Beginning July 1st, 2022 Colorado will impose a $0.27 retail delivery fee on all deliveries by motor vehicle to a location in Colorado. The fee is per order and applies if there is any taxable item in the order. Wholesale or other exempt sales are not subject to this fee.

The fee is displayed on the sales invoice. It is charged to the customer by the retailer and that retailer is liable to collect the fee and remit the total of all fees due on a new return, DR 1786.

More information can be accessed at the Colorado Department of Revenue website: https://tax.colorado.gov/retail-delivery-fee

The following steps will walk through how to set up this fee in Sage 500 if you are using 500 to calculate taxes or Avalara Avatax.

Note:

Sage 500 will not automatically know or process whose Customer to apply this fee. The User will have to determine that and apply the necessary steps to process this fee.

Non-Avalara environments:

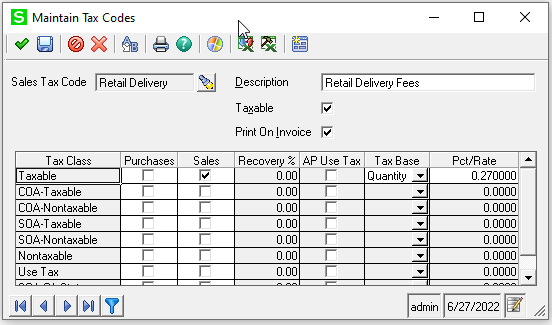

Create a new Sales Tax Code

Go to Common Information > Maintenance > Maintain Sales Tax > Maintain Tax Codes

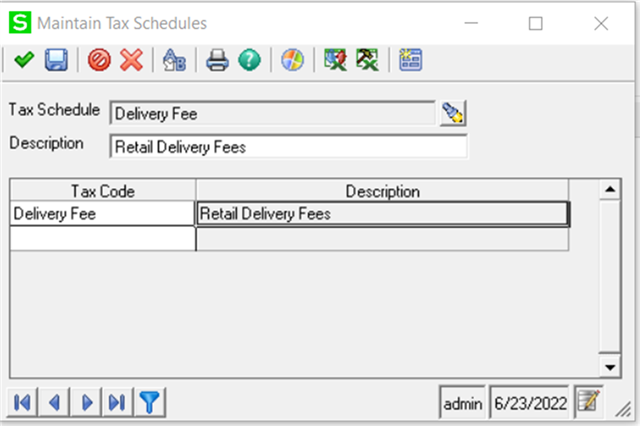

Create a new Tax Schedule for the tax code

Go to Common Information > Maintenance > Maintain Sales Tax > Maintain Tax Schedules

Assign a GL Account to track the AR sales tax

Go to Common Information > Maintenance > Maintain Sales Tax > Maintain Company Tax Information

