Year-end is quickly approaching. Let's focus December's Challenge Questions on Payroll Year-end. Here is the first question:

In Sage HRMS, where does the Form W-2 Box 13 pull it's information from?

< Scroll down for the answer >

< Keep scrolling >

Answer:

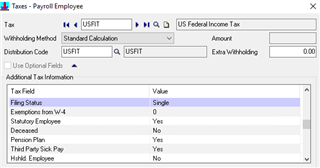

Navigation Path: Employees > (Tasks) View/Edit Employee > Payroll > Employee Payroll > Taxes tab > USFIT > Click Tax Info...

Here you can indicate Statutory Employee, Retirement Plan, Third Party Sick Pay.

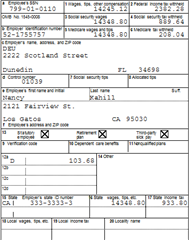

In the above screenshot, Nancy Kahill has a value of Yes for Statutory Employee, Pension Plan, and Third Party Sick Pay. Below is what Nancy's Form W-2 will look like.

All three boxes in Box 13 have an X.

You should review the options entered in the USFIT tax code for employees as it will affect the Form W-2. At any time during the year you can make changes to these indicators. When the W-2 is generated, it will look for the answers to Box 13 in the Employee Payroll > Taxes > USFIT tax code.

It is important to note that the software does not automatically update the Pension Plan indicator or Third Party Sick Pay for Box 13 as to whether or not an employee is contributing to a Pension Plan or receiving Third Party Sick Pay. Let's look at an example. Hugh Allen contributed to a 401(k) plan in 2018 and did not contribute during the 2019 tax year. His employer DEU matches 50% of the employee contribution up to a maximum of 5%. When producing the 2018 W-2's Hugh should have the USFIT Pension Plan indicator set to Yes. When producing the 2019 W-2's you will need to manually change the selection from Yes to No so Box 13 Pension Plan indicator does not have an X. If you have already generated the W-2s for 2019 but have not finalized them, you can edit the W-2 in Aatrix. Please note that this edit does not flow backwards to Sage HRMS.