Withholding tax, also called retention tax, is a government requirement for the payer of an item of income to withhold or deduct tax from the payment and pay that tax to the government. Many jurisdictions require withholding tax on payments of interest or dividends. In most jurisdictions, there are additional withholding tax obligations if the recipient of the income is resident in a different jurisdiction, and in those circumstances withholding tax sometimes applies to royalties, rent or even the sale of real estate. Governments use withholding tax to combat tax evasion, and sometimes impose additional withholding tax requirements if the recipient has been delinquent in filing tax returns or in industries where tax evasion is perceived to be common.

NB: This is from V12P28

Resolution:

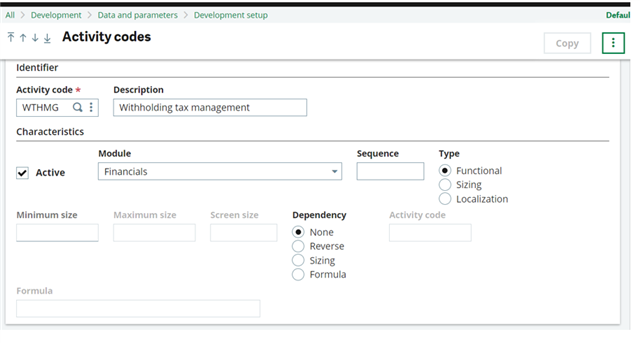

Activate the WTHMG - Withholding tax management activity code.

When the KIT and KAU activity codes are active, the WTHMG activity code will be active, but the opposite is not necessary and can be performed independently.

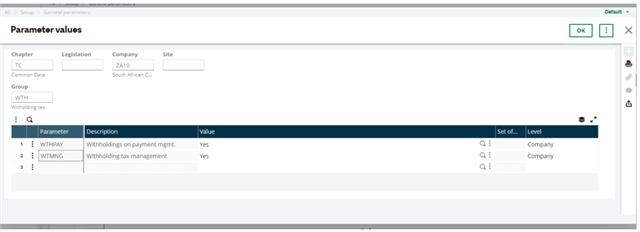

Set the WTHPAY – Withholdings on payment mgmt. and WTMNG – Withholding tax management parameters (TC chapter, WTH group) to Yes. Note: This replaces the RTZPRW – Retentions on payments and ITARTZ – Italian withholding tax parameters (LOC chapter, ITA group).

Note: The technical switch from the former activity code (KIT) to the new one (WTHMG) was already done in the previous release however it was still mandatory to activate both. Now, KIT and WTHMN are independent

Activate the Activity code Withholding tax management (WTHMG).

Development > Data and parameters> Activity codes> WTHMG

The following setup also needs to be completed:

Setup> general parameters> Parameter values> TC chapter > Group WTH (Withholding tax)

This need to be setup at company level

- WTHPAY(Withholdings on payment mgmt.)

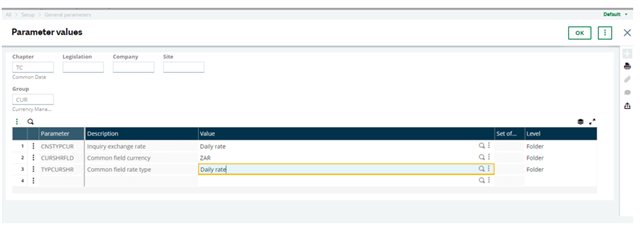

Select the correct currency: Parameters > General parameters > Parameters value

Module = TC, Group= CUR

Currency into which the amounts of retention at source are converted. Caution, this parameter has been designed to manage the transition phase for the transfer to the Euro. The management of retentions at source in currency is not managed. In other words, the invoice entry currency must have a fixed rate with respect to the retention currency.

