South African Revenue Services (SARS) grants an accelerated depreciation schedule for:

- Machinery & plant (new or used)

- Useddirectlyin manufacturing process

- Brought into use for the first time by the taxpayer

- For purposes of his trade

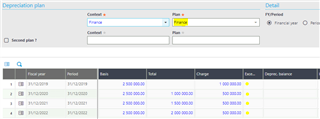

Write-off(% of cost claimed as deduction per year)

- Yr 1: 40%

- Yr 2: 20%

- Yr 3: 20%

- Yr 4: 20%

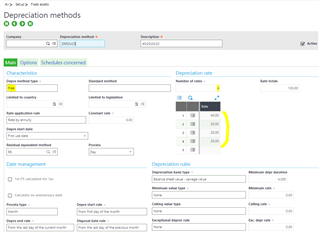

Please advise how I set up a Free depreciation method (or alternative) to accommodate this requirement in SAGE X3?