Standard Sage X3 can post journals of purchase receipts not invoiced for non-stock managed products using function FUNPTH, here is how it works:

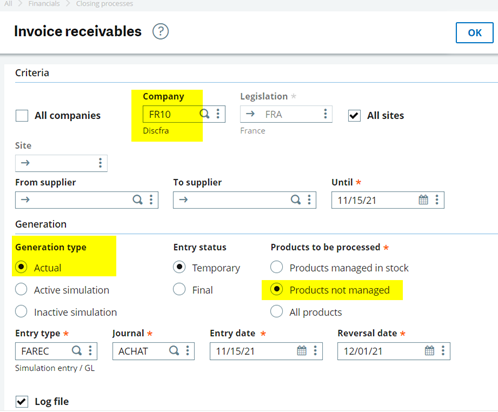

Use this process to generate the automatic accounting of the invoices receivables (IRs) from the not invoiced supplier receipts.

This invoices receivable function is run at the end of the month and it is used to generate recurrent invoice receivables. If a receipt is posted at the end of month N and has not been invoiced for month N+1 yet, a new invoice receivable is generated at the end of month N+1 for this receipt. This process considers the not invoiced and not posted receipts (which have not been the object of an invoice receivable), or the not invoiced but posted receipts whose reversal date on the associated invoice receivable is prior to the new generation date.

Based on the PTH automatic journal setup, it is possible to generate an invoice receivable by receipt or by Company-Site-Supplier-Currency combination. This depends on the Grouping option chosen in the automatic journal header:

- 1 journal entry per line: creation of an invoice receivable by receipt

- Grouped entry: generation of an invoice receivable by Company-Site-Supplier-Currency combination.

Two automatic journals are delivered with the application.

- One entry is used to the to generate invoice receivables including tax (PTH).

- Another entry is used to the to generate invoice receivables excluding tax (PTH1).

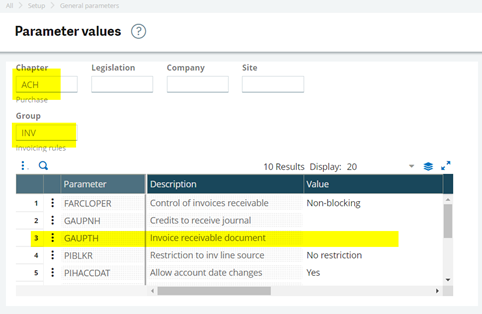

This generation processing of invoice receivables relies on the value of GAUPTH - Invoice receivable document (ACH chapter, INV group). If this parameter value is not entered, the PTH automatic journal is used instead.

Generation type

At the process level, it is possible to choose the generation mode for the journal entry:

- Actual: The actual journal is a journal that can always be viewed and printed (GL, Balance…). When you choose this option, you can decide if this actual journal entry should have a provisional or final status. A receipt processed by an actual journal entry is considered as posted. It can only be considered again when the reversal date has been exceeded. In this case, a reversal document is generated automatically for the invoice receivable on the reversal date.

If the processed receipt arises from an order and the commitment management is activated, a de-commitment will be carried our on the invoice receivable date for the processed lines and a re-commitment will be carried out on the reversal date for the invoice receivable. - Active simulation or inactive simulation: A simulation journal entry, once activated, is also integrated to the inquiry screens and accounting reports. A simulation journal entry can be turned into an actual journal entry or deactivated to become an inactive simulation journal entry (that is to say a latent journal entry, not visible in the accounting reports and inquiries). Warning, to ensure coherence, a simulation journal entry arising from a receipt must not be turned into an actual journal entry since the link is then not guaranteed. A receipt processed by a simulation journal entry is not considered as posted.

You can first generate the journal entry in simulation mode, then relaunch the processing in actual mode. In this case, the simulation journal entry is automatically deleted and replaced by the actual journal entry, which will take any new not invoiced receipt into account.

