We are aware of the following scenario resulting in SARS e@syFile import errors:

- You are generating the IRP5.23 file using the IRP5/IT3a report on Release 5.8a, for the 2022/2023 Interim EMP501 Reconciliation (mid-year) Submission

- The SARS e@syFile application is currently on version 7.2.7

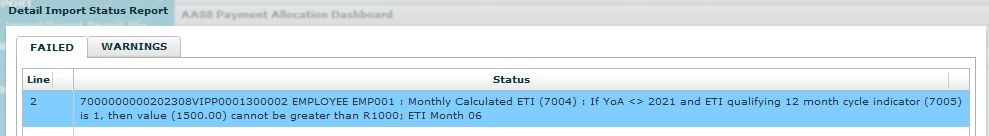

- When you import the IRP5.23 file into SARS e@syFile the import fails and the error on the Import Payroll File Log indicates the following message:

"Monthly Calculated ETI (7004) : If YoA <> 2021 and ETI qualifying 12 month cycle indicator (7005) is 1, then value (1500.00) cannot be greater than R1000; ETI Month XX"

"Monthly Calculated ETI (7004) : If YoA <> 2021 and ETI qualifying 12 month cycle indicator (7005) is 2, then value (750.00) cannot be greater than R500; ETI Month XX"

What is the cause of the issue?

- The import error message is due to the SARS e@syFile application not applying the 2022/2023 ETI tables when validating the data import, and is still using the previous year tables.

Example:

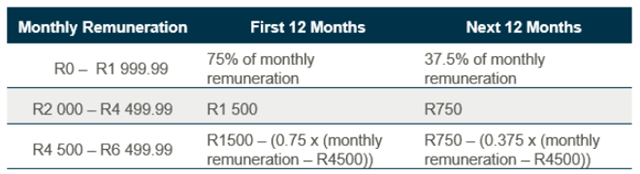

- The employee qualified for ETI for the 1st time, worked more than 160 hours and employee's remuneration was between R2000 and R4999.99 in the month of June,

- According to the 2022/2023 table , them employee would qualify for an ETI amount of R1500

The import error on SARS e@syFile :

"Monthly Calculated ETI (7004) : If YoA <> 2021 and ETI qualifying 12 month cycle indicator (7005) is 1, then value (1500.00) cannot be greater than R1000; ETI Month 06"

How will I resolve this error?

- You can review the ETI values in your payroll to confirm they are correct - As from Release 5.8a, the application is applying the correct ETI tables, validations and calculations

- For the 2022/2023 Interim EMP501 Reconciliation (mid-year) Submission, your payroll application must be on Release 5.9a (scheduled to available as from 17 September 2022) to align with the latest SARS Business Requirement Specifications

- SARS will also release an updated version of SARS e@syFile which will include the updated validations for the 2022/2023 tax year and alignment with their Business Requirement Specifications

- The recommendation will be to export IRP5.23 file on Release 5.9a, and import the file into the latest version of SARS e@syFile when it becomes available (expected 19 September 2022)