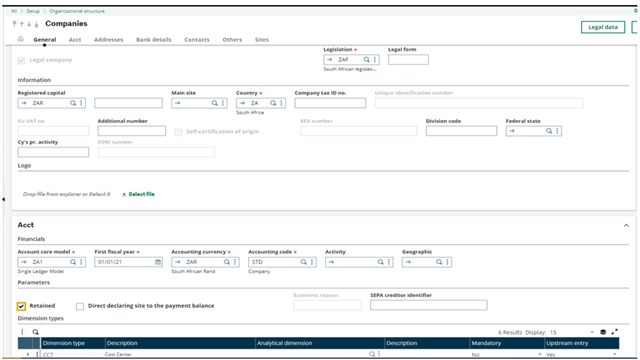

Parameters> Organizational structure > Companies

Choose your companies and in the accounting tab in the parameters section tick on Retention

Scenario 1: Withholding Tax at Invoice level

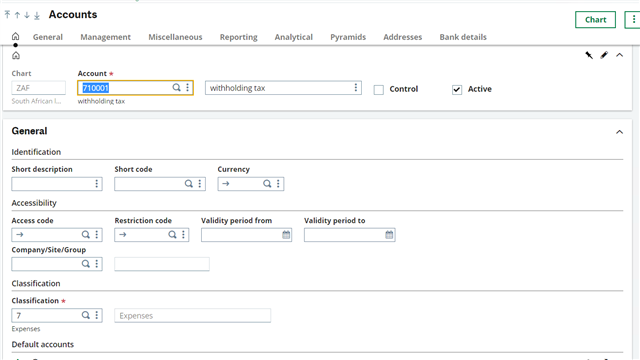

Create an account for withholding tax

Common data> General Accounting tables> Accounts

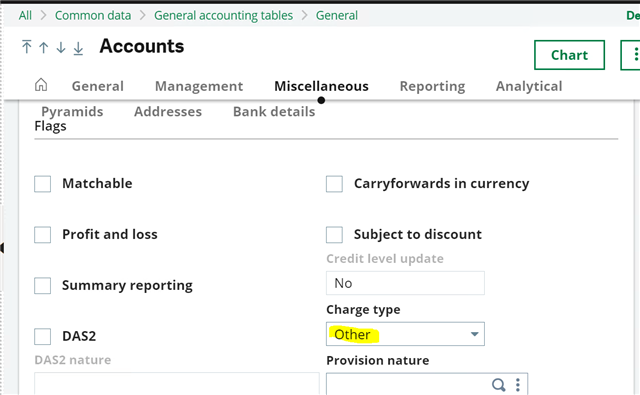

Ensure that the Charge type on this account and is set to Other

Ensure all accounts that will be used for withholding tax are set as Charges.

