This blog article will cover the depreciation calculation for different depreciation methods as well as the factors that influence the calculation of depreciation. Firstly, lets define depreciation and the reason we need to account for depreciation.

Depreciation is the decline in the carrying value of an asset overtime due to use, wear and tear or obsolescence. Carrying value is the net of purchase price less the accumulated depreciation to date. The depreciation amount constitutes how much of the asset’s value has been depleted. The purpose of depreciation is to match the expense recognition for an asset to the revenue generated by that asset. This process is referred to as the Matching Principle. The depreciation expense is then calculated according to business specified “periods in year” which may be daily, weekly, monthly, annually, etc.

Sage 200 Evolution caters for 7 methods of depreciation namely: Straight Line, Equal Allowance, Reducing Balance, Plant & Machinery, Units of Usage, Immediate Write-Off and 0% Depreciation.

Below I will cover the calculation for all these depreciation methods as well as a brief explanation for each method.

Straight Line

Using this depreciation method, depreciation is calculated equally over the asset’s useful life. Usually using a percentage rate to calculate the value of depreciation.

- Scenario

An asset with a purchase price of R100000 to be depreciated monthly at 20%.

- Calculation

Depreciation Per Month = Purchase Price * percentage

= 100000 * 20/100*1/12

= R1666.67 Per month

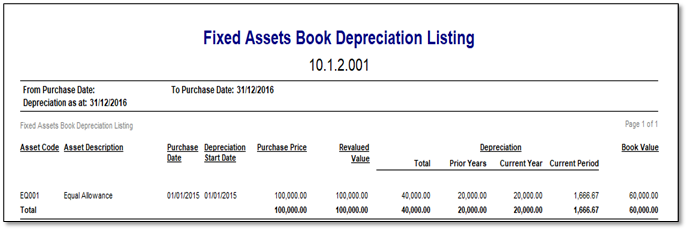

Equal Allowance

Similar to the Straight-Line method, depreciation is calculated equally over the asset’s useful life. Usually using the number of periods.

- Scenario

An asset with a purchase price of R100000 to be depreciated monthly over 5 years (60 months)

- Calculation

Depreciation Per Month = Purchase Price /Useful life (in months)

= 100000 /60

= R1666.67 Per month

Reducing Balance

The reducing balance method which is also known as the diminishing balance or declining balance is calculated using the carrying value at the end of the previous year. For the first year the calculation is similar to that of the straight-line or equal allowance method and then the reduction takes place for the following years.

- Scenario

An asset with a purchase price of R100000 to be depreciated using the diminishing balance method over 5 years or 20%.

- Calculation Year 1

Depreciation Year 1 = Purchase Price* percentage rate

= 100000*20%

= 20000 Per Year or 1666.67 Per month

- Calculation Year 2

Depreciation Year 2 = (Purchase price – Accumulated depreciation) * percentage

= (100000 – 20000) * 20%

= 16000 Per year or 1333.33 Per month

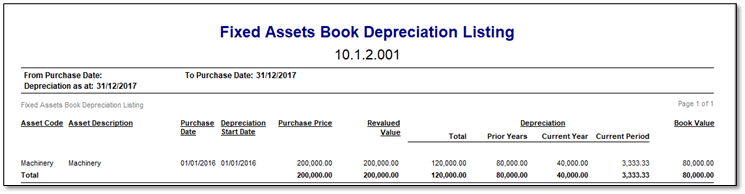

Plant and Machinery

This method allows you to specify the useful life of the asset in years. You may then specify a percentage individually for each year. The overall sum of all percentages should be 100%.

- Scenario

A plant and machinery asset purchased for R200000 Over 4 years. Asset will depreciation 40% in the first year and 20% for the following 3 years.

- Calculation

Depreciation Year 1 = Purchase Price* percentage rate

= 200000 * 40%

= 80000

Depreciation Year 2,3 & 4 = Purchase Price* percentage rate

= 200000 * 20%

= 40000 per year

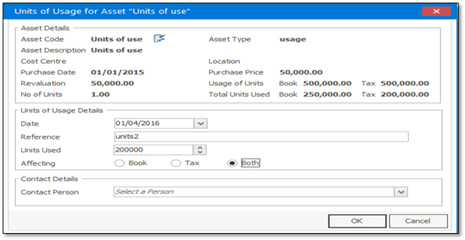

Units of Usage

Also known as Units of Production, the asset depreciates each month in proportion to the number of hours you use it, or number of units produced. With this method, you enter the monthly usage, in this case units manufactured, and the system calculates the depreciation amount.

To enter the units, you would need to navigate to Fixed Assets | Transactions | Asset Transactions.

