In a previous article, ZIMRA (Zimbabwe Revenue Authority) confirmed that the higest marginal rate should be 45%. Click here to view previous post

According to the latest information released on 20 September 2019 by ZIMRA:

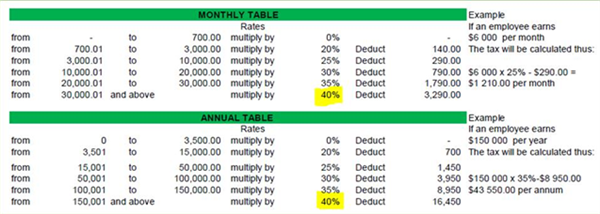

"The highest tax rate of 45% on the taxable income earned from employment which was gazetted in the Finance Act (7) No. 2 of 2019 is being corrected to 40%.

The necessary legislation amending the highest rate from 45% to 40% will be promulgated in due course and will be with effect from 1 August 2019. Employers are therefore advised to effect the correct rate of 40% as shown below

Tax tables for periods 01 August 2019 to 31 December 2019

(Annual tax table is pro-rated from August to December)"

* Updated 25/09/2019 *

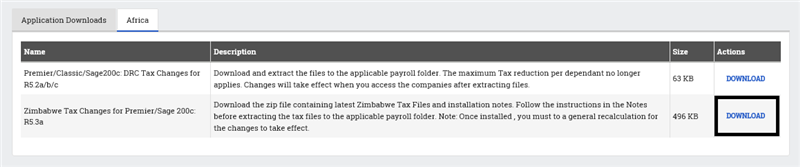

The updated Zimbabwe tax file is available for download for Sage VIP Premier, Classic and Sage 200c VIP:

- We recommend that you make a full system backup, before installing the new tax files

- You application must be updated to Release 5.3a

- Click here to access the Application Downloads page

- Click on the Africa tab

- Click on Download button under Actions - the browser will prompt you to save the file, or automatically save it to the downloads folder (setting determined by the browser)

- Once downloaded, browse to the file on your computer, and open it (will be opened by your computer's default application e.g. Winzip

- Select to extract the files to your payroll application folder

- When prompted to replace the files, say Yes to overwrite

- Access your payroll application, en do a General Recalculation