The following message has been updated on the landing page of Sage Business Cloud Payroll Professional: Updated (27/05/2020)

National Treasury and SARS published a second draft Disaster Management Tax Relief Bill on 19 May 2020. This revised draft Bill contains the information i.r.o the further proposed tax relief measures as announced by the President .

To view the responded documents click on the link below:

https://www.sars.gov.za/Legal/Preparation-of-Legislation/Pages/Response-Documents.aspx

- Media Statement: Publication of the 2nd revised COVID-19 Draft Tax Bill and extension of time for public comments on specific 2020 tax proposals

- Draft Disaster Management Tax Relief Bill – 19 May 2020

- Draft Explanatory Memorandum on the Revised Draft Disaster Management Tax Relief Bill – 19 May 2020

Although not promulgated yet, this draft Bill provides the necessary legislative amendments required to implement the Covid-19 tax relief measures.

This article only explains the compliance changes, and is currently with our Product Development teams to implement the latest changes (which differs from the Revised Disaster Management Tax Relief Bill and draft Disaster Management Tax Administration Relief Bill published on 1 May 2020)

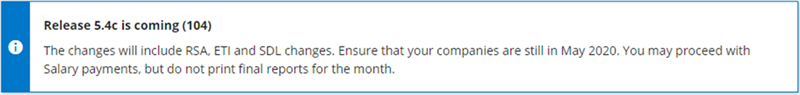

Additional relief and changes to existing measures and calculations were communicated, which will be included in the deployment of Release 5.4c in May 2020.

Please refer to the information below for important details about some of the expected changes.

Changes to the previous draft bill are highlighted in red. Click on each link below to open up a document outlining the changes and what needs to be done on the payroll: