Accounting documents in X3 have controls that are meant to ensure good record keeping and integrity that complies with general accounting standards and practices, which are meant to facilitate not only business control, but also tax and other governmental requirements.

Control on posted invoice records in X3 is implemented through a combination of activity codes and general parameters. An invoice can either be cancelled or deleted. Deletion is before invoice posting.

After posting/validation, the invoice has to be cancelled. This is reversing the journal entry, which must first be not final.

We will only look at sales invoice cancellation.

Implementation

The set up consists of an activity code, general parameters, document types, and entry transactions.

Activity Code:

For sales invoice cancellation, the Activity code INVCA must be active.

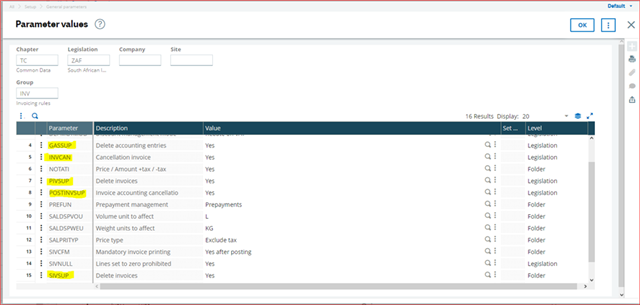

General parameters

The highlighted parameters are related to invoice functionality. However, only one, INVCAN is relevant for invoice cancellation.

SIVSUP, when set to Yes will allow a sales invoice to be deleted, before it has been validated.

GASSUP is for deleting manually created journal entries, when set to yes.

We are interested in INVCAN, which must be set to Yes at Legislation level.

This allows the invoice document type to be selected as ‘invoice cancellation’, where its category is credit memo or credit notes.

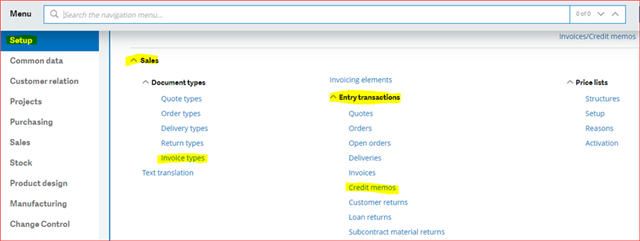

The set up for the invoice cancellation transaction is done on the highlighted functions below.

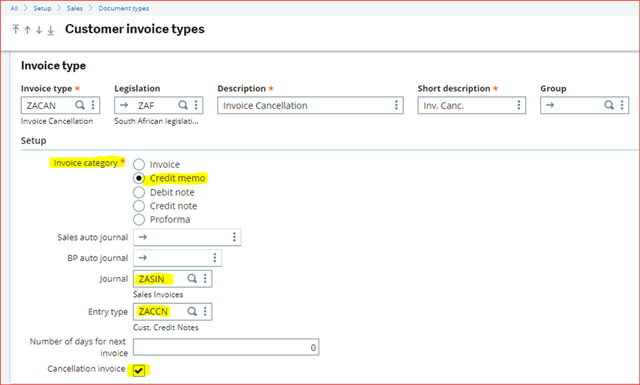

Invoice type

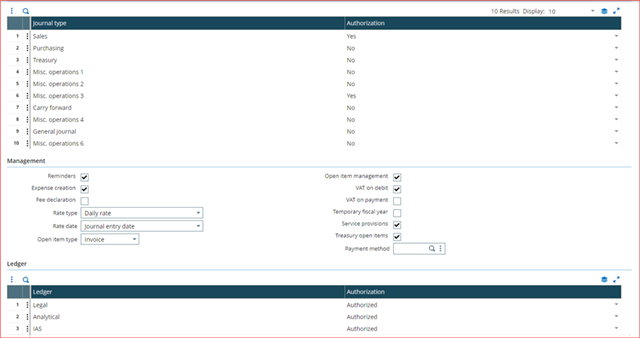

On the sales->document types->invoice types, the customer invoice type for invoice cancellation has to be set up as below

Note that "Credit memo" or "Credit note" must be selected for the invoice category and "Cancellation invoice" selected.

Note that the "Sales auto journal" and "BP auto journal" are left blank as the cancellation uses the original invoice auto journals, but reverses the journal entries.

