The Minister of Employment and Labour has issued a new amended TERS Directive.

Previous posts related to the TERS Directive:

- COVID-19 Temporary Employee/Employer Relief Scheme (RSA) (Released 26/03/2020)

- C19 TERS (Temporary Employee/Employer Relief Scheme) - Amended Directive released 08/04/2020

- C19 TERS (Temporary Employee/Employer Relief Scheme) - Amended Directive released 04/05/2020

The changes included in the new directive are indicated in red below.

Please note:

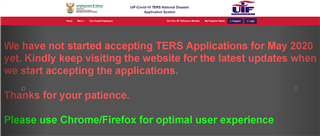

The Fund has posted a notice on the online TERS application website that they have not started accepting applications for May 2020 yet.

Employers should keep on visiting the website for information on when applications will re-open.

C19 TERS:

The Minister of Employment and Labour has issued a Directive called Covid19 Temporary Employee/Employer Relief Scheme (C19 TERS) effective 26 March 2020. This Directive will remain in operation for a period of 3 months or until it is withdrawn by the Minister, whichever comes first.

During this COVID-19 lockdown period, most companies have shut down/closed (whether total or partial) and for some employers it is not economically possible to continue to pay employees. In this case, the Department of Employment and Labour has created a special benefit under the Unemployment Insurance Fund as per the Directive.

Purpose of the Directive:

- To make provision for the payment of benefits to contributors who have lost income or have been required to take annual leave in terms of the BCEA due to the Covid-19 pandemic.

- To minimise economic impact of loss of employment due to the Covid-19 pandemic.

- To avoid contact with, and the spread of Covid-19.

- To establish the Temporary Employee/Employer Relief Scheme and set out the application process for benefits.

- To make provisions of online applications for benefits in order to avoid contact during the national disaster period.

Qualifying employers:

- In view of social distancing and in order to avoid in person individual applications at Departmental offices for the Covid-19 benefit during lockdown, should an employer as a result of the Covid-19 pandemic close its operations, or part of its operations, for a 3 months or lessor period the employer must apply in accordance with the Directive for Covid-19 benefits for and on behalf of its affected employees.

- For the company to qualify for TERS, it must satisfy the following requirements:

- the company must be registered with UIF,

- the company must comply with the application procedure for the financial relief scheme, and

- the company’s closure must be directly linked to the Covid-19 pandemic.

***‘Temporary lay-off’ means a reduction in work following a temporary closure of business operations, whether total or partial, due to Covid-19 pandemic for the period of the National Disaster.

TERS benefits:

- The benefit shall be de-linked from the UIF’s normal benefits and therefore the normal rule (for every 4 days worked, the employee accumulates one day credit an 7d the maximum credit days payable of 365 days for every 4 years) will not apply.

- The benefits will only pay for the cost of salary for the employees during the temporary closure of the business operations.

- The salary to be taken into account in calculating the benefits will be capped at a maximum amount of R17 712 per month, per employee and an employee will be paid in terms of the income replacement rate sliding scale (38% - 60%) as provided in the UI Act.

- Should an employee’s income determine in terms of the income replacement sliding scale fall below R3500, the employee will be paid a replacement income equal to that amount.

- Qualifying employees will receive a benefit calculated in terms of section 12 and 13 (1) and (2) of the UI Act, provided that an employee shall receive a benefit of no less than R3500.

- Subject to the amount of the benefit calculated according to the rules above, an employee may only receive Covid-19 benefits in terms of the Directive if the total of the benefit together with any additional payment by the employer in any period is not more than the remuneration that the employee would ordinarily have received for working during that period.

- All amounts paid by or for the UIF to employers or bargaining council(s) under the terms of the Scheme shall be utilized solely for the purposes of the Scheme and for no other purpose. No amount paid by or for the UIF to an employer or bargaining council under the terms of the Scheme that is required to be paid, in turn, to an employee will fall into the general assets of the employer or bargaining council, and no bank may refuse to release or administer the transfer of that amount into the bank account of the employee as required by the Scheme, irrespective whether the employer or bargaining council is in breach of its overdraft or similar contractual arrangements with the bank concerned.

- An employer, who has required an employee to take annual leave during the period of the lockdown in terms of the BCEA may set off any amount received from the UIF in respect of that employee’s Covid-19 benefit against the amount paid to the employee in respect of annual leave provided that the employee is credited with the proportionate entitlement to paid annual leave in the future.

- To speed payment of Covid-19 benefits to employees, employers are urged to pay employees based on the calculation applied and reimburse or set off such with Covid-19 benefits claim payments from UIF.

- A contributing employee may individually apply for Covid-19 benefits if:

- the employee has lost income due to Covid-19,

- no bargaining council or entity has concluded a MOA with the UIF, and

- the employee’s employer as failed or refused to apply for Covid-19 benefits.

Based on current information, this should be done via uFiling.

Agreements with bargaining councils (i.r.o TERS):

- An employer whose employees are entitled to receive Covid-19 benefits provided by the UIF during the period of lockdown from the bargaining council or entity may not make an application in terms of the Scheme and the employees of that employer may not receive any payment in terms of the Scheme than through the bargaining council or entity.

The above restriction only applies if –

- the parties to the bargaining council have concluded a collective agreement that-

- has been extended by the Minister of Employment and Labour in terms of section 32 of the Labour Relations Act, and

- provides for the disbursement of funds received from the UIF to provide Covid-19 benefits to employees bound by the collective agreement during the period of lock-down, and/or

- the bargaining council has concluded a memorandum of agreement with the Fund for the council to disburse covid-19 benefits on behalf of the Fund to -

- the employees who fall within the scope of the collective agreement or its registered scope, and

- if authorised by the memorandum of agreement, any other employees in a sector identified in the agreement, whether or not they fall within the registered scope of the bargaining council, or

- an entity has concluded a memorandum of agreement wit the fund for it to disburse Covid-19 benefits on behalf of the Fund to employees who are employed by its members, or

- the employer has not submitted an application for Covid-19 benefits prior to the bargaining council or entity signing of a MOA with the UIF.

“Bargaining council” means a bargaining council or stautory council registered in terms of the Labour Relations Act.

“Entity” means any juristic person that in terms of its articles of association or constitution has employees or employers as members and is permitted to pay Covid-19 benefits to employees directly or indirectly through its employer members.

Application procedure:

- The employers shall apply by reporting their closure to email box [email protected] and there shall be an automatic response outlining the application process.

- The employer must then apply online at https://uifecc.labour.gov.za/covid19/covid19

- The employer shall be required to furnish the Fund with the following documents:

-

- MOA (if the employer employs more than 10 employees).

- CSV file in the prescribed format that will require critical information from the employer. If the employer submits online, the employer has the option to either upload the CSV file or manually load each employee by completing the required fields.

- Excel sheet containing the banking details of the employer or bargaining council of the payment is made to the employer or bargaining council.

- Confirmation of bank account in the form of the latest bank statement.

- Letter of undertaking.

- All document submitted will be subject to verification.

For more information regarding TERS, please refer to the Department of Employment and Labour website.

UIF has also developed a hotline for COVID-19 TERS Benefit enquiries during lockdown period: 012 337 1997.

Workers, companies and stakeholders are urged to follow @DeptofLabour and @UIFbenefits on Twitter and visit www.labour.gov.za for regular updates.