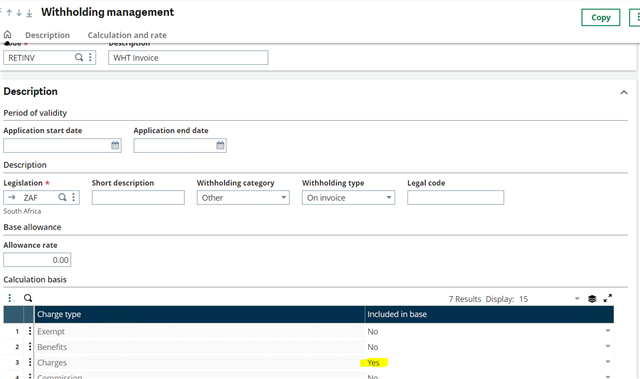

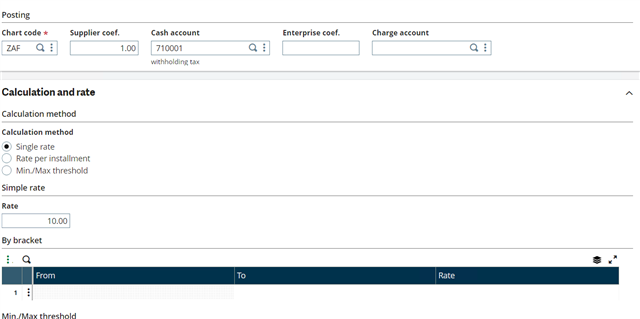

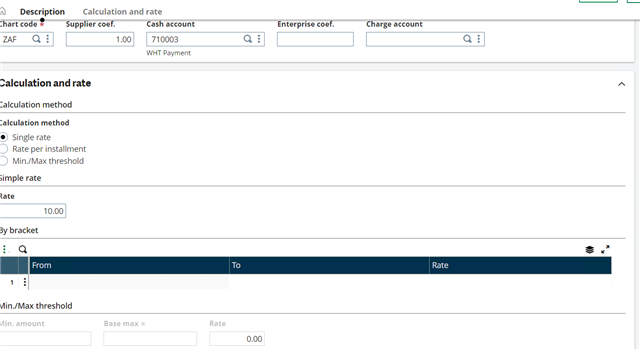

Create a withholding management code on Invoice

• Common data > Common tables > Withholding management

Creation of a new retention code: RETINV for Invoice

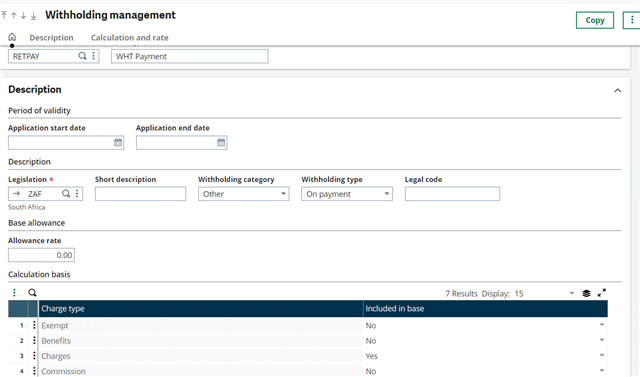

Charge type> Yes for charges

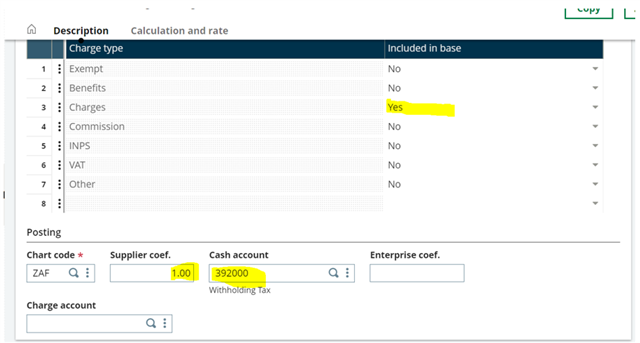

Enter the supplier Coef. and link the account created

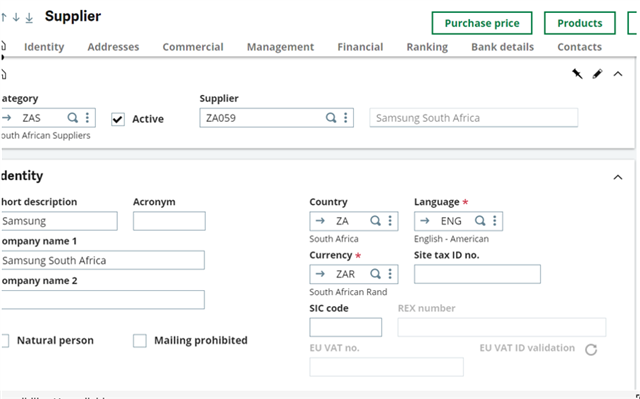

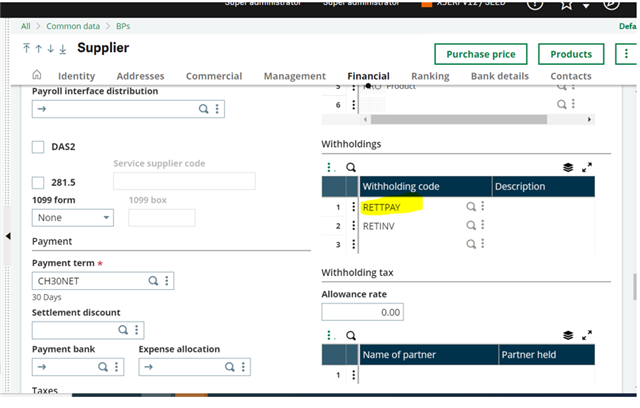

