When generating a sales document, sometimes there is a need to bypass the Avalara tax calculation especially when that country is not using Avalara tax calculation.

Now with the new enhancement that was implemented in Sage X3 V12, when a customer has an address in a county that is not using Avalara tax calculation, the Entity/Use field is populated and it is possible to enter a code to exclude that address from tax calculation.

Here is how to it works:

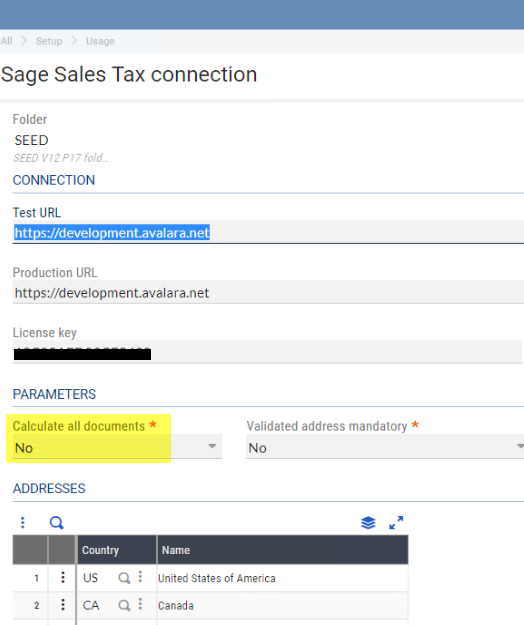

First, in Setup, Usage, Sage Sales Tax connection, set “Calculate all documents” to No

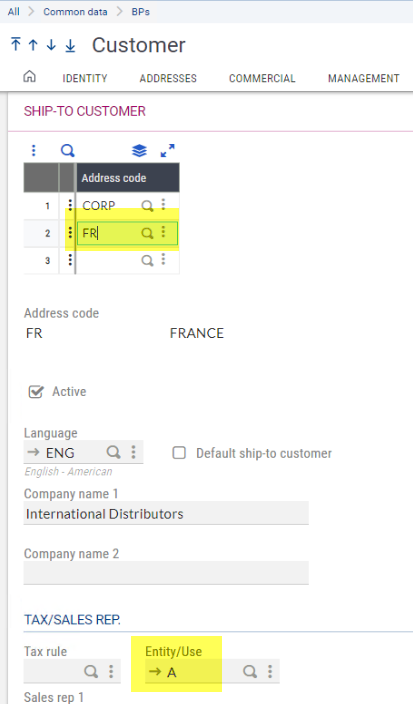

Next, in Customer, Ship-to customer tab, select a county address that is not using Sages Sales Tax and notice the Entity/Use field is available for use. A code can be entered to exclude from tax calculation.

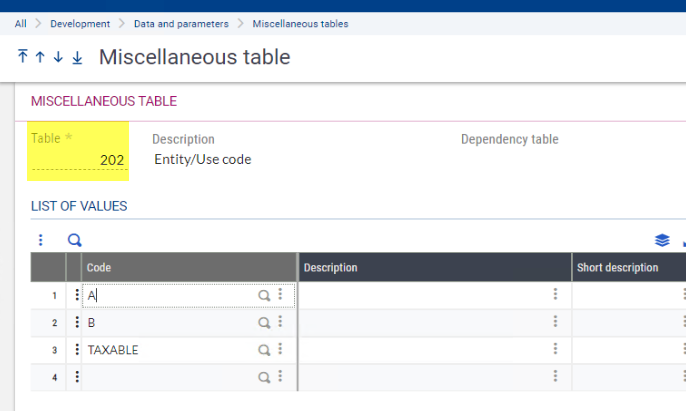

Please note that Entity/Use codes can be setup in Miscellaneous table 202

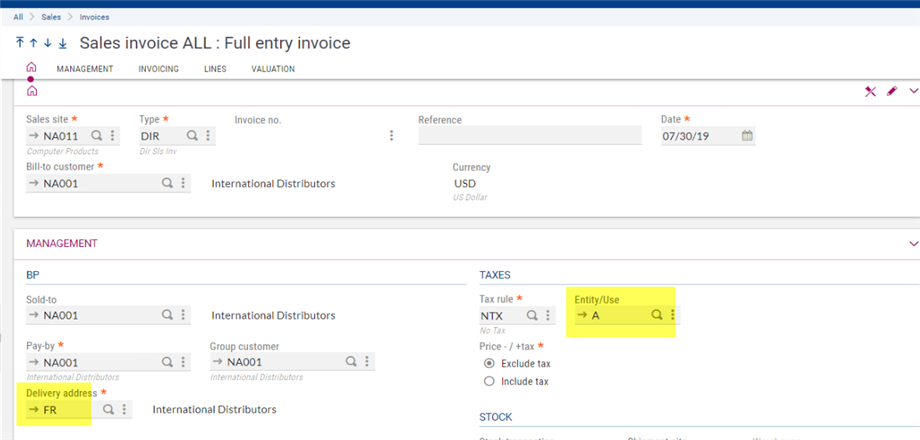

Finally, when a Sales invoice is processed and the Entity/Use code is entered on the invoice header, Sage Sales Tax will not be used in the tax calculation and the document is tax-exempt.