Dear X3 HR and Payroll User,

The repurchase rate (repo rate) has decreased from 6.50% to 6.25% on 17 January 2020. As from February 2020, the ‘low or interest free loan/debt’ fringe benefit should be calculated by using the new ‘official interest rate’.

The ‘official interest rate’ as defined in section 1 of the Income Tax Act:

= repo rate + 1%

= 6.25% + 1%

= 7.25%

https://www.resbank.co.za/Research/Rates/Pages/CurrentMarketRates.aspx

Please update the official interest rate on Legislation values applicable from February 2020 in all relevant folders. A payroll plan patch will not be sent out with this change, but will be included in the next payroll plan patch released for South Africa.

Version 12

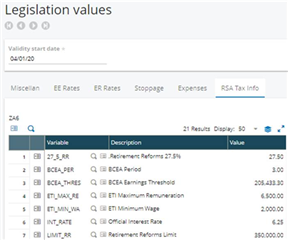

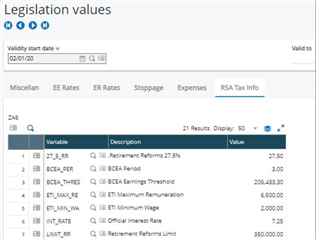

Access: Payroll > Entry of values > Legislation values > Legislation ZAF > RSA Tax Info tab

Create a new “valid from’ date 02/01/20 by copying the latest values. The Legislation value for the variable INT_RATE – Official interest rate should be changed to 7.25 effective 1 February 2020.

Version 9

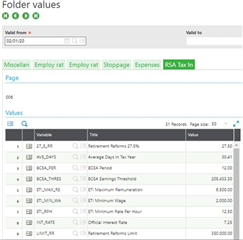

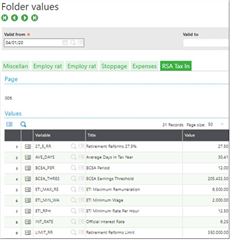

Access: Payroll > Entry of values > Folder values > RSA Tax Info tab

Create a new “valid from’ date 02/01/20 by copying the latest values. The Folder value for the variable INT_RATE – Official interest rate should be changed to 7.25 effective 1 February 2020.

There has now been an update released that brings this rate down even further please see latest communication released

Version 12

Access: Payroll > Entry of values > Legislation values > Legislation ZAF > RSA Tax Info tab

Create a new “valid from’ date 04/01/20 by copying the latest values. The Legislation value for the variable INT_RATE – Official interest rate should be changed to 6.25 effective 1 April 2020