In this blog let us look at some of the recent changes to periodic accruals.

This functionality is used to generate charges or revenue for a given date and for a given period.

Previously, we used the general parameter ITAPRE (analytical apportionment) for accrual management located under LOC chapter and ITA group.

Currently, we have a dedicated activity code, “SVC” (Periodic accruals) and a general parameter SVCFLG to enable the accruals.

This parameter is located under TC chapter and SVC group.

Additionally, we have the following general parameters and associated auto journals to record revenue and expenses.

- GAUKIK1 = KIK1: to record revenue accruals for customer invoices

- GAUKIK2 = KIK2: to record expense accruals for supplier invoices

- GAUKIK3 = KIK3: to record revenue accruals for sales invoices

- GAUKIK4 = KIK4: to record expense accruals for purchase invoices

These changes were introduced in 2020 R4 (12.0.24), where analytical apportionment, the ability to generate journal entries that distribute invoice amounts across the periods has been removed from the “KIT” (Italian legislation) activity code.

In order to generate periodic accrual journals, service dates must be entered and they can be entered in Customer BP invoices, Supplier BP invoices, Purchasing Invoices and Sales Invoices.

We can generate the accrual journals when,

1) SVCFLG = No: we need to check the following.

a) Specify the accrual automatic journal codes for the following parameters in CPT chapter and CLO.

- GAUCCA (Expense accruals journal) = CCA

- GAUPCA (Revenue accruals journal) = PCA

b) Optionally, you can set the SVCCLOPER (Period closing accruals ctrl.) parameter to blocking or not blocking.

- When it is set to “Not blocking”, there will be a verification done prior to closing the last period of the fiscal year and verify whether the accruals were generated or not.

- When it is set to “Blocking”, it will prevent the period from closing, and you will receive the following error if the accrual entries were not generated.

- Error: “$VERF_SVC ## (invoice sequence number) Revenue accruals not posted”.

c) TYPGNRSVC (Accrual generation type) parameter can be set to either “1 document per invoice” or “1 document per BP”. It determines the management level of the accrual journals.

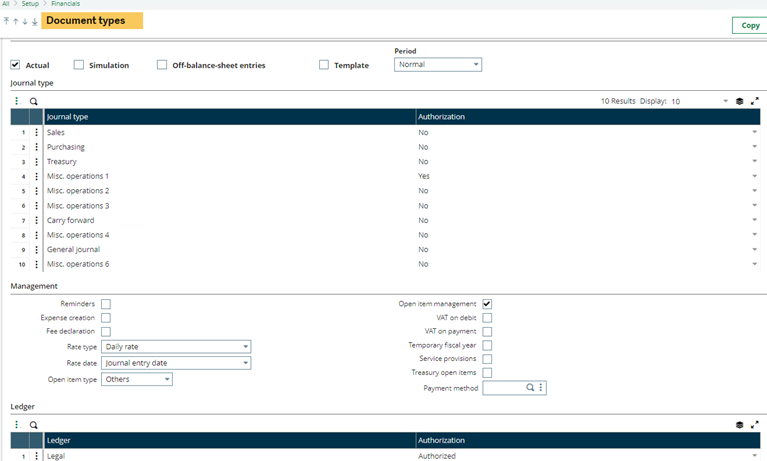

d) VCRTYPSVC (Accruals entry type) parameter defines the default journal type used when running the accruals postings.

- Note, The document type defined in parameter VCRTYPSVC cannot have the flag "VAT/debits" active, because no VAT line will be generated.

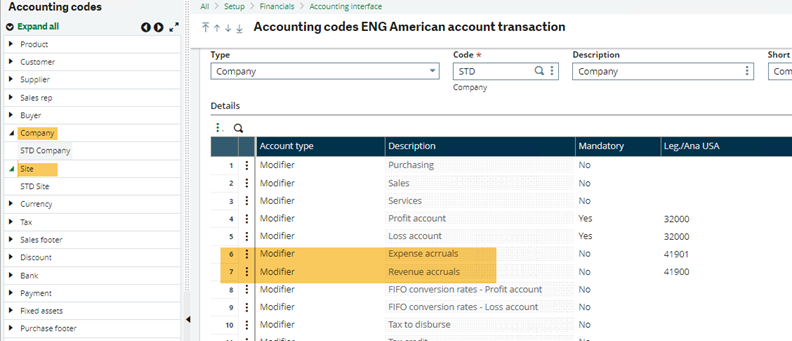

e) Assign a GL account for the company and site accounting code lines 6 (expense accruals) and 7 (Revenue accruals).