Common data > BP’s > Suppliers

select your supplier; Example: ZA059

in the financial tab on the retentions block, add the retention code RETTPAY

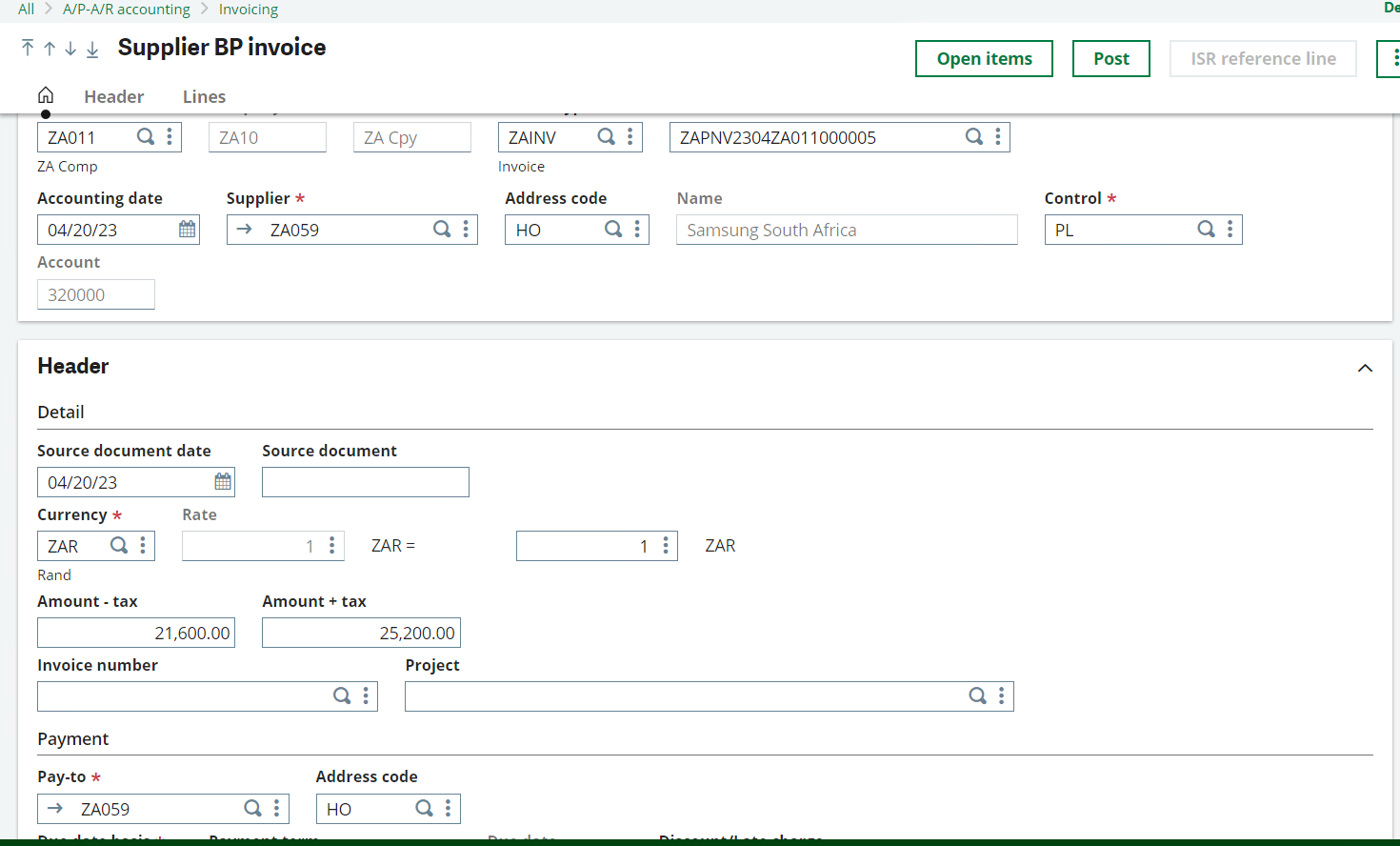

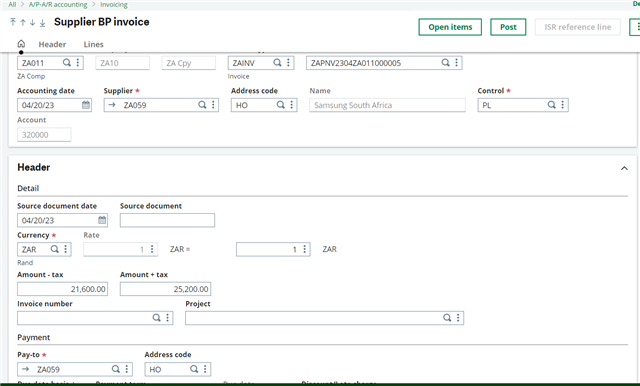

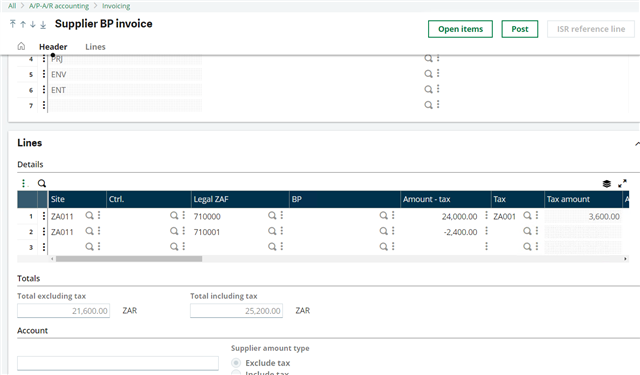

- A/P-A/R Accounting > Invoicing > Supplier BP Invoices

Creation of a new invoice with retention on Invoice

Notice that the withholding tax appear on the second line and the value is negative

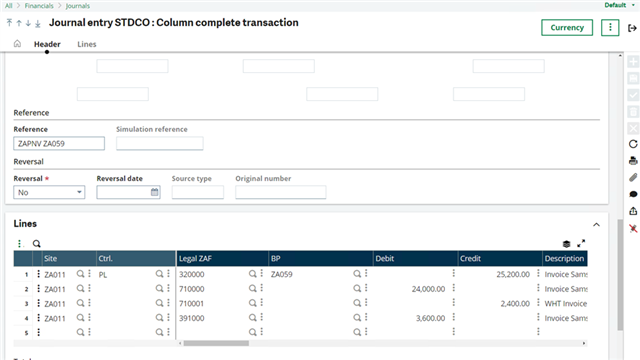

