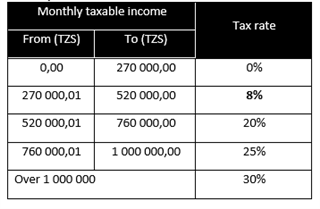

Below are the proposed changes for employment taxes based on the recent Tanzania Budget Speech 2021.

Proposed tax table

Workers Compensation Fund

The Minister has proposed to decrease the contribution rate to the WCF from 1% to 0.6% for the private sector.

Contribution rates for the public sector is expected to remain the same.

Skills Development Levy (SDL)

The SDL rate is expected to remain the same.

NOTE:

We expect the effective date to be 1 July 2021.

The information provided above is subject to approval by Parliament, therefore we are awaiting the Finance Act in order to take action.

Update: 05/07/2021

- Section 25 - The PAYE tax tables as proposed have been enacted, as well as page 12 of the attached Finance Act 2021 - effective 1 July 2021 - Refer to the Tanzania Tax changes post regarding the changes.

- Section 82 - Skills Development Levy(SDL) rate remains unchanged. However, employers who have 10 (previously 4) or more employees are liable for the skills levy.

Update: 19/07/2021

Refer to the post on the Workers compensation fund