- Scenario

A machinery asset purchased for R50000 with an expected total production of 500000 units over its useful life. During the first year 50000 units were produced and 200000 units in the second year.

- Calculation

Depreciation = Purchase Price* usage for current period/total units

= 50000 * 50000/500000

= 5000 Depreciation Year 1

Depreciation = Purchase Price* usage for current period/total units

= 50000 * 200000/500000

= 20000 Depreciation Year 2

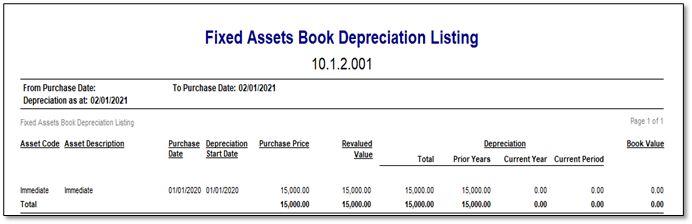

Immediate Write-Off

With this method, the asset is fully depreciated at acquisition. No further depreciation is calculated.

0% Depreciation

No depreciation is calculated when using this method. This may be used for assets that do not depreciate

Now that we have covered the different depreciation method calculations, we need to consider the different factors that may influence the depreciation calculation. Below we look at the impact of Residual value, Revaluation, and Impairments on the depreciation calculation.

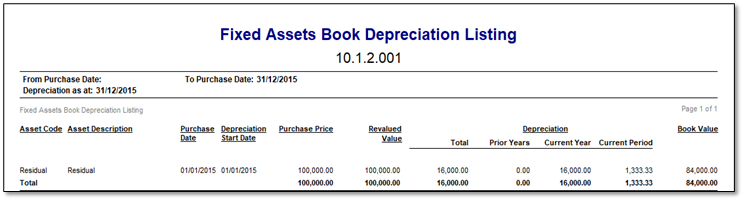

Residual Value

Otherwise known as the Salvage value, the residual value is an estimated value of the asset at the end of its useful life. An asset with a residual value may not be depreciated to zero. The residual value is subtracted from the purchase price to get the depreciable amount.

- Scenario

An asset with a purchase price of R100000 is to be depreciated equally over 5 years. The asset is expected to be worth R20000 at the end of its useful life.

- Calculation

Depreciation = (Purchase price – Residual Value)/useful life

= (100000-20000)/5

= R16000 Per Year

Revaluation

Asset revaluation is an increase in the asset’s value to reflect the current market value of the asset. Revaluation is the positive difference between an asset’s fair market value and its original purchase price, less depreciation. The revalued amount is then used to calculate depreciation as at when the asset was revalued and the revalued amount is then depreciated equally for the remaining life span of the asset.

Fixed Asset | Transactions | Asset Transactions | Revaluation

- Scenario

An asset purchased for R100000 is to be depreciated using the straight-line method over 5 years. At the end of Year 3 the fair market value of the asset is R65000.

- Calculation

Depreciation for the first 3 year prior to revaluation

= (Purchase price – residual value)/useful life

= (100000-0)/5

= 20000 Per Year

Depreciation for Year 4 & 5

= (Revalued amount - residual value) / remaining useful life

= (R65 000 – 0)/ 2

= R32500

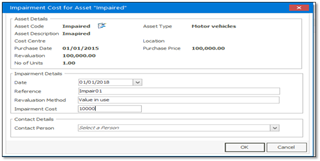

Impairment

An impairment is a reduction in the recoverable amount of an asset. The decline in value is so drastic that expected future cash flows for the asset have declined below its book value. An Impairment loss may be because of a significant decline in market value, increase in market interest rates, changes in technology, markets and economy, physical damages etc. The carrying value is then depreciated equally using the remaining lifespan of the asset.

Fixed Asset | Transactions | Asset Transactions | Impairments

- Scenario

An asset purchased for R100000 is to be depreciated using the straight-line method over 5 years. At the end of Year 3 the fair market value of the asset declined significantly by R10000.

- Calculation

Depreciation for the first 3 year prior to revaluation

= (Purchase price – residual value)/useful life

= (100000-0)/5

=20000 Per Year

Depreciation for Year 4 & 5

= (Purchase price -Accumulated depreciation - Impairment loss) / remaining useful life

= (100000-60000-10000)/2

= 15000 Per Year

In conclusion, depreciation is a vital part of a business’ financial statements and thus it is important that it is recorded correctly. The depreciation expense is reflected on the Income Statement/ Statement of Comprehensive Income and the accumulated depreciation portion is represented on the Balance Sheet/Statement of Financial Position. Different methods of depreciation are used for either Tax and Accounting purposes and they have a different impact on the overall net profit of an entity.