen where you can search for "Audit Trail" and get the resource below.

As part of your period-end and year-end procedures, you are required to print out records of your business operations for your accountant, providing information on financial transactions during a specific period.

|

Report |

Month End |

Calendar Year End |

Fiscal Year End |

|

Income Statement (month-to-date) |

x |

|

x |

|

Income Statement (year-to-date) |

x |

|

x |

|

Balance Sheet |

x |

|

x |

|

Transactions By Account (past month) |

x |

|

x |

|

All Transactions (past month) |

x |

|

x |

|

Chart of Accounts |

x |

|

x |

|

Cheque Log (for purchases and payroll) |

x |

|

|

|

Direct Deposit Log |

x |

|

|

|

Vendors and Purchases |

|

|

|

|

Purchase Transaction Details |

x |

|

x |

|

Payment Transaction Details |

x |

|

x |

|

Vendor Aged (summary and detail) |

x |

|

x |

|

Customers and Sales |

|

|

|

|

Sales Transaction Details |

x |

|

x |

|

Receipts Transaction Details |

x |

|

x |

|

Customer Aged (summary and detail) |

x |

|

x |

|

Payroll |

|

|

|

|

Payroll Transaction Details (past month) |

x |

x |

|

|

Employee Year-to-date summary |

|

x |

|

|

Employee Detail |

|

x |

|

|

T-4 slips and summary |

|

x |

|

|

Releve 1 slips and summary |

|

x |

|

|

Payroll Remittance report |

At the end of the remittance reporting period (for the amounts owed to government tax authorities.) |

|

|

|

Inventory and Services |

|

|

|

|

Inventory (Quantity and Summary) |

x |

|

x |

|

Item Assembly Transactions (past month) |

x |

|

x |

|

Adjustment Transactions (past month) |

x |

|

x |

|

Tax reports for the taxes you report |

End of tax reporting period |

|

|

|

Account Reconciliation (summary and detail) |

During and after reconciliation |

|

|

Published: June 12, 2019

What about the audit trail of other Sage software options?

Whether you select Sage 50 for its integration abilities with other essential business software such as Microsoft's Office 365; or whether you go for a startup small business software solution that is fully cloud based such as Sage Business Cloud Accounting; or go bigger with a mid-market product line such as Sage 300. Sage has you covered for audit trail technology.

Other Resources

|

The YEAR-END CENTER |

Thanks for reading!

For more resources visit: Sage Product Support Resources for help with products in North America