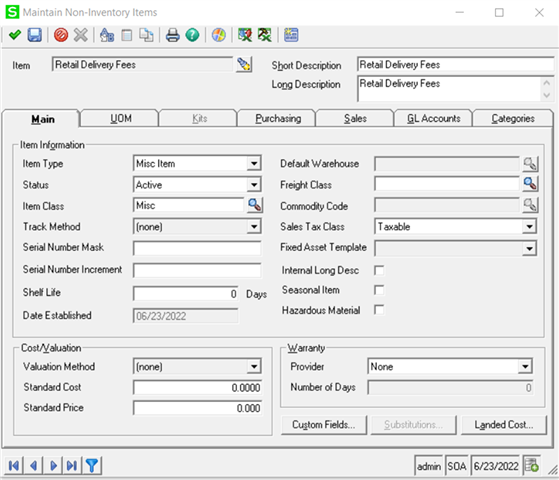

Create the non-inventory item as a Misc Item

Go to Common Information > Maintenance > Maintain Non-Inventory Items

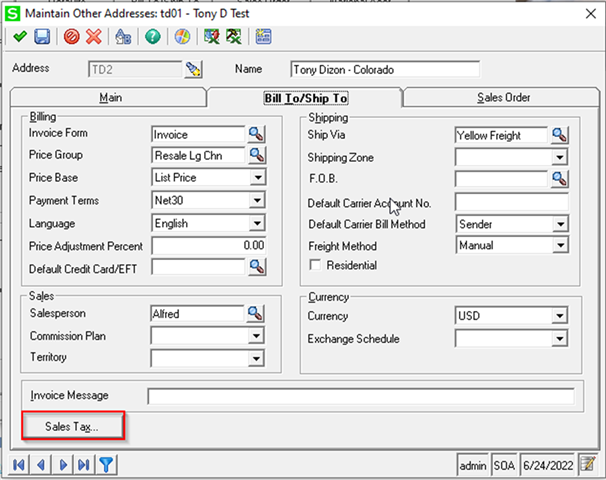

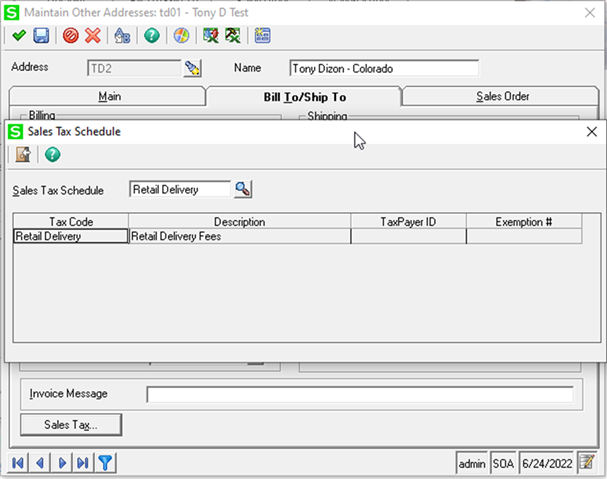

Update the Customer Primary and/or specific Ship to Address to the new Tax Schedule

Go to Accounts Receivable > Maintenance > Maintain Customers

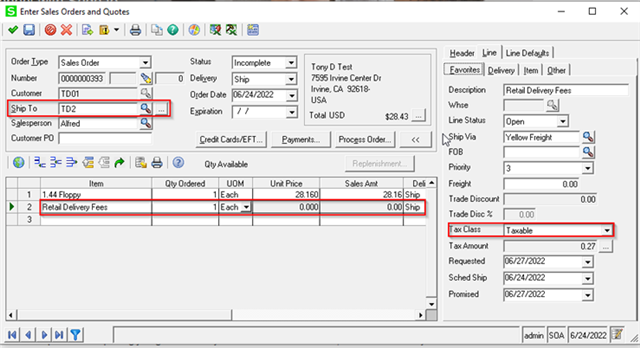

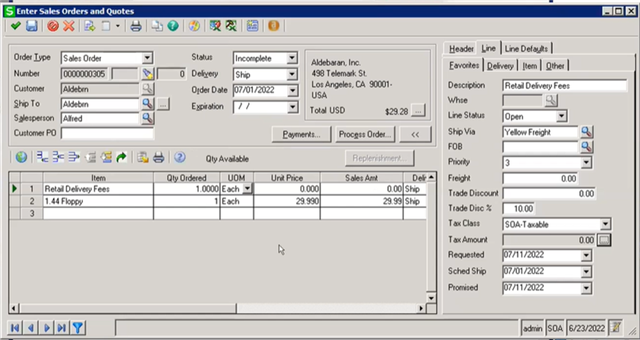

Create the Sales Order, and makes sure that the Ship To is set to the ‘Colorado’ Address

Print the Sales Order

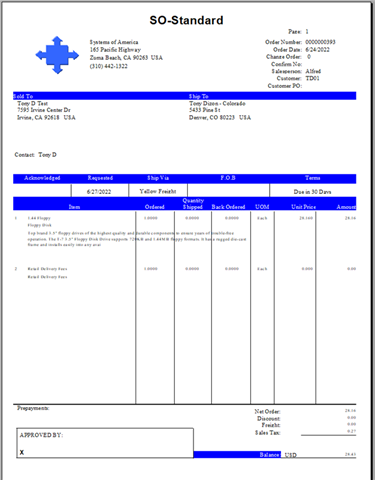

Pick, ship, commit, and invoice the Sales order. Print the sales invoice to see the added fee.

