The weekly employees are setup with the working days as per the below screenshot:

Monday to Thursday they work 8.5 hours per day and on Friday they work 6 hours.

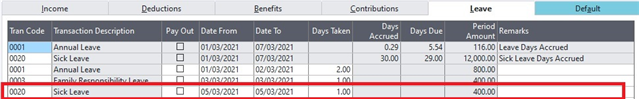

I processed sick for a Friday as per the screenshot below:

When I process sick leave, it adds transaction code 5016 to the income tab as per the screenshot below:

The first issue I have is that when I process sick leave for a wage earner, I don't want it to add a transaction for paid sick leave with a value to the income tab. I don't want it to add any transaction to the income tab. When processing sick leave for a salary earner it doesn't and I want it to be the same for a wage earner.

The second issue I have, is that if I can't stop Payroll from adding transaction 5016 with a value to the income tab, then it need to pick up the correct hours for the days sick leave has been processed for. For a Monday to Thursday these should be 8.5 hours per day and for a Friday it should be 6 hours per day. However, Payroll takes the average hours per day, being 8, and adds that to the income tab under transaction code 5016, which it totally incorrect.

The third issue I have, is that Payroll doesn't allow me to override the quantity on transaction 5016. I tick the override button, change the hours from 8 to 6 but as soon as I go to a new line it automatically goes back to 8 hours.

My client has just purchased the Payroll software package and this is a seroius issue for them. They are not able to complete their weekly payroll run because of this issue.

I need assistance in resovling this issue urgently.