e@syFile 6.9.1 was released on 1 October 2018, and all users accesing the application is prompted to upgrade to the new version.

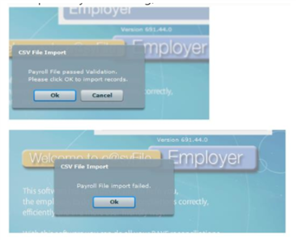

There has been reports that as from the update, that payroll files generate from Sage 200c VIP and Sage VIP (Release 5.1a), passes the import validation, however fail to import.

On the Import Payroll File Log, no reasons are provided why the file import fails.

The issue was escalated to SARS to investigate and address the issue.

We have found that the cause of the issue, is related to the certificates with code 4497 with a value of zero (4497,000000000000000,). The issue is caused by a new validation implemented with the new e@syFile release, which was not present in v6.9.0.

According to the SARS Business Requirement Specification, code 4479 should only be in the file if you have deduction codes 40, or company contribution codes 44 or information codes 45. If none of the mentioned codes are present then code 4497 with a value of zero is not mandatory.

Your payroll application has always exported the code 4497 irrespective of whether or not there were 40,44 or 45 codes present, and no error or rejections were experienced in the past.

Solution:

- SARS has confirmed that they will be making changes on their side to accommodate this issue, and a new version of their software will be released to address the issue. There is however no date confirmed, when the software will be released.

- Sage will be releasing a patch file for Release 5.1a within this week, to address the issue and remove the code 4497, if the value calculated for this specific code is zero, and notification will be made via Newsflash, in-product messages and on this forum. More details to follow…