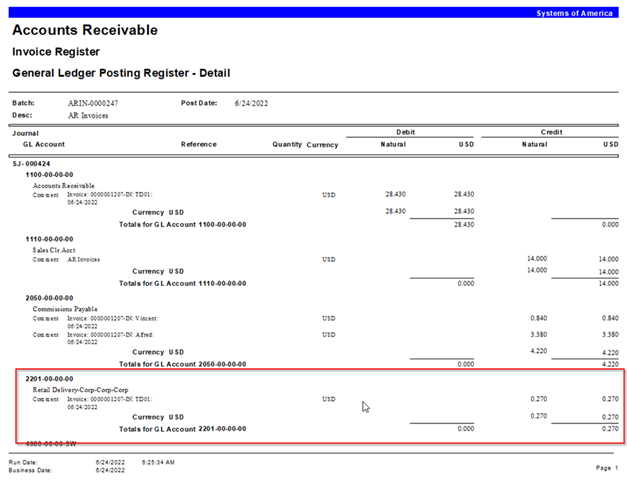

Post the Sales invoice. Note the GL Account for the Company Tax Information is used.

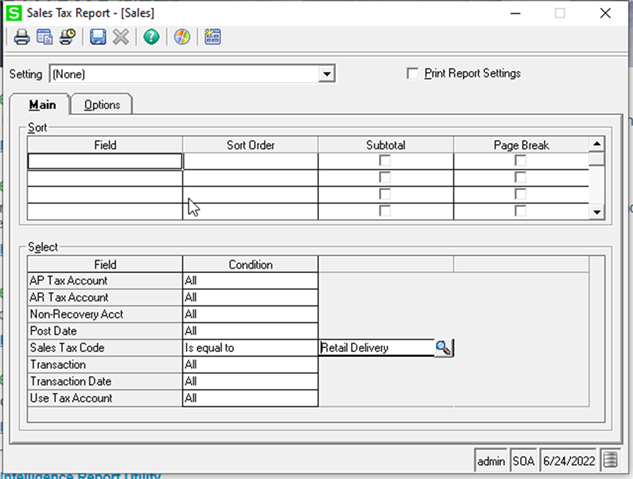

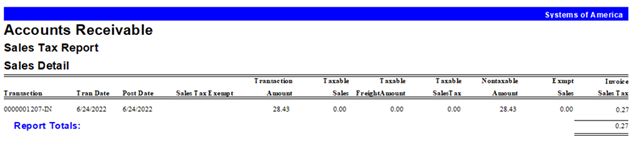

Run the Sales tax Report in Accounts Receivable

Avalara Avatax environments

Create the non-inventory item as a Misc Item

Go to Common Information > Maintenance > Maintain Non-Inventory Items

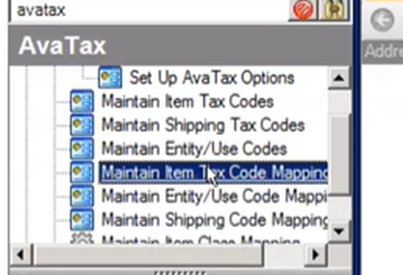

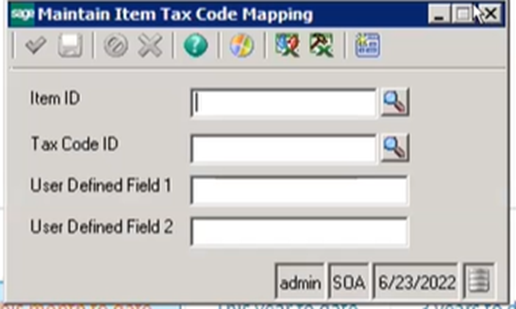

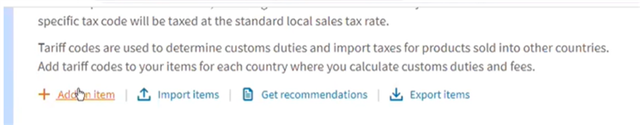

You can add the item to Avalara using the Maintain Item Tax Code mapping task or in Avalara.

In Avalara:

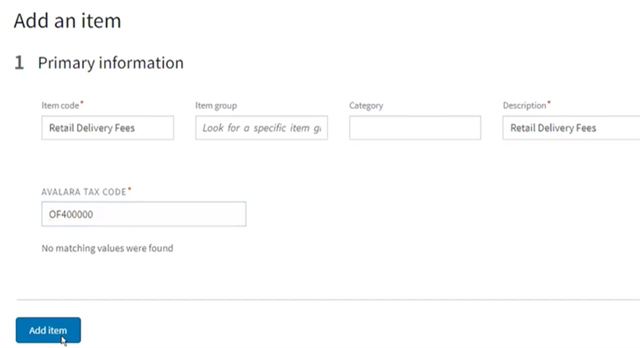

Go to Settings > Select ‘Add an Item’

