The Finance Act 2021 has been enacted. Below are the key changes that affect payroll taxes:

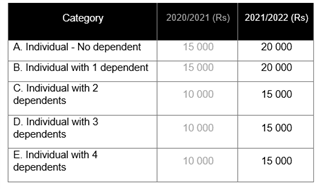

1. IET

The Income Exemption Threshold remains the same.

2. Relief for Medical Insurance premium or contribution

Medical insurance premiums of up to Rs20 000 for self and first dependent and up to Rs15 000 for every other dependent.

3. Additional exemption in respect of dependent child pursuing undergraduate course

The additional exemption in respect of dependent child pursuing a non-sponsored full-time undergraduate course at a recognised institution in or outside Mauritius has been increased to Rs 225 000.

4. Deduction for contribution made to National Covid-19 Vaccination Programme Fund (New)

A person who has contributed to the Covid-19 Vaccination Programme Fund is entitled to deduct such amount from his net income.

5. Deduction for donation to charitable institutions (New)

A person who makes a donation to a charitable institution shall be entitled to deduct such amount, up to a maximum of Rs 30 000, from his net income.

6. Deduction for contribution made to approved personal pension schemes (New)

A person, who has contributed to an individual pension scheme approved by the Financial Services Commission for the provision of a pension for himself, shall be entitled to deduct such amount, up to a maximum of Rs30 000, from his net income.

An exempt person remains an employee whose emoluments in a month do not exceed Rs 25 000 and is not subject to tax deductions under PAYE.

The Notes on page 2 of the EDF also contain a summary of all the deductions and EDF exemptions that are relevant for this tax year.

All changes are effective 01 July 2021.

Note: Please contact your Business Partner for assistance with the changes that need to be applied on the system.