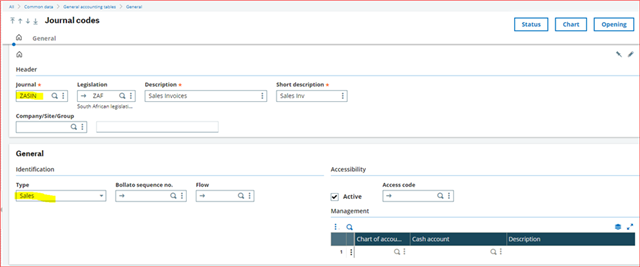

Journal code

We create a journal code ZASIN or select one existing one

Document type

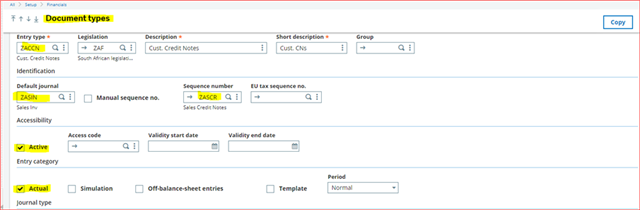

The document type ZACCN is set up as below

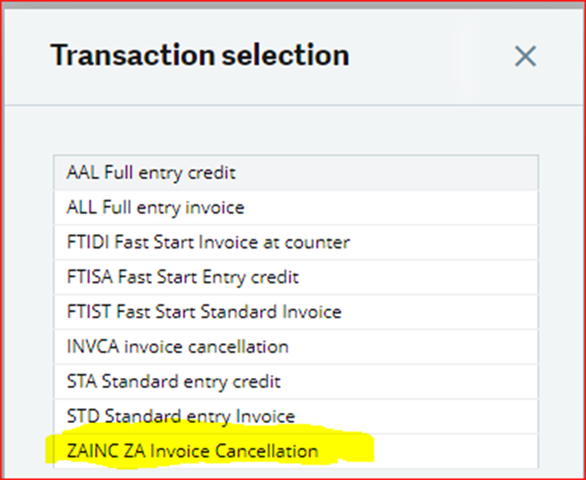

Entry transaction

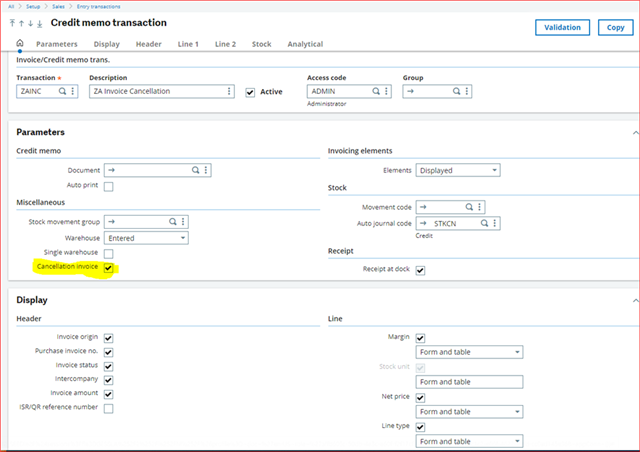

The next step is to create a Credit Memo entry transaction as below. Most fields can be left to default except for the highlighted field which must be selected.

This completes the set up.

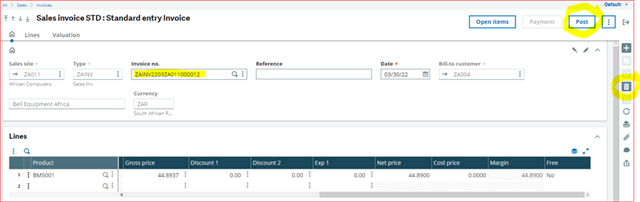

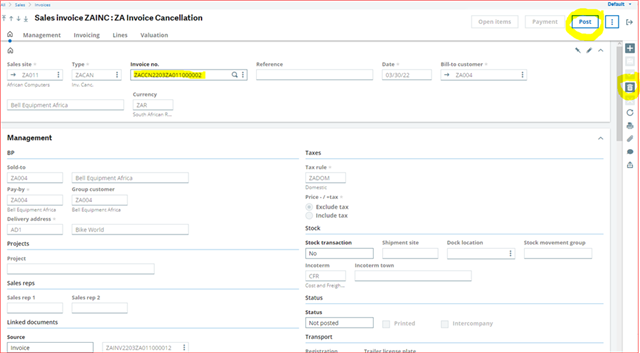

We now test by creating a sales invoice in the sales module, post it and then apply the invoice cancellation.

