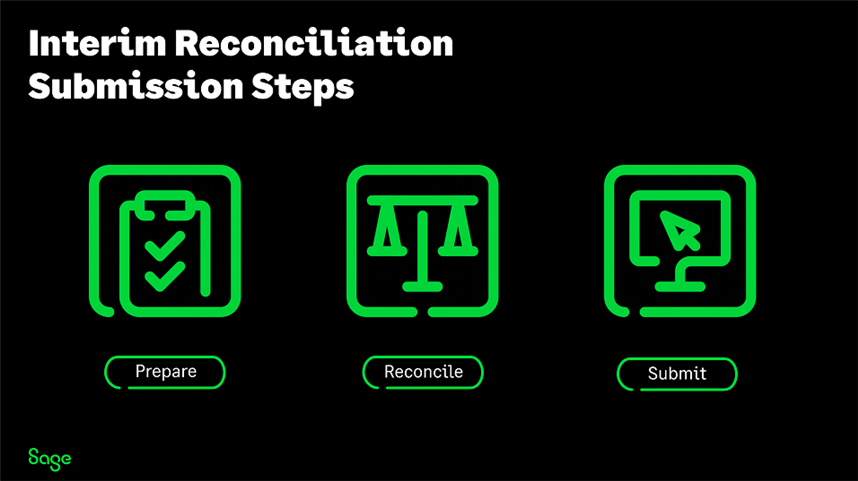

The Midyear submission process will allow you to prepare and submit your Interim Employer reconciliation to the South Africa Revenue Services (SARS).

Follow these guidelines for a successful submission.

Prepare your payroll

Validation and preparation are key to ensuring the information provided on the employee certificates is correct.

- How do I prepare my payroll for submission?

- Where can I download the latest checklist as guideline for my submission?

- Known IRP5/IT3a Report validation errors and possible solution on how to resolve them

Reconcile your financial values

Ensure your PAYE, SDL, UIF, and ETI balances on your payroll and declarations to SARS.

- How do I reconcile my payroll financial values?

- Which reports can I use to reconcile my EMP501?

- Which reports can I use to reconcile my Employment Tax Incentive (ETI) values?

Submission to SARS

Be sure to submit before the deadline of 31 October to avoid the rush and queues!