Products to be processed

These check boxes are used to only take into account some receipt lines, by either selecting the products managed in stock, or the products not managed in stock, or all products and so all receipt lines (default value).

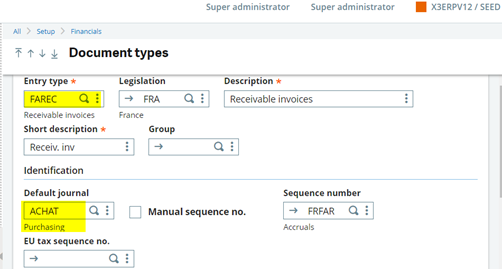

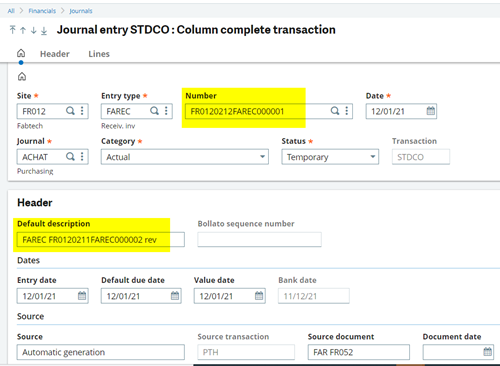

Entry type

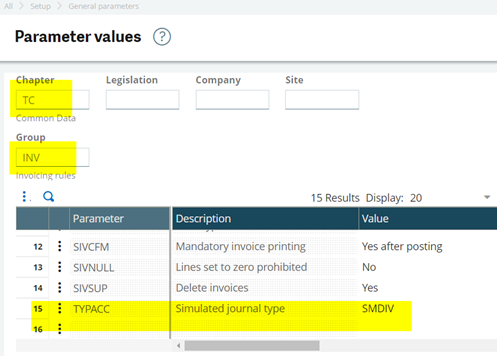

This document entry type is used to generate the invoice receivables and their reversals. The document entry type is initialized by the document entry type entered in the PTH automatic journal when the generation mode is the actual mode. If you are in simulation mode, the document entry type is defined by the TYPACC - Simulation entry type parameter (TC chapter, INV group) for the folder value.

Journal

Enter the journal in which the entry is recorded (if the entry type supports the journal). By default, for a simulation-type generation, the journal entry is recorded in the journal attached to the document entry type. If the generation is in real mode, the journal used will be the journal inscribed in the PTH automatic journal or if this is not specified by the journal associated with the journal entry type.

Document entry date and reversal date

Enter the date of the generated invoice receivable and the reversal entry date (only if the generation type is Actual). The reversal date submitted by default is the first day of the next accounting period. In a classic operating structure, the invoice receivables are generated at the end of the month and they are reversed at the start of the next month in order to have an end-of-month situation for the receipts that have not been invoiced yet.

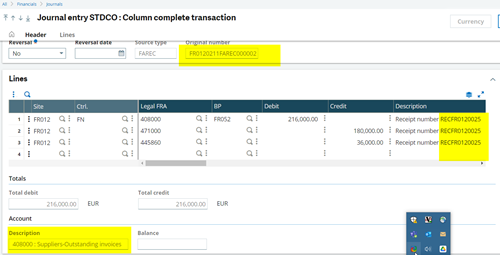

It should be noted that the invoice receivables processing generates two journal entries in Actual mode: the invoice receivable and its reversal. If commitments are tracked at order level (in relation to processed receipts), they will be reversed on invoice receivable date and regenerated on reversal date in order to have a balanced budget situation for each accounting period.

Log file

Use the Log file check box to display a summary once the process is complete, of all the journals generated by company, site and supplier (invoice receivables, invoice receivable reversals, de-commitment entries, de-commitment reversals) as well as the various ex-tax or tax-inc totals by company and site with a valuation for each processed receipt line.

See attached log file.

Enjoy the use of a hustle free GRNI.