In this article I would like to discuss how to issue a main asset using unitary process (single asset).

1. Let me list out my general parameter settings;

- ACCPERCTL Accounting period control (AAS chapter/ CPT group) = No

Modification of the FY/period breakdown is authorized.

- SALINV Sales invoice to generate (AAS/FAS) = Yes

A customer BP invoice is automatically generated upon validation of the issue.

- TYPINVFAS Fixed assets invoice type (TRS/INV) = DIR

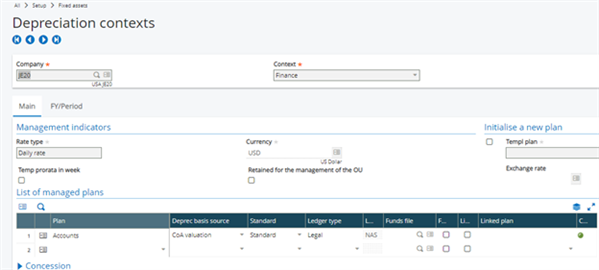

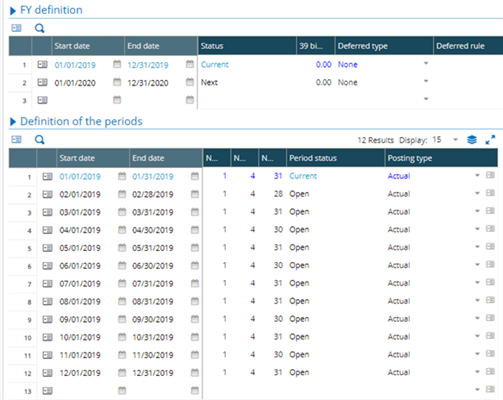

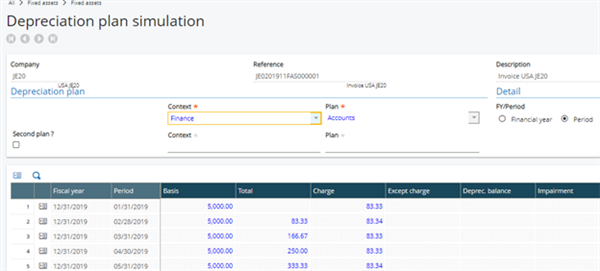

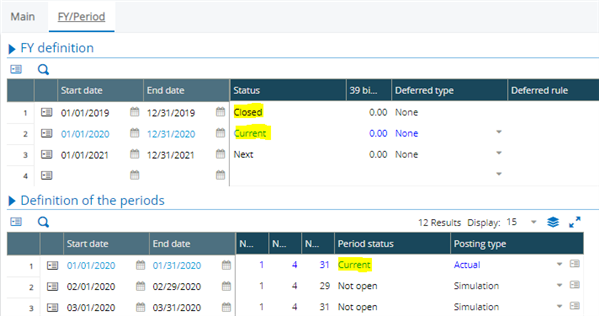

2. Let’s look at the depreciation context setup;

Managed plans

- Current year 01/01/19 – 12/31/19 (12-month periods)

