View our video regarding this matter here.

If you are making use of tax directives, there are a few mandatory changes that you will need to apply to your Pastel Payroll System once you have updated. Applicable to the 2021-2022 tax year, SARS is requiring extra information for any non tax method related directives (Directives for Lump Sums, severance pay, arbitrations etc.).

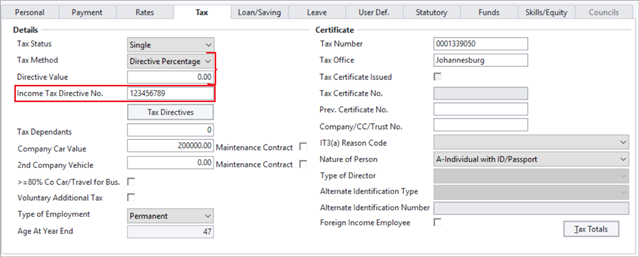

If you have a directive that is linked to your tax method (Directive Percentage, Directive Amount) it will need to be entered in the new Income Tax Directive field, that tax number will work directly with your tax method and Directive Value this directive number only needs to be entered in this spot.

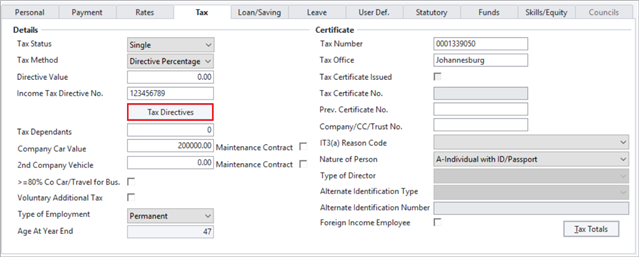

If you have a directive currently processed for lump sum payments, severance packages etc. you need to ensure that the directive number and supporting information has been entered by clicking on the new Tax Directive Button:

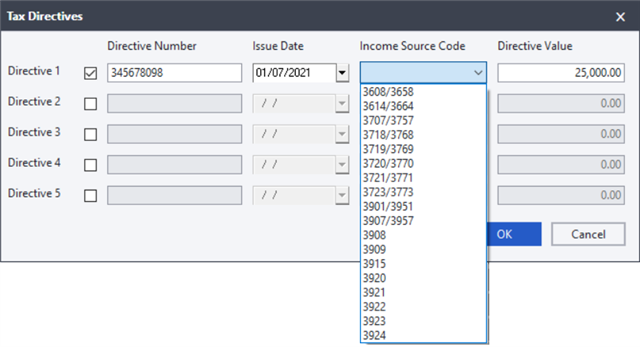

You will now:

- Check the check box for the Directive (this will be done automatically if you had a directive number on the masterfile prior to the update)

- Enter the directive number (this will be done automatically if you had a directive number on the masterfile prior to the update)

- Enter the date that the directive was issued

- Click on the source code and select the income source code that was stipulated in your directive from the list

- Enter the value of the directive.

NOTE: Your directive numbers that where entered in the directive number fields on the masterfile will automatically be entered into the new Tax Directive button screen. You will have to enter the date, source code and directive value that goes along with the directive number. Your tax directive number linked to the tax method needs to be removed from this screen and be entered to the Income Tax Directive no field that is underneath the directive value field.

View our video regarding this matter here.