According to the Zimbabwean Revenue Authority, separate ITF16 annual returns must be submitted for a year of assessment where different currencies were paid to employees, so as to reflect the remuneration paid in the Zimbabwean dollar(ZWL) and the US dollar(US$).

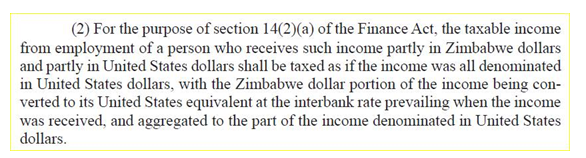

Finance Act 2021, Act No. 7. Section 5(2) clarifies how employers should process payrolls where an employee is paid in multiple currencies.

Where an employer pays employees in both the ZWL and the US$, the ZWL income should be converted to US$ and then added to the US$ income. Then all the taxable income will be taxed using the US$ tax tables.