Release 6.0b was released on 8 May 2023 and include the new tax tables for Ghana applicable from May 2023. Your payroll system will prompt your to update to Release 6.0b when accessed.

For more information, click here.

Update post 02/05/2023

The Ghana Revenue Authority (GRA) has announced that the implementation date for the new and revised taxes, which were introduced in the 2023 Budget, will be 1 May 2023 and not April 2023

The new and revised taxes include the Excise Amendment Act, 2023; Income Tax Amendment Act, 2023; and the Growth and Sustainability Levy Act, 2023

Please see the link below confirming the effective date as 1 May 2023:

Original post

Income Tax (Amendment) Act of 2023 included payroll-related changes, including revised tax tables with and upper limits for the quantification of motor vehicle benefits.

Click here to view the Ghana Income (Tax Amendment) Act 2023.

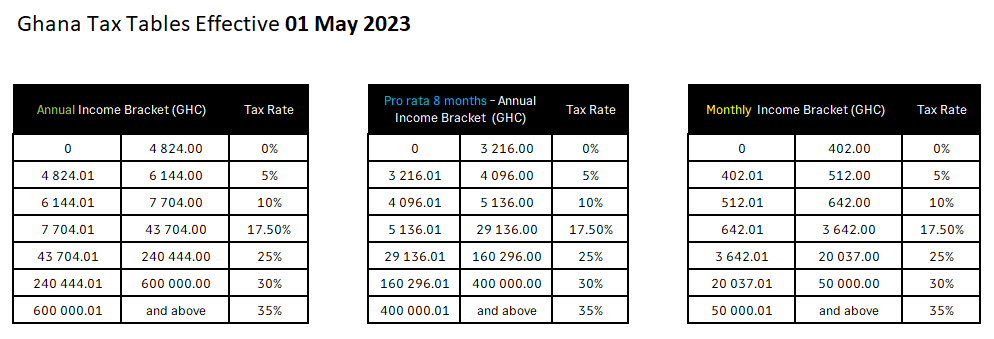

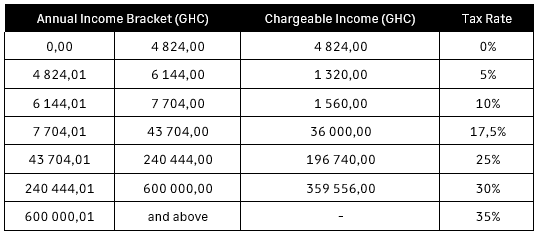

First Schedule(1) – PAYE Tax table

- Additional tax bracket at 35%

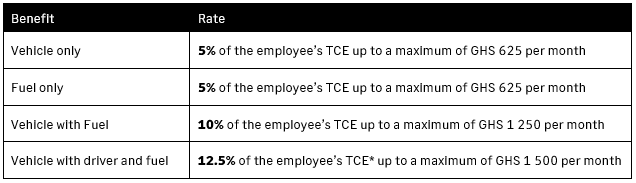

Fourth Schedule (1) – Vehicle benefit

*TCE – Total Cash Emoluments

Take note: The Sage Development teams are currently busy with the changes, and due to the additional tax table bracket, will require a new system update version. More information on the release date to follow.