You can check the accounting document to see if the withholding by clicking on the action button>Accounting documents

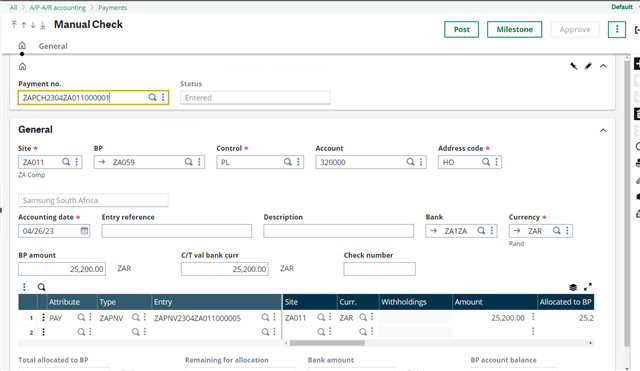

Create a payment for the Purchase invoice,

A/P-A/R accounting> Payments> Payment/Receipt Entry

See the Withholding value

Scenario 2: Withholding Tax at Payment level

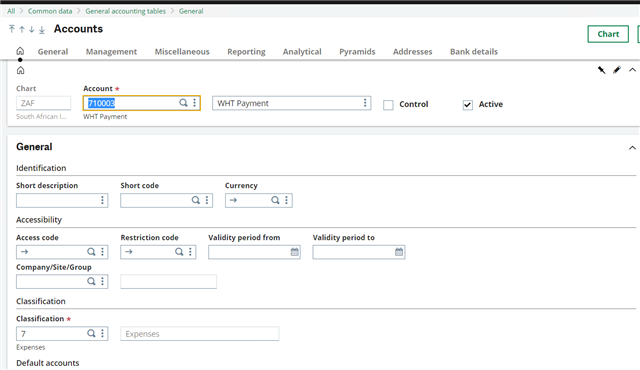

Create an account for withholding tax

Common data> General Accounting tables> Accounts

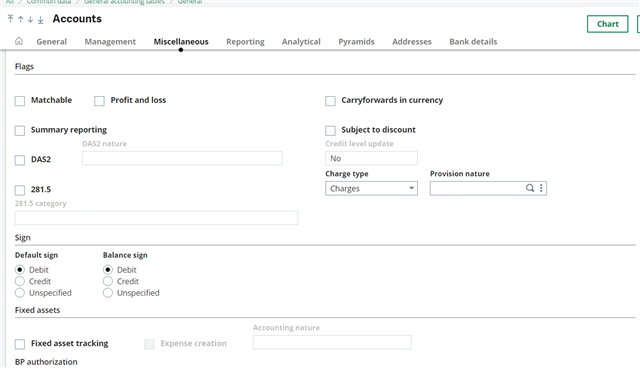

The purchasing account need to be set to charges for charge type under miscellaneous tab.

