Customers claiming ETI must install the latest ETI Validation patch as soon as possible.

We’ve identified a few scenarios which requires updated ETI payroll files to ensure that your ETI reflects accurately.

What does the patch fix?

It was established that under some scenarios, the ETI set may revert from 3 to 1.

The change in the Set from 3 to 1 may affect employees younger than 30 where ETI might have been over claimed.

Where do I find the ETI Patch?

- On the Software Downloads page, select the Patch Files tab.

- Look for the line item - RSA ETI: Premier and Classic: R57a (October 2021)

OR you may download the file from

- On Sage Portal, select Product Updates, then select your payroll product.

- Select Additional Files. On the next page, scroll down to Patch File Downloads.

- Here you will find - Patch file to resolve ETI Sets reverting from 3 to 1 and updated ETI Validation Tool (v2.30)

- Please take note of the onscreen download and installation instructions.

- Download the ETI_Patch_R57a_202110.zip file

- Extract the contents to the payroll application folder and overwrite the existing files

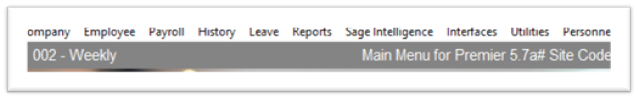

Once the patch has been installed, the system version will reflect 5.7a# on each company’s Main Menu (Not on the Company Listing screen)

- Run the ETI Validation Utility/Tool to identify any possible ETI issues. The version of the ETI Validation tool is 2.30

Note: The ETI Validation Tool makes provision for the 2021 COVID-19 ETI Relief measures and has been updated with additional scenarios.

Before extracting the patch file:

- Ensure that payroll is on Release 5.7a

- Make a Full System Backup

- Ensure that all operators have closed their payroll companies

- Close all open instances of Excel

FAQ’s

Is this patch mandatory for my payroll?

Yes, if your company claims ETI, we ask that you download and install the patch file to ensure that you have the latest ETI payroll files.

I did not install the ETI Validation tool for Release 5.7a (launched on 28 Sept 2021), do I install that one first?

The ETI Validation patch released on 18 October 2021, contains the updated ETI Validation tool as well. There is no requirement to install any other versions beforehand.

If I installed the ETI Validation tool for Release 5.7a released on 28 Sept, am I still required to install this patch file?

Yes, the latest patch must be installed to ensure that your ETI reporting will be correct.

How will I know that I have the latest ETI files within my payroll?

Access any company’s Main Menu. It must reflect as Release R5.7a#

The # indicates the latest release based on the ETI patch.

Note: The # will not display on the Company Listing screen.

What do I need to do after installing the ETI Validation patch?

To correct values and sets which calculated incorrectly:

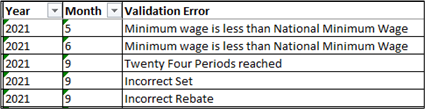

a. Access the ETI Validation tool/utility (Main Menu > Utility > ETI > ETI Validation) and run Step 1 of the ETI validation process.

Be on the lookout for “Incorrect Set” validation errors.

b. Follow the steps as indicated on the ETI Validation tool/utility to import the correct periods and sets for all affected employees.

c. If values that are imported are less than the values already declared on the EMP201 reports, administrators will need to restate the EMP201 values.

Important: Customers claiming ETI are encouraged to run the ETI Validation Tool/Utility every month as part of monthly processing checks.

Please check and make the ETI adjustments as soon as possible.

Helpful videos: