With the release of the Finance Act, No. 8 of 2020 a few changes have been introduced that will affect the tax on Employment income. To view this document, please click here.

The following changes will affect your payroll:

- Tax on Overtime/Bonus

- The end of the Home Ownership Savings Plan (only effective 1 January 2021)

1. Tax on Overtime/Bonus - Effective 30 June 2020

Previously, employees whose taxable employment income before bonus and overtime allowances did not exceed the lowest tax band (below KES 12,298 per month) were not subject to PAYE on receipt of bonuses and overtime allowance over and above their basic pay.

The Act has removed the exemption from tax of bonuses, overtime and retirement benefits paid to employees whose taxable employment income before bonus and overtime allowances does not exceed the lowest tax band.

The new change is only applicable from 30 June 2020 and not for the full tax year.

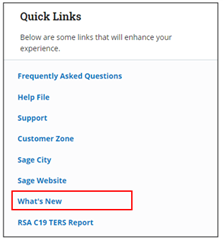

Please refer to “What’s new” on your subscription Landing page more details.

2. The end of the Home Ownership Savings Plan

Communication regarding these changes will follow in January 2021.