- Current period – 01/31/19

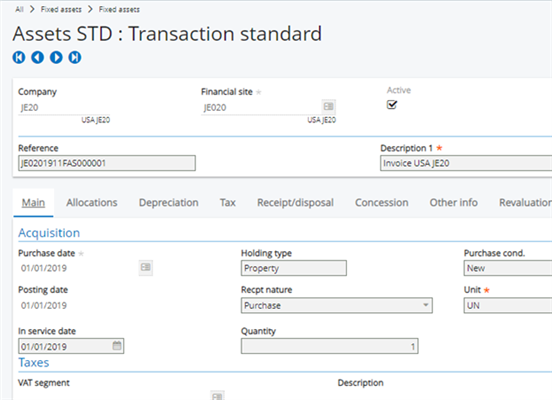

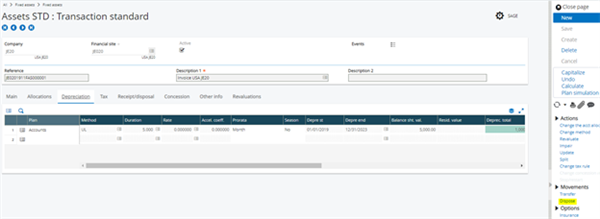

3. Enter an asset with a service date - 01/01/19

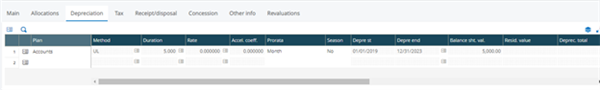

- B/S value – 5000

- Depreciation method - UL

- Duration 5 years

- Prorata - monthly

4. Monthly depreciation charge 83.33

5. Since then we have posted the depreciation entries for the periods (optional).

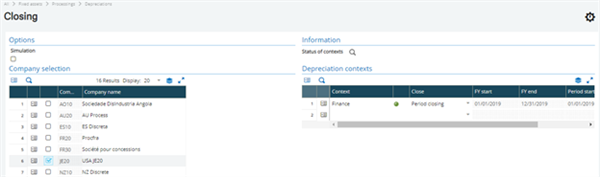

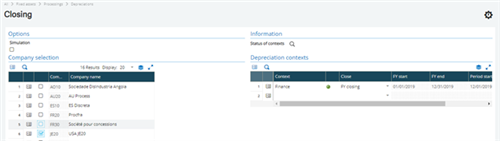

6. Periods were closed for fiscal year 2019 and then the fiscal year is also closed (optional).

- Now we are in FY 2020

7. Dispose the asset using the unitary issue in Fixed assets, Fixed assets, Assets select the Dispose menu on the right.

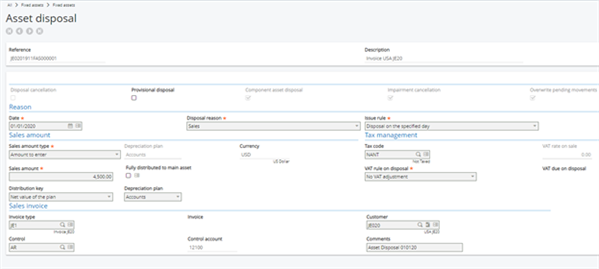

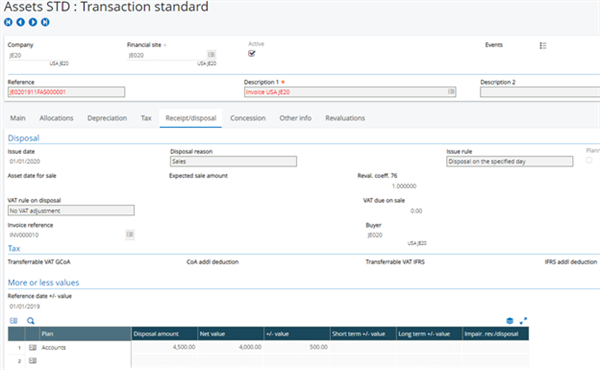

- In the Asset disposal screen select the following values;

Enter an issue date – 01/01/20

- This date must be greater than or equal to the depreciation start date for each plan managed by the company.

- In the case of an actual issue, this date must be in the current or next fiscal year for each of the managed depreciation contexts.

- This date must also be greater than or equal to the asset purchase date.

Select a disposal reason – Sales

- In a unitary process, the reason is selected according to the asset holding type.

- For assets in the property, in the provision or in the concession, the issue reason can be: Sales, Scrap, Stolen or disappeared.

Select an issue rule – Disposal on the specified day

- This field is used to enter the depreciation calculation rule to apply to the financial asset for the financial year of the issue. It defines the issue day according to the issue date entered.

- Default issue rule – Disposal on the specified day

Sales amount type – Amount to enter

Sales amount - 4500

Distribution key – Net value of the plan

Tax code – NANT (Not taxed)

VAT rule on disposal – No VAT adjustment

In Sales invoice grid, use the magnifying glass to select an invoice type – JE1

Enter the customer - JE020

Select the control a/c and enter a comment

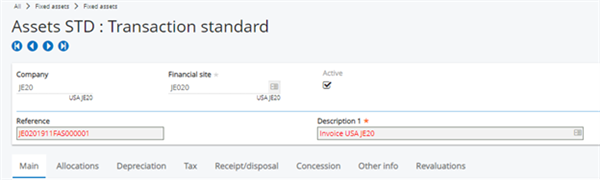

8. Click ‘OK’ and ‘Save’ the changes in the fixed assets screen.

- Note; if you get the following error “BP invoice creation impossible :: Mandatory account”

- Please refer to KB 83990

- Error: "The customer BP invoice cannot be generated: sale abandoned".

