Click here to access Zimbabwe’s Finance (No. 2) Act of 2020, it contains tax changes which affect employment income. Summarised as follows:

- Tax deductions - pension

The tax deduction for pension contributions and retirement annuity has increased to ZWL240 000

USD limits not provided in the legislation.

- Interest on loans

Prescribed interest rate for loans in forex is LIBOR rate plus 5% for loans exceeding USD100.

Prescribed interest rate for loans in ZWL is 15% for loans exceeding ZWL8 000.

- Tax credits

The following tax credit limits are increased to ZWL72 000:

- Blind person’s credit

- Mentally or physically disabled person credit

- Credit for taxpayers over 55 years of age

USD limits not provided in the legislation.

- Exemption for pension commutation or annuity

Exemption is ZWL800 000 or 1/3 of the package up to max of ZWL3 600 000.

USD limits not provided in the legislation.

The above-mention exemption is for any amount of pension commutation or annuity, which is paid to an employee on the cessation of his or her employment, where his or her employment has ceased due to retrenchment, and is received by a person who has not attained the age of 55 years before the start of the tax year.

- Motoring Benefits

The new motoring benefit values are tabulated below

|

Engine Capacity |

Deemed Value ZWL unchanged |

Deemed Value USD |

|

Up to 1 500 cc |

54 000 |

675 |

|

1 501 to 2 000 cc |

72 000 |

900 |

|

2 001 to 3000 cc |

108 000 |

1 350 |

|

3001 and above |

154 000 |

9 800 |

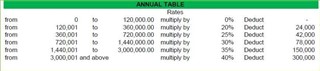

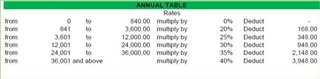

- Tax tables

See below the tax tables for the various tax periods in both the local (RTGS/ZWL) and foreign currency (USD).

7. Bonus exemption

The tax-free bonus has increased to ZWL25 000 (USD320). Effective 1 November 2020

Note that all the changes are effective 1 January 2021, except for the bonus exemption threshold which was effective 1 November 2020.