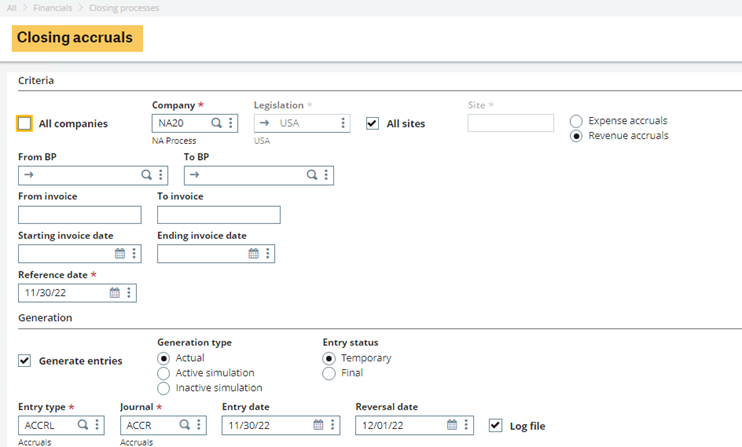

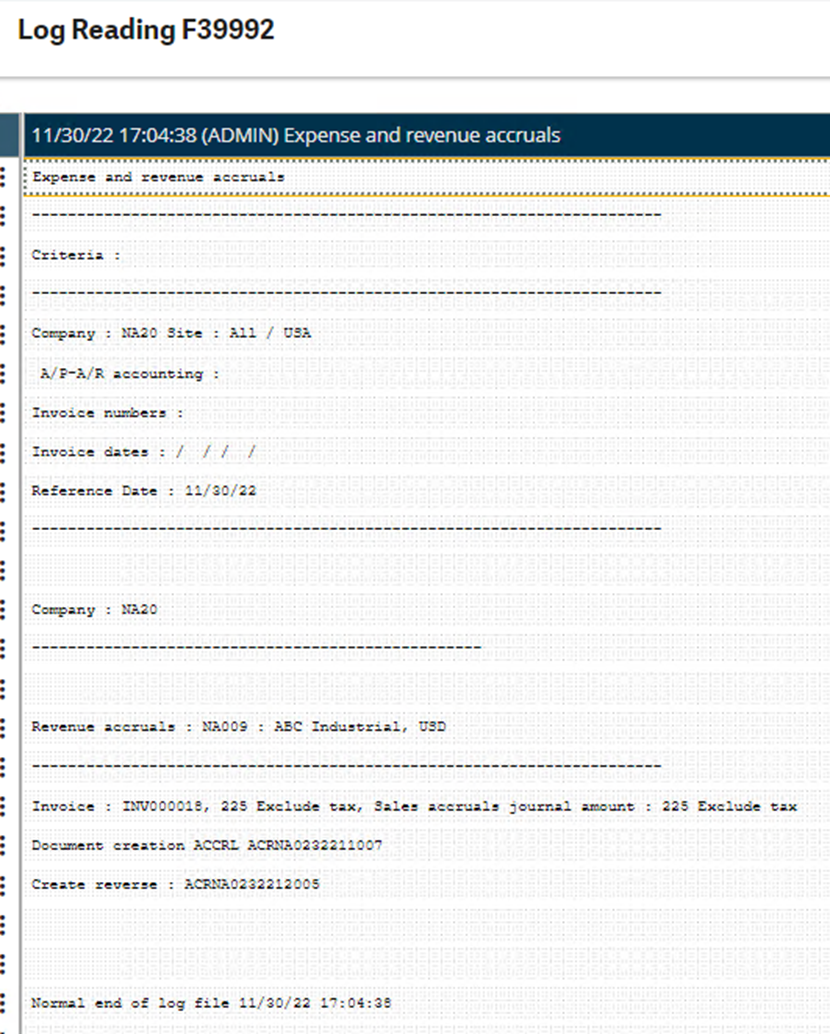

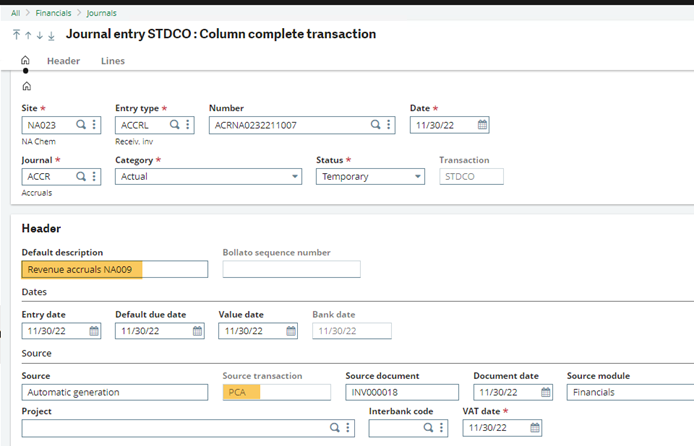

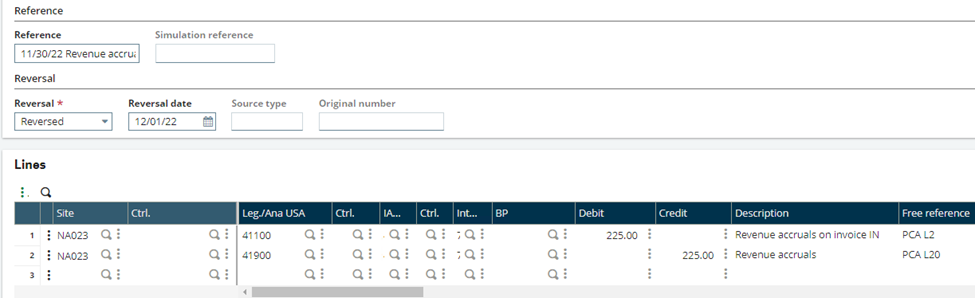

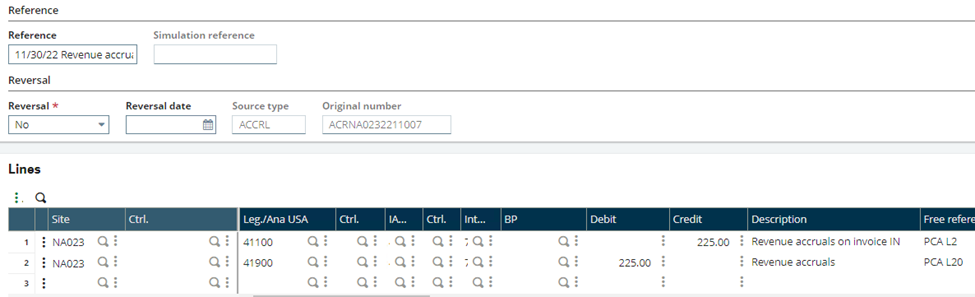

f) Once the invoices with the service dates are posted run the Closing accruals (CPTSVC) function under Financials, Closing processes to generate the accrual entries.

- Generally, you will run this process at the end of each period.

- In GESGAS you can review the generated accrual entries.

- Additionally, you can use the CPT010 Purchase accruals in progress and CPT011 Sales accruals in Progress report to view the accrual invoices.

