Dear Sage City Member

This blog article will cover steps on how to configure the Evolution company for the Fiscal Printer as used by Rwanda Evolution clients, when using the Point of Sale and Annuity Billing modules.

Note that the Fiscal Printer is relevant to all modules where invoice and credit notes are generated. It is however not available for Retail POS and Job Costing.

Please note that the Fiscal Printer setup on this blog is only applicable to Evolution Version 10.1 (not version 10).

Apply the following steps to achieve the above:

On Evolution version 10.1 the company creation option determines the country. Select the Other option for Rwanda.

Please note the Fiscal Integration module is installed automatically, part of the Core installation of Evolution

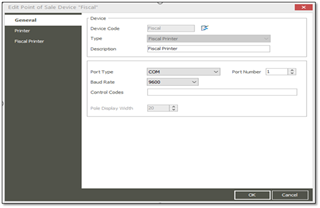

1.If using the POS module, go to POS | Maintenance | Devices | General tab and

setup the device as follows.

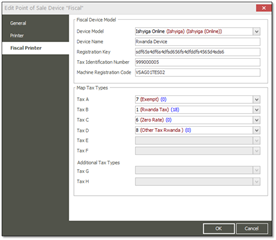

2.For POS module (as relevant), go to the Devices | Fiscal Printer tab.

3.In here map the Tax Types to the Tax Labels (Fiscal Labels) by selecting the 4 Tax Types as setup below.

4.When done, click OK below to save the changes.

The Fiscal Printer tab will only be available if the Fiscal Printer type has been selected on the General tab

5.Go to the Printer tab – you don’t need to select any printer drivers in here.

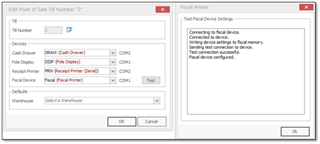

6.If using the POS module go to POS | Maintenance | Tills and edit the first till record.

7.Select the Fiscal Device record as created/configured above and setup the rest of the fields below.

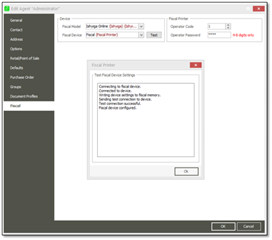

8.Click the Test button after selecting the device to determine if there is a valid connection between the Till and the Fiscal Device.

9.If you are using the Annuity Billing add-on module, do the following:

Log in as agent Admin into the company

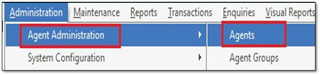

Go to Administration | Agent Administration | Agents

Find and edit the first agent for which the fiscal printer needs to be setup.

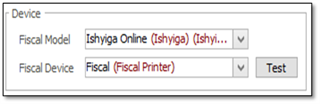

On the Fiscal page | Fiscal Model dropdown, select the Ishyiga Online fiscal printer.

Note that this Fiscal printer is only available in Evolution version 10.1.

On the Fiscal Device dropdown, select the new device setup earlier in the steps above (Steps 3-9).

When done, save the new changes.

Repeat steps from 9 for the other relevant agents.

FINALLY, PLEASE ALSO NOTE:

- The company (Company VAT Number) must be 9 digits.

- All account receivables MUST have tax numbers and addresses. Automatically created CASH CUSTOMER in Evolution can have a tax number “N/A”.

- Credit notes MUST be load as a linked document. This setup is in agent permissions.

- Note that the device only uses inventory items and not GL accounts, as the device requires item information.

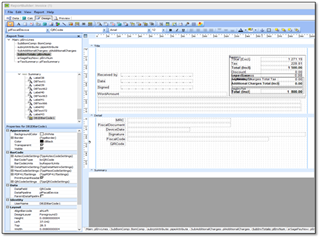

QR Code

QR code is the same for the invoice and the credit note.

We are using DB2BarCode with the following settings:

- BarCodeType: bcQRCode

- PrintHumanReadable: ticked

- CharEncoding: bceUTF8

- EncodeType: etqrAlphaNumeric

- Data Field: signature

- Data Pipeline: plFiscalDevice

- Font Size: 3

To run the algorithm, we need the config file (EvolutionConfig.xml) in the VSDC folder.

If the algorithm changes the software, the version in this file should also be updated.

<VERSION_TIER>VSDC 5.7.2RB ISAMBAZA</VERSION_TIER>

<TOKEN>sdf65s4df6s4dfsd656fs4dfddfs4565d4sds6</TOKEN>

<CMD></CMD>

<DATA></DATA>

<SENDER>KIERRORMENYI</SENDER>

<MSG>END</MSG>

Here is a brief description of what was done for Rwanda with regards to the Signature:

This is basically the Signature for Source documents when they are processed, and this includes the following documents:

- Credit note and the Credit note Copy (this includes the reprint of the document),

- Invoice and the Invoice Copy (this includes the reprint of the document),

- Annuity Billing.

Signature is also included on the following scenario:

- When you setup an Agent and Point of Sale is not Registered

- When you setup a Till and Point of Sale is registered

There is also new functionality to setup the Device and the taxes which is specific to Rwanda.

Implemented the QR Code’s and Signature fields on the document layouts, this includes Source documents and Annuity billing

There is also functionality that has been implemented to validate the tax number, the tax number must be 9 digits/letters.

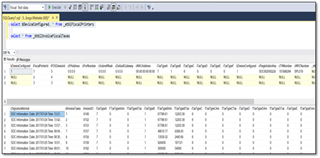

Run below script on SQL to see if the device is configured and Signature is reflecting, bDevicecnfigured should reflect 1.

select bDeviceConfigured, * from _etblFiscalPrinters

select * from _btblInvoiceFiscalTaxes