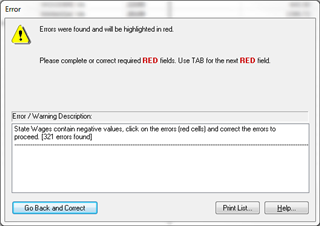

I am using BusinessWorks 2017 SP2. I tried to print my 2017 W-2s and when I got to confirming the state wages the program gave me the following error.

The error appears to be the reduction in taxable state wages caused by a SIMPLE IRA deduction or a Section 125 deduction. I have employees that live in Maryland, Virginia, and West Virginia. The deductions for the Maryland employees did not create a problem but the deductions for the VA and WV employees is giving me the error above.

The program will not allow me to finish the W-2s. If you have any suggestions about what I may be doing wrong or a way to bypass this error it is greatly appreciated.