Please refer to our initial ETI guide for all information regarding the new ETI changes in 2022 Update 2:

3527.Employement Tax Incentive Guide.pdf - this guide was created for the initial extended ETI in 2020, but the same rules applied to the second extended ETI.

In 2022 Update 2:

- You will have to change your registered for PAYE on Setup, Company Parameters, Statutory tab to state whether you have been registered for PAYE on or before 25 June 2021.

- You will have to add a Wage Regulatory Measure to all employees you will be claiming ETI for, you can do this in bulk using the Employee Batch assistant.

- Your Wage Regulatory Measure that has been added to the masterfile has to be higher or equal to this employees Hourly Rate.

- For employees older than 30, the definition for date engaged have been changed

In regards to back dating ETI you have two options to back date the Extended ETI values from August.

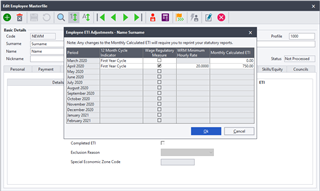

Option 1: ETI Adjustment screen

This can be found on the Masterfile.

- Navigate to Edit,

- Select Employee Masterfile

- Click on Statutory

- Click on ETI

- Select ETI Adjustments.

This will show you all previous ETI periods that can be adjusted. Please note that we recommend you use this screen to Adjust the ETI values only. All other extended ETI employee indicators will not be updated by this screen. The ETI amounts will be limited to the maximum you can claim for the period. This means that the limits will change between March and April – July. The ETI values on the ETI Report and the EMP201 will be updated once the changes have been saved. Please reach out to you tax practitioner for advice on restating the EMP201’s for the affected periods:

Employee ETI Adjustment Utility

This can be found by going to Utility…Employee ETI Adjustment Utility. This screen will show you all your ETI employees and gives you the option for Payroll to recalculate the ETI values for August. The ETI values on the ETI Report and the EMP201 will be updated once the changes have been saved.

Please note that only the ETI values for the month of August can be adjusted using this utility, the ETI adjustment screen must be used to correct the ETI values for any other months.

If you have not claimed Extended ETI for your employees for August it is recommended to reprocess your Payroll for these months as the Extended ETI indicators must be updated for the IRP5 file to be correct. You can restore your last Month/week/fortnight April backup and setup your employees for ETI if necessary and do a Payroll Run for your employees ETI amounts to be calculated. You will then need to roll over into May and reprocess May.

Please reach out to you tax practitioner for advice on restating the EMP201’s for the affected periods.