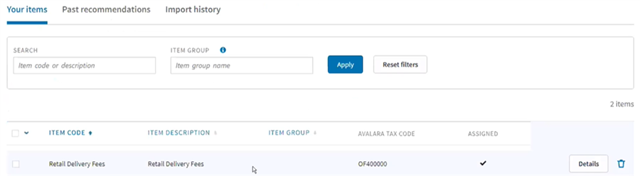

Enter the item and assign it to Avalara Tax Code: OF400000. Click on ‘Add item’.

When entering a Sales Order, you will add the item to the sales order for those orders shipping to Colorado and require the tax.

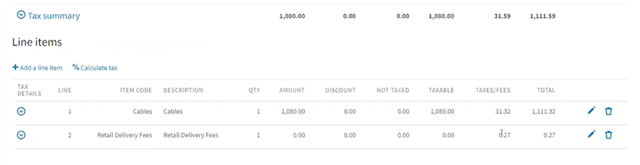

Avalara will display the fee for the order:

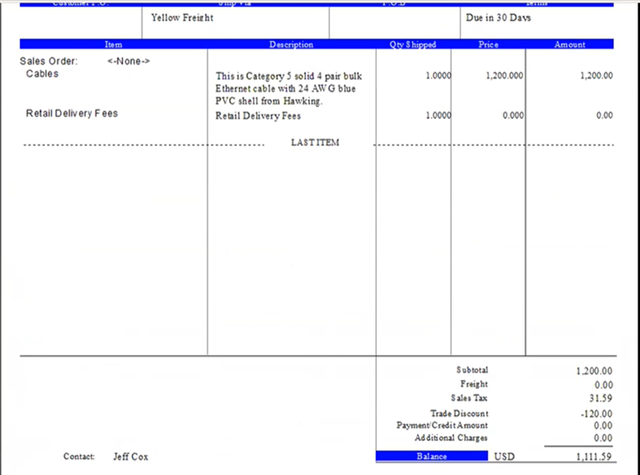

Printing the Sales invoice will display the line item for the fee.

Note: You will need to have the sales order form and the sales invoice form modified so the Sage Sales Tax section of the invoice form displays “Retail delivery fees” and the sales tax is not combined with other taxes.

Note: This information is in collaboration with Sage 500 Support and RKL eSolutions, LLC.