FISCAL Year End Closing Checklist:

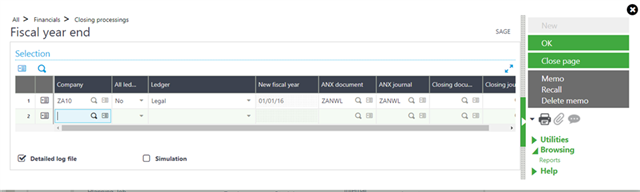

The Fiscal Year End function FIYEND (Financials > Period Processing > Fiscal Year End)

closes a Company’s fiscal year and generates the corresponding accounting entries with the document type of NEW.

The fiscal year end processing is done on a single screen. Specify the company [ZA10] for which the fiscal year will be

closed the document type and the journal on which the new journal/document/invoices must be generated. The start date for the

new fiscal year is automatically displayed. After the process is launched, a log file will trace all processed operations.

NB:The Year End Simulation function should be run for the ‘new year’ prior to closing a fiscal year for the ‘current year’.

The Year End Simulation (SIMULFINEX - Financials > Utilities > Year End Simulation) can be run to simulate what the

Fiscal Year end function will do. It can be used for cases where the previous fiscal year must remain open for a period of time

into the current year. There are no journals created nor is the fiscal year closed but it will roll the balances forward for any asset

or liability accounts. Performing a yearend simulation allows you to run a trial balance for the new year without formally ‘closing’ the current year.

A few Preliminary Setups

1.

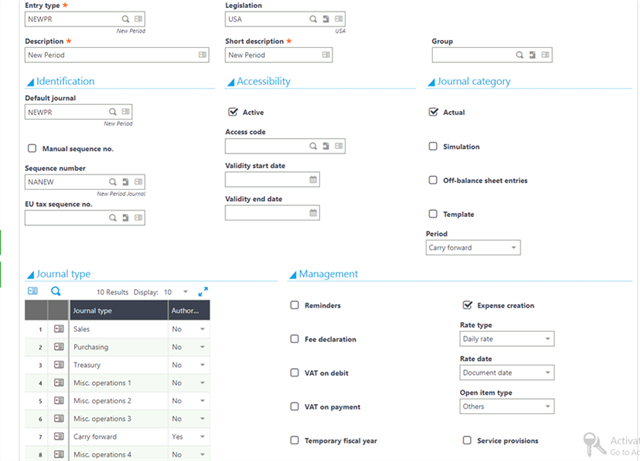

- Verify that NEWPR Document Type is created.