2) SVCFLG = Yes

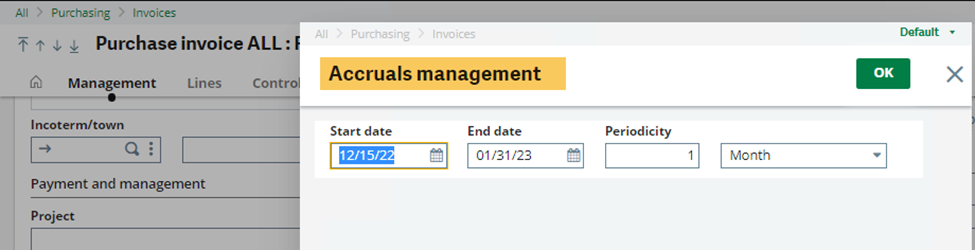

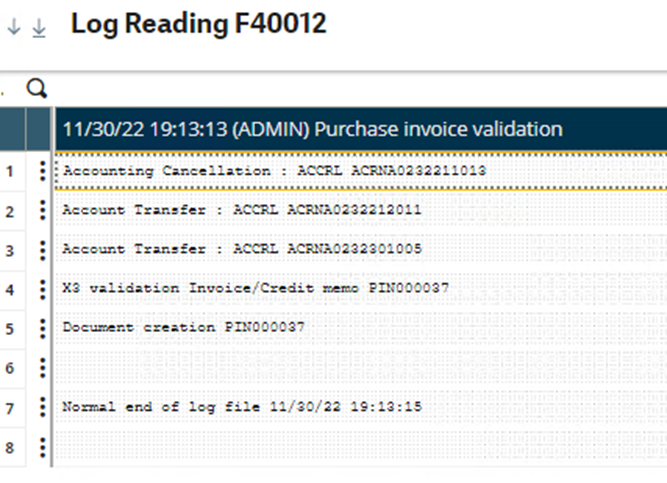

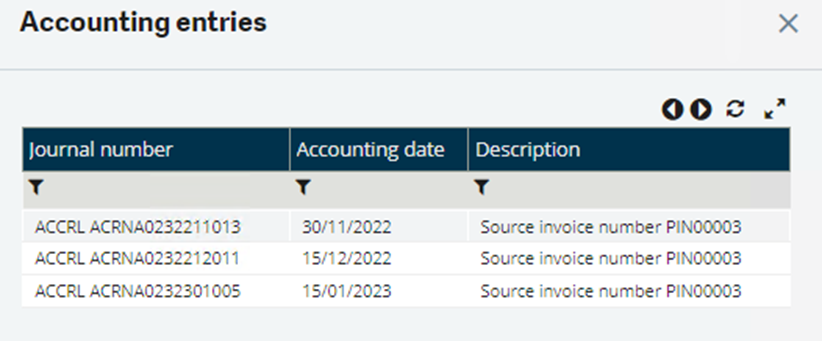

a) Accrual entries will be generated once you validate the invoice and according to the defined periodicity in the accruals management window /the line.

- Regardless of the start date of the accruals, the value for each accrual period will be the same.

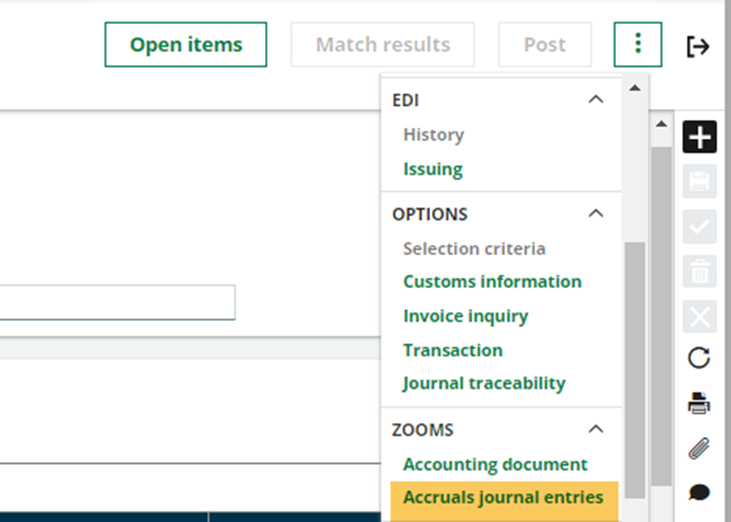

- To view the accrual documents when SVCFLG = Yes, use the ZOOMS, Accruals journal entries menu on the right.

