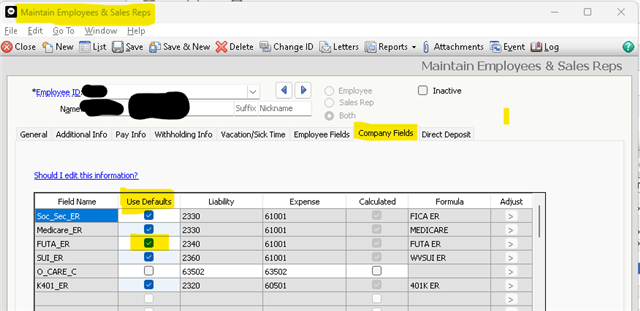

We recently had an employee move from one state to another. I did see that Sage50 suggests creating separate Employee IDs for each state the employee works in and I have done that and I think I have the state unemployment set up correctly. Now my concern is that for the remainder of the year we will be double paying federal unemployment. Is there something else I need to do to fix this problem or will I just have to remember to zero out the FUTA_ER for each pay period for the rest of the year?

150

113