Dear Sage City Member

Under UAE VAT Law, the responsibility to levy, collect and pay tax to the government is on the person who is making taxable supplies i.e. on the supplier. This means, whenever a registered supplier is making a taxable supply, he needs to charge VAT and pay the same to the government. The mechanism of collecting tax by a registered supplier from his customers is known as forward charge mechanism.

However, the UAE VAT Law and Executive Regulations notifies certain types of supplies on which VAT needs to be charged on Reverse Charge Mechanism.

What is VAT Reverse Charge Mechanism?

Under reverse charge mechanism, on certain notified supplies, the buyer of goods or services is responsible to pay the tax to the Government, unlike in the forward charge, where the supplier is liable to pay the tax. With the UAE VAT Law and Executive Regulations introduction of reverse charge, the key change is the shift in the responsibility of paying tax, which is moved from the supplier to the customer.

Why is reverse charge required?

Tracking the transactions made by business from outside of UAE (United Arab Emirates) and ensuring VAT compliance was tedious for FTA (Federal Tax Authority). Hence, recipients who are citizens of UAE were made to pay VAT on reverse charge basis. This mechanism is primarily used for cross-border transactions, hereby relieving non-resident suppliers from the burden of registration and accounting for VAT in their consumers’ location.

Sage 200 Evolution caters for the reverse charge for UAE Sage 200 Evolution users/clients.

Please Note: The database needs to be a Middle East database to have the reverse charge node

The below example will provide a better understanding on how to capture these Reverse Charge transactions in Evolution.

Example:

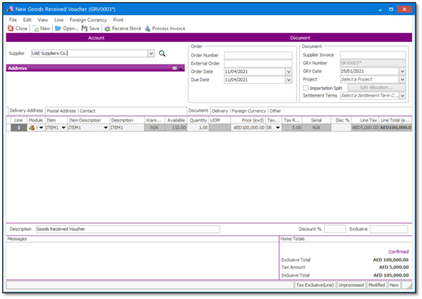

UAE Suppliers Co. sold goods worth AED 100000 to Us (Evolution user Company) and charged VAT of AED 5000 at the rate of 5% (Standard-Rated Supplies). The VAT of AED 5000 is collected on a Reverse Charge basis. Please see the supplier invoice process below.

To record the AED 5000 charged on Reverse Charge, please navigate to Supplier/Purchases | Transactions | Reverse Charge

The below details are required before you can view and process the transaction.

- Tax Type (Filters section) – This is the tax type used on the supplier’s invoice.

- Tax type (options section) – This is the type to use on the reverse charge transactions.

- Credit Tax Account – Tax Account to be credited when the Reverse Charge is processed.

- Debit Tax Account – Tax Account to be debited when the Reverse Charge is processed.

The captured reverse charge transactions will now reflect on the Vat reports.

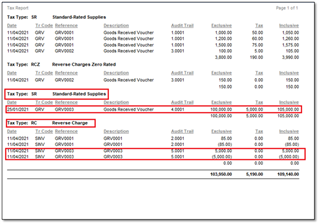

The Tax Listing Report:

Navigate to Tax | Report | Tax Report

The report will display the supplier invoice with the VAT charged using the SR tax type and the Reverse Charge Transactions using RC tax type as specified on the Reverse Charge transaction.

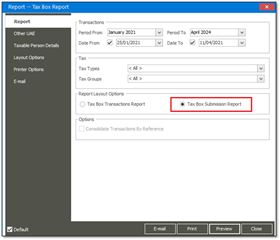

Tax Box Submission Report:

Navigate to Tax | Reports | Tax Box, select Tax Box Submission Report under the report option section and preview.

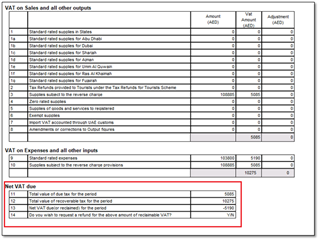

The Middle East database is required to use a specific Submission Report layout for Value Added Tax Return. When running the Tax Box Submission report, it will give all the Vat details with the Net Vat due details.

The net result of reverse charge mechanism is the same as that of the forward charge basis. The only difference in reverse charge VAT is the shift in the responsibility of paying VAT which is moved from supplier to the customer. In the above example, it is moved from UAE Suppliers Co. to Us as the buyer of goods.

The concept of Reverse Charging Vat was created to simplify trade within a single market. This reduces the necessity of VAT registration for sellers in the country where the supply is made. In other words “Reverse Charge” eliminates the responsibility of reporting a VAT transaction from the seller to the buyer of a good or service. In a standard business scenario, the supplier provides the goods and obtains the VAT in favor of the customers, that is later paid to the government, but in reverse charge mechanism the buyer or end consumer pays the tax directly to government.