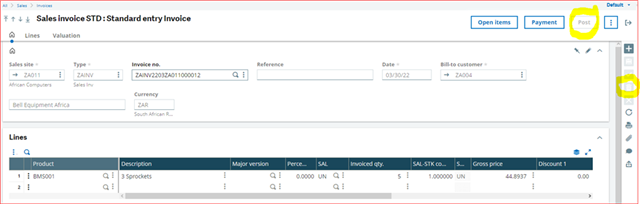

The sales invoice below has the delete button active, before the invoice is validated. This is due to the parameter SIVUP.

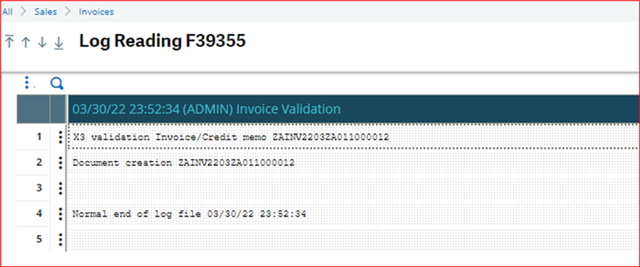

We post the invoice

The deletion button is now inactive.

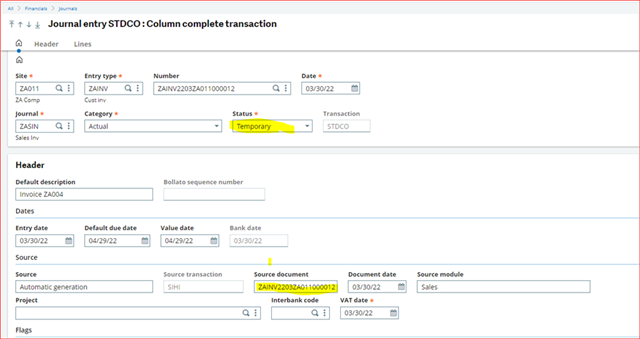

The invoice journal entry is temporary. This will allow for invoice cancellation.

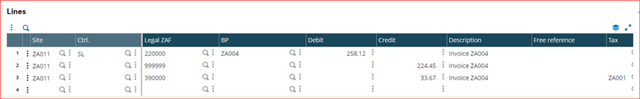

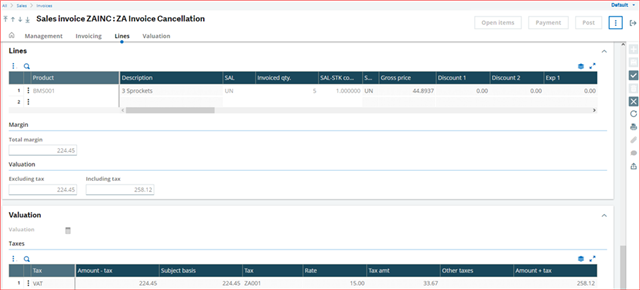

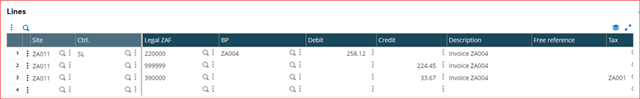

And note the line entries. They will be reversed when we apply the invoice cancellation.

We now create the invoice cancellation by selecting the Invoice cancellation entry transaction.

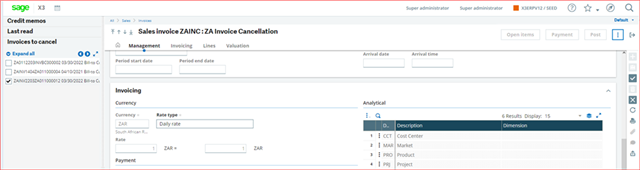

After completing the header fields, we select the invoice to be cancelled in the left list.

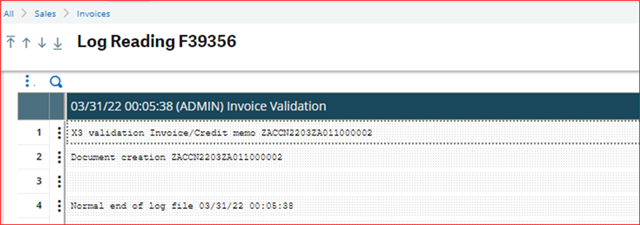

Create and post the invoice cancellation

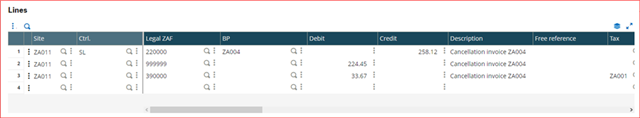

We go to the journal entry and see that it is the original invoice journal entry reversed.

Original invoice entry below

Errors made in sales invoicing can thus be corrected using invoice cancellation. The method preserves the original entry also, which is useful.