The 2022 CA SPSL law requires that we list the number of hours taken on a paystub (or on a memo) even if those hours are 0. The hours can also be reported on a separate insert, but with weekly payroll, that becomes quite burdensome.

According to KB Article 114615, it appears there's still no way to report zero CA SPSL hours taken on a paystub other than on the "standard" check stub. "We are currently testing the Extended and Short stub forms. Please refer to KB 65901 Why is my check stub not printing items with 0 amounts?". I don't see any info as to when this may be resolved.

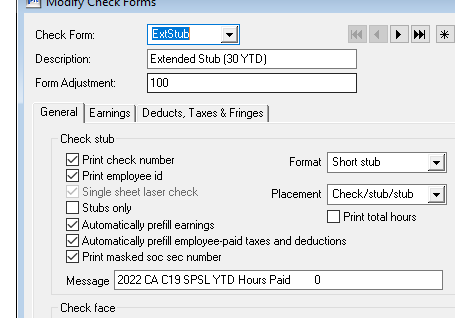

Fortunately, we haven't had many folks need to use CA SPSL so far this year and I was able come up with a solution that works for us. Using "Modify Check Forms" I added a message to the check stub that says "2022 CA C19 SPSL YTD Hours Paid 0". This covers everyone who hasn't taken any hours and has space where I can literally just write in the number of hours taken when applicable. For someone who has received CASPSL pay it will look something like "2022 CA C19 SPSL YTD Hours Paid 32.0". It may not be the most elegant solution, and probably not feasible for larger employers, but it will work for the time-being.

I haven't played around too much, but I think if you've worked out how to list the hours paid when they're not zero, you could probably remove the "message" from the check form and then run those checks separately.

Anyone else come up with a solution that works?