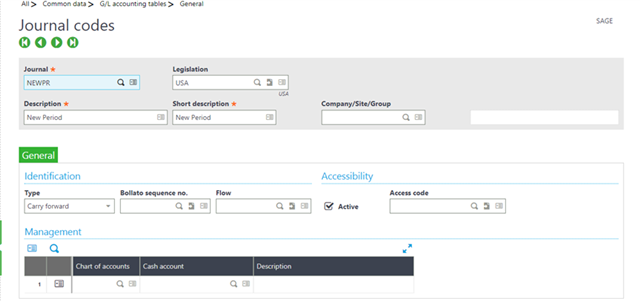

2. Verify that NEWPR Journal Code is created

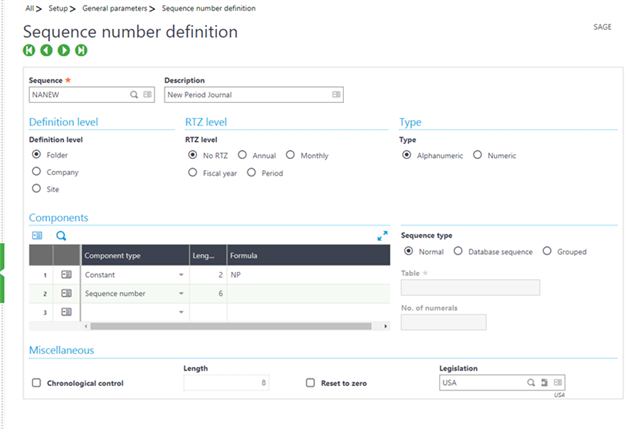

3 Sequence Numbers

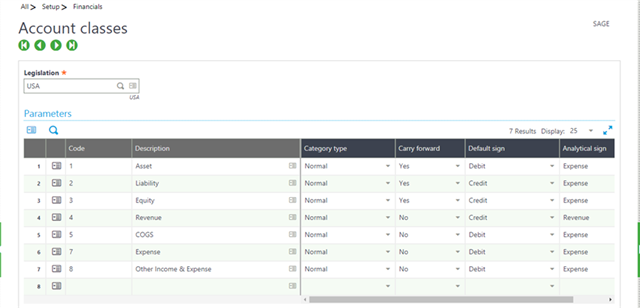

4.Account classes must be setup correctly and subsequently each gl account be classified correctly. This is important in determining whether or not to carry forward opening balances into a new year.

5 Items that must be performed prior to closing a year:

- Set SUP General Parameter ENDDAT to 12/31/xx, where xx is a couple of years in the future.

- The next fiscal year must be opened prior to closing the current fiscal year.

- Execute the Dimension Balance Recovery function if necessary. This function need only be run if the dimension views have changed or new dimension views have been added.

- All invoices must be validated.

- All receipts and payments must be validated (Batch Posting).

- All recurring journal entries must be generated and posted.

- Final Validation must be performed on all journals prior to closing. This is a batch function within G/L Accounting. This will turn all Temporary journals to Final. Also note that if the company is using Simulation journals, there may be other functions to execute prior to Final Validation such as changing the status of Simulated journals to Actual journals.

- Price updates for the next year must be entered.

- Cost transfers/cost calculations must be entered/updated for the next fiscal year.

- Close all periods for Current Fiscal Year (see Monthly Closing document for items to be performed for monthly closes).

- All users must be out of Sage ERP

Note: There is a Pre-Closing verification report named CLOPER that should be run before the year-end close is attempted. This report will list out any open items that need to be addressed before a successful year-end close can be performed.

Year End Process

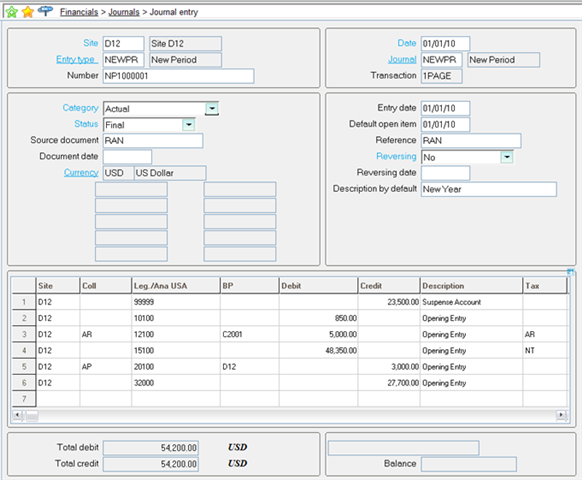

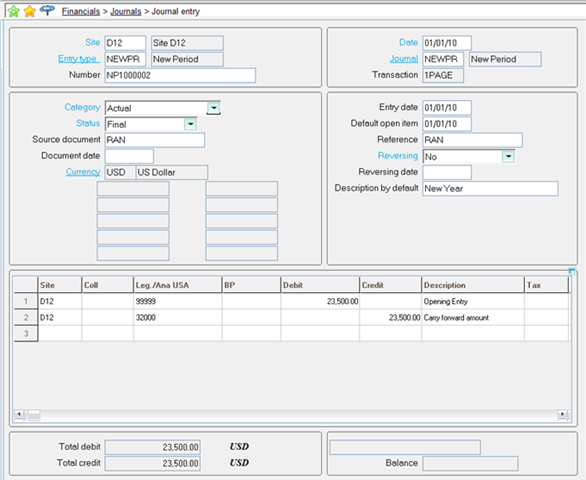

The Year End Process will shut down the Journal Status Monitor. Therefore, when executing Year End, the log displays 2 journals

with NEWNP document types. The first entry closes out the current fiscal year (Rolls forward Balance Sheet account balances and

posts the Net Income/Loss to the New Period Suspense account – ANOUVO). The second entry clears out the New Period Suspense

account and DR/CR the Retained Earnings account. In order to view the closing journals, the Journal Status Monitor must be restarted.

Note: The ‘Closing Document’ field should be blank (this feature is not typically used in the US legislation).