9. Once the disposal is complete the asset reference and description color will change to Red.

- You can check the details of the disposal under Receipt/disposal tab and under the event journal detail screen.

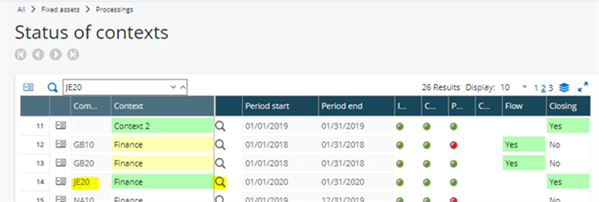

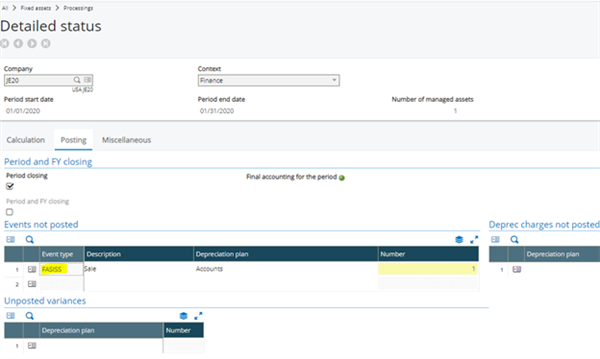

- Additionally, to verify that there is an asset sale event, we can check in the status of context by selecting the company and tunneling into it.

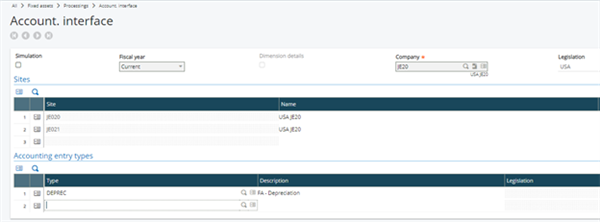

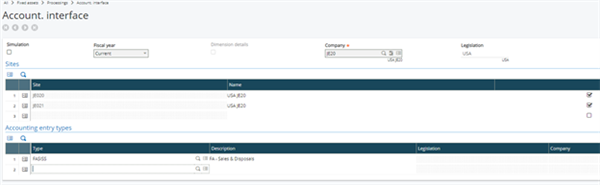

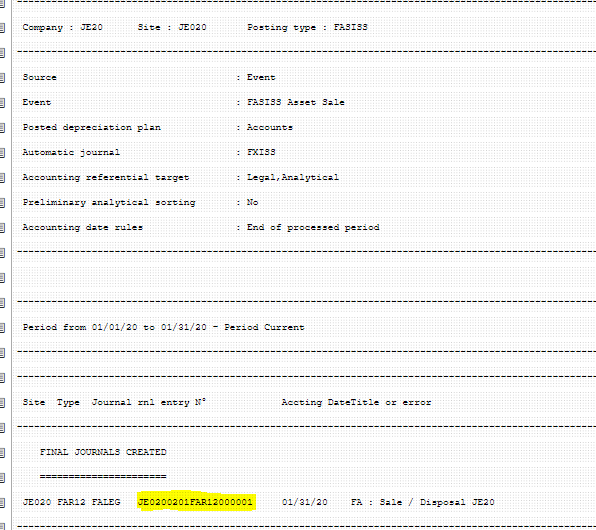

10. Finally, we can generate the accounting entry for the disposal - Generation of accounting entries.

- Accounting entry type - FASISS

Log file

Accounting document lines

Customer BP invoice generated by the asset disposal.

I hope this article may give you some insight on how to dispose an asset.

You can use the Asset disposal function in Fixed assets, Processings, Movements to issue more than one asset.