Important note*: Do you have Quebec Payroll to post in 2018? We've got a workaround for the temporary issue with the taxes, see these links: EN (KB 88178) / FR (KB 260-1008049).

This update (for Sage 50 2018.1 Canadian Edition) brings even more improvements to Sage 50c cloud solutions integrations with products such as MS Office 365, improved security and some invaluable tools and incorporates some of your top-ranking suggestions. We focused on three main areas: Improved User Experience, Improved Sage 50c Cloud Solutions and Government Compliance.

To download/check for the update open Sage 50 CA 2018 and see Help > Check for product updates…

What Sage Ideas have been implemented?

To help you stay organized we've added some new functionality based on your top-ranking Sage Ideas suggestions.

Top items:

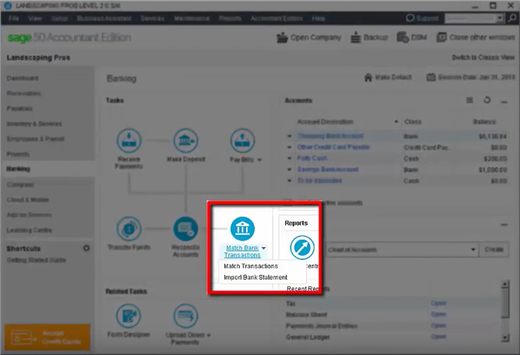

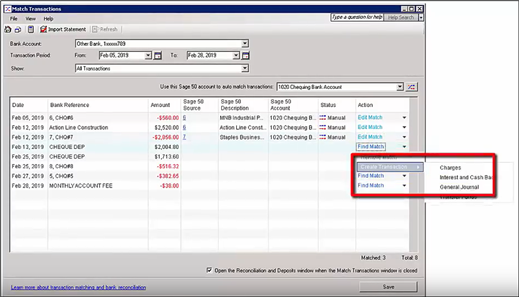

Improved User Experience with Bank Rec*

You can now enter missing transactions easily and breeze through reconciliation routines with matching of bank transactions from imported statements. Thanks to these new features, Sage 50 matches existing transactions automatically.

You can also match transactions or create new ones using the information from the imported bank statements. This saves you time and minimizes errors.

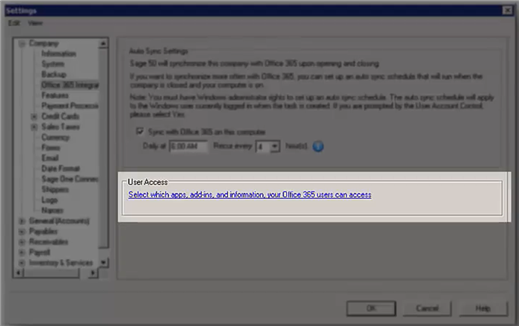

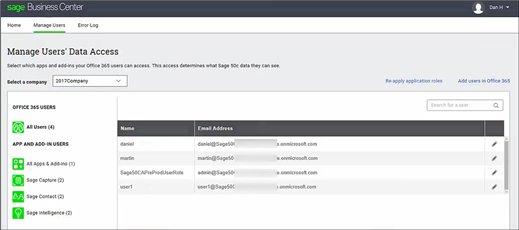

Improved Sage 50c Cloud Solutions

When using the MS Office 365 integration, business builders can now control what employees see in their MS Office 365 apps with user permissions.

You can now save time by providing team members access to relevant accounting data based on their roles.

Government Compliance

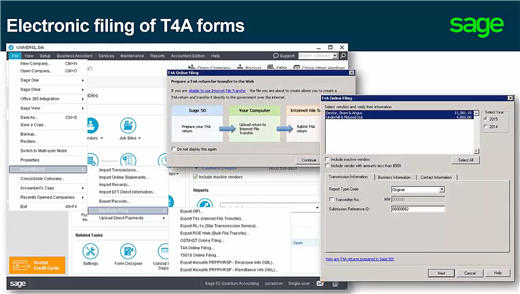

T4A slips are issued to non-construction contractors to report payments to the Canada Revenue Agency (CRA).

As of the Sage 50 2017.2 version it's possible to create T4As for your vendors, Sage 50 validates the format of the vendor's SIN or CRA business numbers for the form.

New for version 2018.1, Sage 50 now enables companies to electronically file their T4A forms.

If you're filing fewer than 50 T4A slips, you can print them and mail them or you can file them electronically. If you're filing more than 50 slips, the CRA requires you to file the forms electronically.

This Sage 50 2018.1 release also includes the Federal and Provincial payroll tax updates for January 1st, 2018.

Fixes to known issues:

As per the What's New in 2018.1 PDF document, the following issues have been resolved:

- (Pro Accounting and higher) The Download Summary for Sage Capture transactions was partly in English when viewing your company in French.

- (Pro Accounting and higher) If you were working in French and emailed a customer statement, the file was incorrectly named "statement.pdf". This also occurred when viewing your company in English and the customer preferred to conduct business in French.

- (Pro Accounting and higher) If you looked up a paycheque older than the previous calendar year, you could reverse the paycheque, which would then cause incorrect YTD amounts.

- (Pro Accounting and higher) After converting to Release 2018.0, if a vendor record had an Other Payment transaction with more than two sales tax codes and you tried to record a payment, Sage 50 would stop working when the vendor list or Vendor window opened.

- (Pro Accounting and higher) When attempting to look up general journal entries posted before the "Do not allow transactions before" date, an error relating to adjusting transactions would appear.

- (Pro Accounting and higher) If you entered a contact name with more than 26 characters on the Contact Information tab of the Export RL-1 window, Sage 50 would stop working.

- (Pro Accounting and higher) If you exported a paycheque to a CSV file, the header for the cheque number column was missing.

- (Pro Accounting and higher) When converting an order with prepaid amounts to an invoice, sometimes errors occurred with the line item tax amounts due to rounding.

Hope you're now as excited as we are about this update! Stay tuned for more and view our blog on how to enter and vote for more Sage Ideas! Happy holidays!