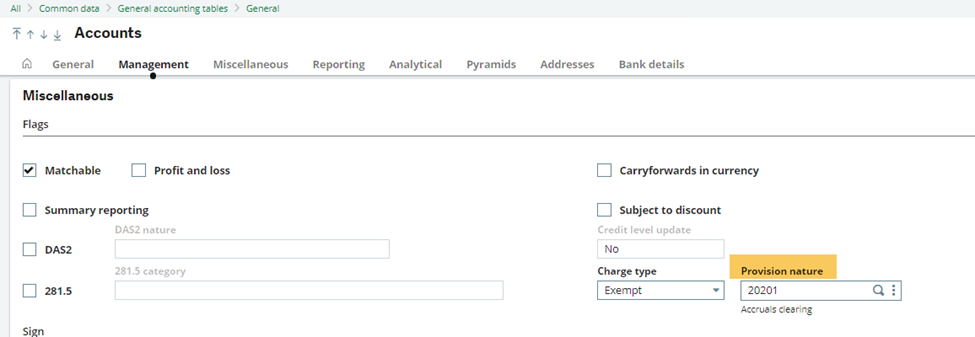

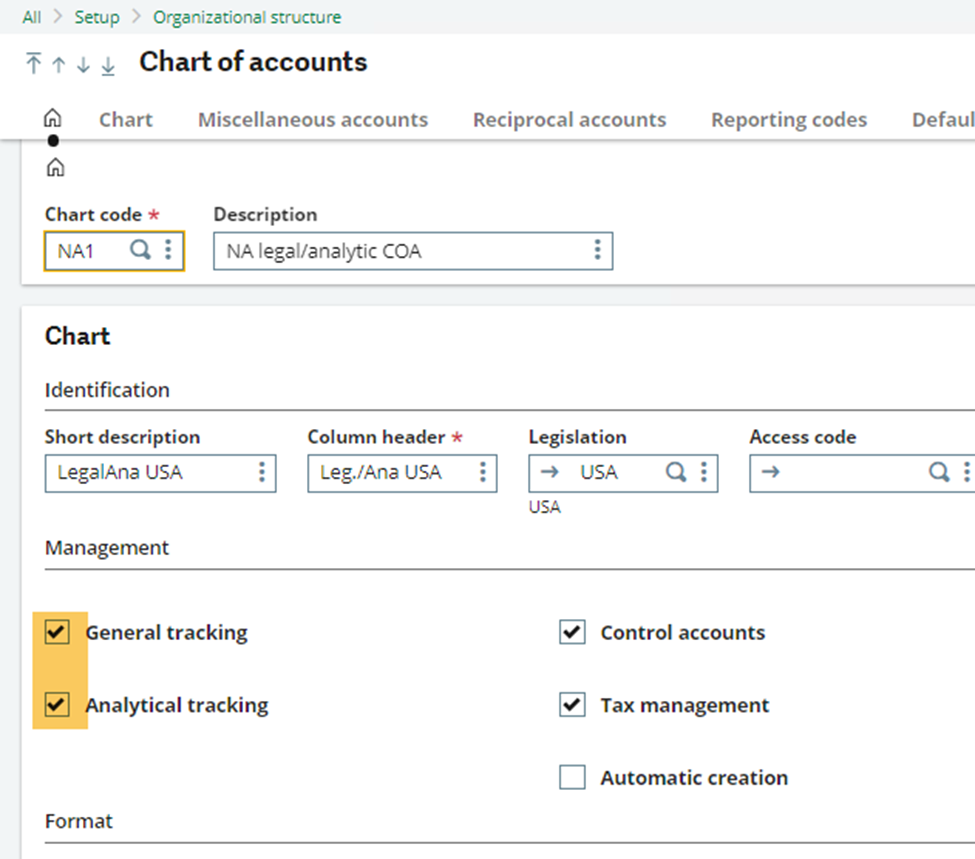

- Note, the field, “Provision nature” for expenditure or revenue accounts (GESGAC) must be filled with an account and this field is only editable for a chart with both General and Analytical tracking flags checked or for the Analytical chart defined in the Account Core Model.

Else, you will receive the following Error: PIN000036 Benefits: 20200: Nature of provision not referenced (30)

-

Martins de Almeida

-

Cancel

-

Vote Up

0

Vote Down

-

-

Sign in to reply

-

More

-

Cancel

Comment-

Martins de Almeida

-

Cancel

-

Vote Up

0

Vote Down

-

-

Sign in to reply

-

More

-

Cancel

Children