Create a withholding management code on Invoice

• Common data > Common tables > Withholding management

Creation of a new retention code: RETTPAY for Purchasing

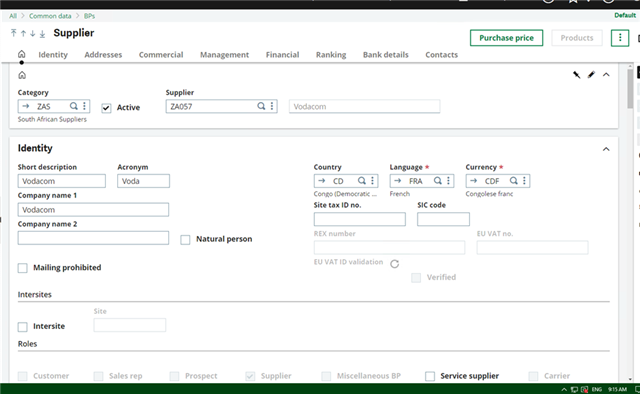

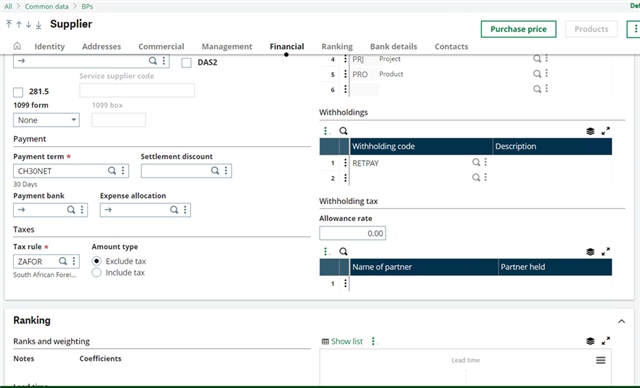

Common data > BP’s > Suppliers

select your supplier; Example: ZA057

in the financial tab on the retentions block, add the retention code RETTPAY

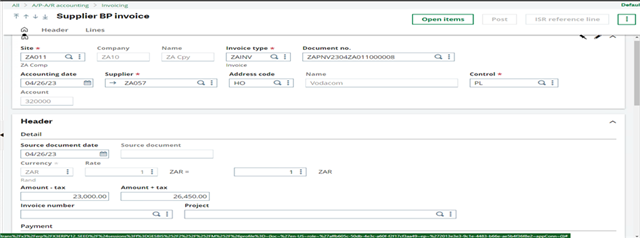

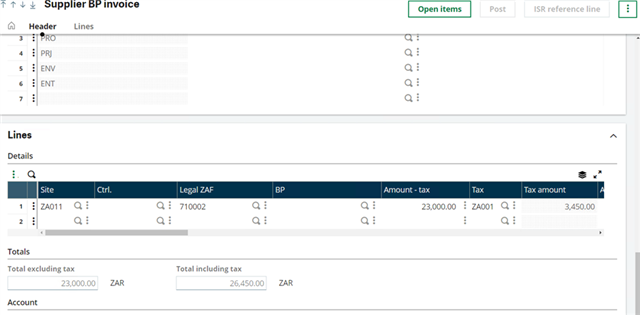

- A/P-A/R Accounting > Invoicing > Supplier BP Invoices

Creation of a new invoice with retention on Invoice

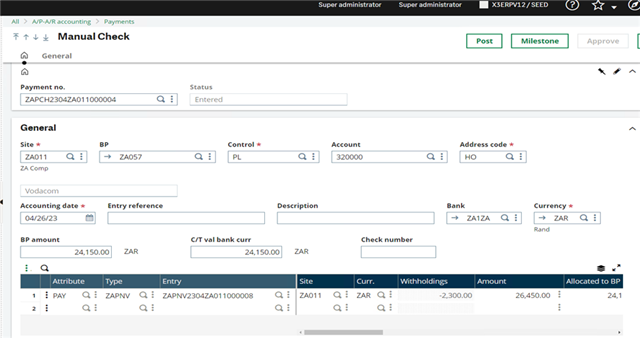

Create a payment for the Purchase invoice,

A/P-A/R accounting> Payments> Payment/Receipt Entry

See the Withholding value