Written-down value can be calculated by a method of depreciation that is sometime called the declining (UD) or diminishing balance method. This accounting technique applies a constant rate of depreciation to the net book value of assets each year, thereby recognizing more depreciation expenses in the early years of the asset’s life and less depreciation in the later years of the life of the asset.

In short, this method systematically accelerates the recognition of depreciation expenses and helps businesses recognize more depreciation in the early years.

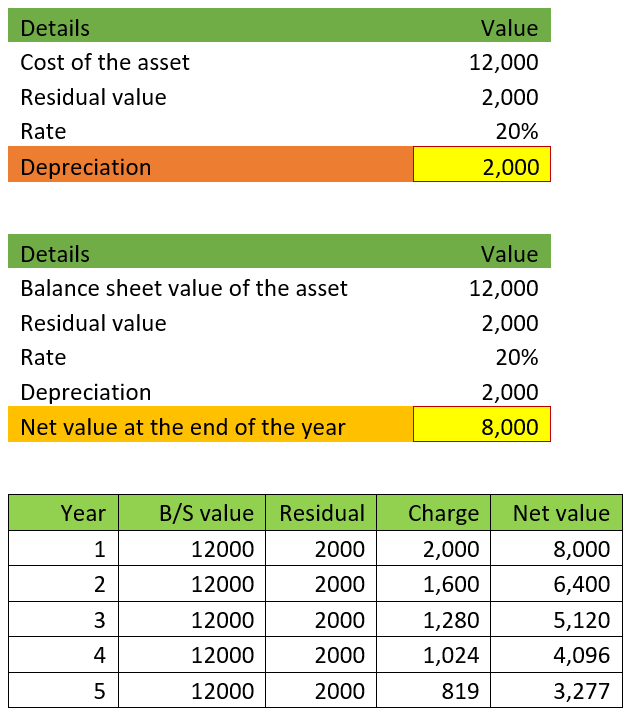

The formula is as follows:

Written down value = (Cost of the asset – Salvage value of the assets) * Rate of depreciation in %

Let’s look at the following values and see how the depreciation charges gets calculated for a free method which can be used to calculate the written down value method.

In the above grid you can see the depreciation charges for the initial year was higher compared to the remaining years.

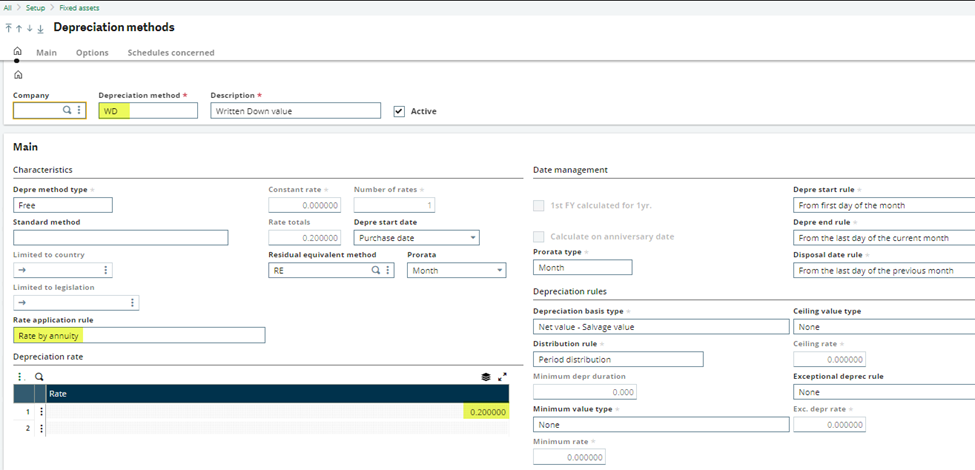

Reason why I couldn’t use the UD method is that the rate cannot be entered. The rate is automatically calculated according to the accelerated coefficient. It’s difficult to achieve the expected depreciation charges.

Whereas using a Free method I can enter a fix rate to calculate written down values.

Setup:

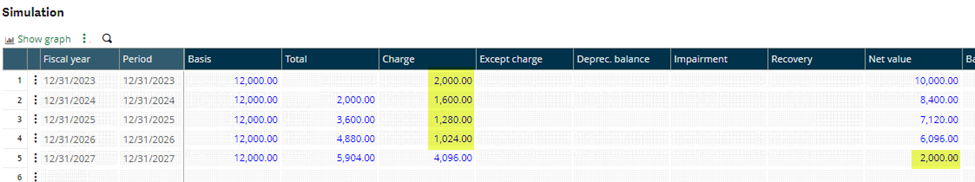

Asset's depreciation grid

Plan simulation screen

That's all I have on this topic and hope you'll find it useful.