Hi All,

Please confirm that if any additional TAX CREDIT is applicable for the >65 Years aged employees. We can't see any update in the Payroll guide.

Regards,

Sivachidambaram S

Hi All,

Please confirm that if any additional TAX CREDIT is applicable for the >65 Years aged employees. We can't see any update in the Payroll guide.

Regards,

Sivachidambaram S

Hi Sivachidambaram,

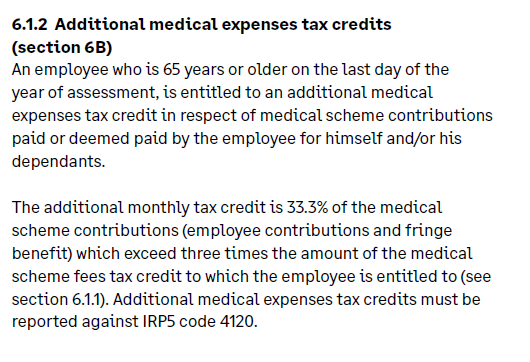

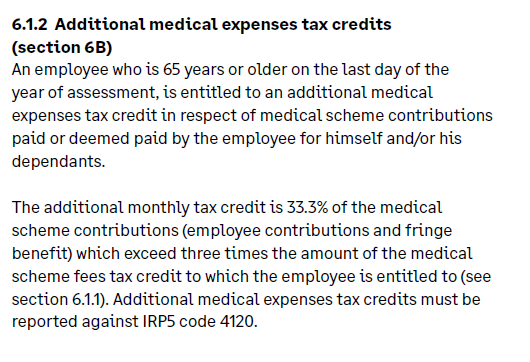

Please refer to page 29 of the Payroll Tax Pocket guide for 2023/2024:

The formula for calculation the additional tax credit remains the same, and the values are determined by the new credit amounts:

The monthly medical scheme fees tax credit amounts are:

• R364 for the main member,

• R364 for the first dependant, and

• R246 for each additional dependant.

Hi Sivachidambaram,

Please refer to page 29 of the Payroll Tax Pocket guide for 2023/2024:

The formula for calculation the additional tax credit remains the same, and the values are determined by the new credit amounts:

The monthly medical scheme fees tax credit amounts are:

• R364 for the main member,

• R364 for the first dependant, and

• R246 for each additional dependant.

*Community Hub is the new name for Sage City