The Minster of Employment and Labour has extended the TERS benefit from 16 October 2020 to 15 March 2021. Please click here to view the new Direction.

The Fund has created a new template with one change to column O (Remuneration for Work Done or Work To Be Done from 16 October 2020 to 31.12.2020). Therefore, the employer must complete 2.5 month’s remuneration for the application period of 16 October to 2020 31 December 2020. Employers are reminded that advances, ex gratia payments, or income related to annual or other leave, should be excluded from this value.

For assistance on how do I print the TERS report for the period 16 October 2020 to 15 March 2021 click here

Please note: For the below, remuneration means remuneration as defined in the BCEA (Basic Conditions of Employment Act) read with Government Gazette 24889. “Remuneration” is defined in the BCEA as any payment in money or in kind, or both in money and in kind, made or owing to any person in return for that person working for any other person.

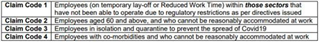

| Summary of the new TERS rules (only new rules have been summarized below) | |

| Who may claim? |

|

| The TERS benefit amount |

|

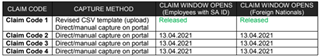

| The application procedure |

(a)Each employee’s vulnerability status for serious outcomes of a Covid-19 infection; (b)Details of the Covid-19 screening of employees who are symptomatic (c)Details of employees who test positive in terms of a positive laboratory test for the Covid-19 virus; (d)Details of employees identified as high risk contracts with the workplace if a worker has been confirmed as being positive; (e)Details on the post -infection outcomes of those testing positive, including the return to work assessment outcomes The employee declaration returns by the employer will confirm loss of income and thus inability to make alternative arrangements for the affected employees.

|

| Reduced work time benefit | |

| Who may claim? | Subject to the availability of sufficient credits, contributors whose employers do not operate in sectors set out in Annexure A and whose employers are unable to make use of their services either fully or partially as a result of compliance with Regulations made in terms of the Disaster Management Act or directions made under Regulations, shall be entitled to a reduced work time benefit in accordance with section 12(1B) of the Unemployment Insurance Act. |

| The reduced work time benefit amount: | The amount of the reduced work time benefit shall not be calculated with reference to the benefit level as contemplated in section 12(1B) of the Unemployment Insurance Act, but by utilising the IRR and sliding scale as provided for in the UI (Unemployment Insurance) Act. The employer shall be entitled to supplement the reduced work time benefit amount received from the Fund, provided that the reduced work time benefit amount as well as any remuneration received by the employer for work performed in any period shall not exceed 100% of the remuneration that the employee would ordinarily have received for working during that period, provided that such supplement amount is disclosed upfront in the benefit application. |

| The application procedure: | For information, please click here and here. |