Were you ever asked by auditors to track deleted payments? Is it a requirement in one of the countries where you have operations If so, I have a parameter for you: PAYDELTRC (Tracking deleted payments)! We use this parameter to determine whether information for deleted payments, like date and user, is saved in a dedicated table. This parameter was added in 2021 R4.

What happens when a payment is deleted?

- When a payment is deleted, records in the PAYMENTH and PAYMENTD tables are cleared.

- We no longer have system records of the payee, amount, invoices paid etc.

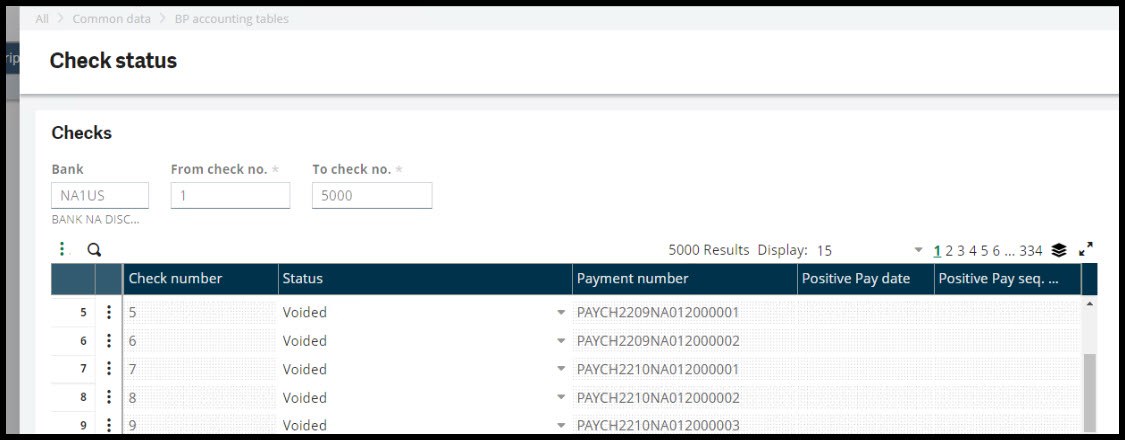

- If the Checkbook is used, the deleted payment will show in Check status with the Check number, Payment number and Status of Voided.

- The Checkbook grid is located under Common data, BP accounting tables, Checks.

- To view the status, click the Action icon on the grid line and select Check status

- Checks 5 through 9 below were deleted.

- While you have the payment numbers, you don’t have any details on payee, amounts, invoices paid, etc.

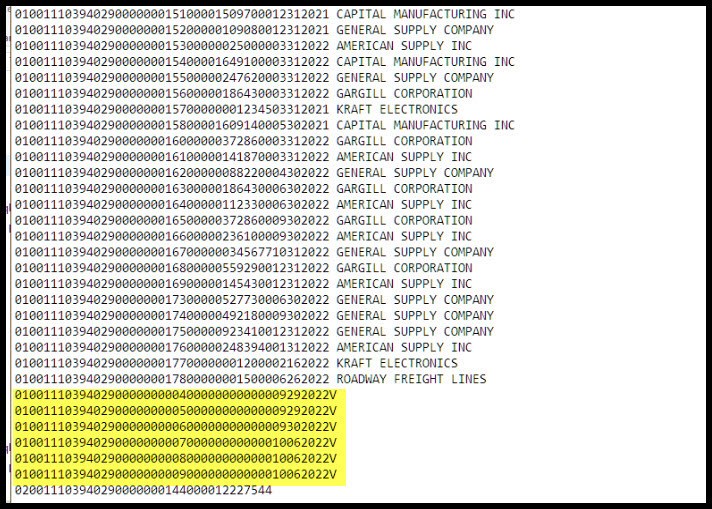

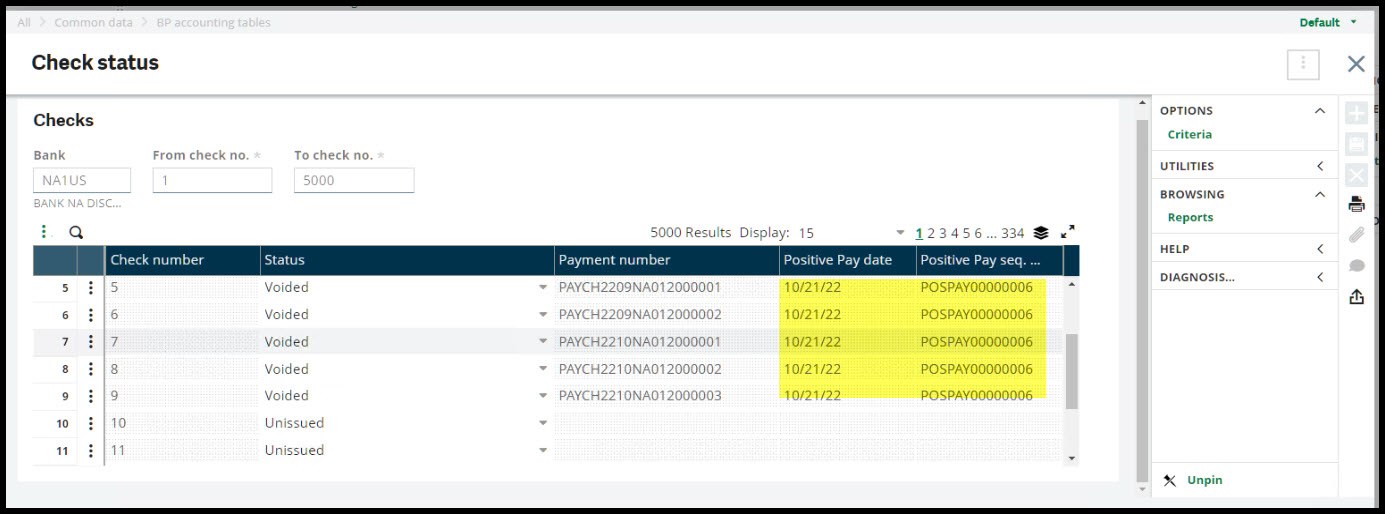

- Note that the check will display as voided after the Positive pay file generation (GESPPY) is executed. The file generation function is found under A/P-A/R accounting, Payments. Below is the Positive pay file with the deleted checks 5 through 9.

- Now back to the Check status The Positive Pay number and the Positive Pay sequence number fields have been populated.

- We only know the Payment number and the Check number for these checks.

Why are we interested in tracking deleted payments?

- Tracking helps account for gaps in sequence numbers created by the deletion of a payment.

- Auditors may request this tracking for internal control purposes.

- Certain countries. such as Portugal, have a mandatory requirement to track deleted payments.

- In the case of accidental or fraudulent deletion of payments, tracking will provide the payment amount, payee, associated invoices details, deletion date and user who deleted the payment so that the payment can be either be traced or entered into the system.

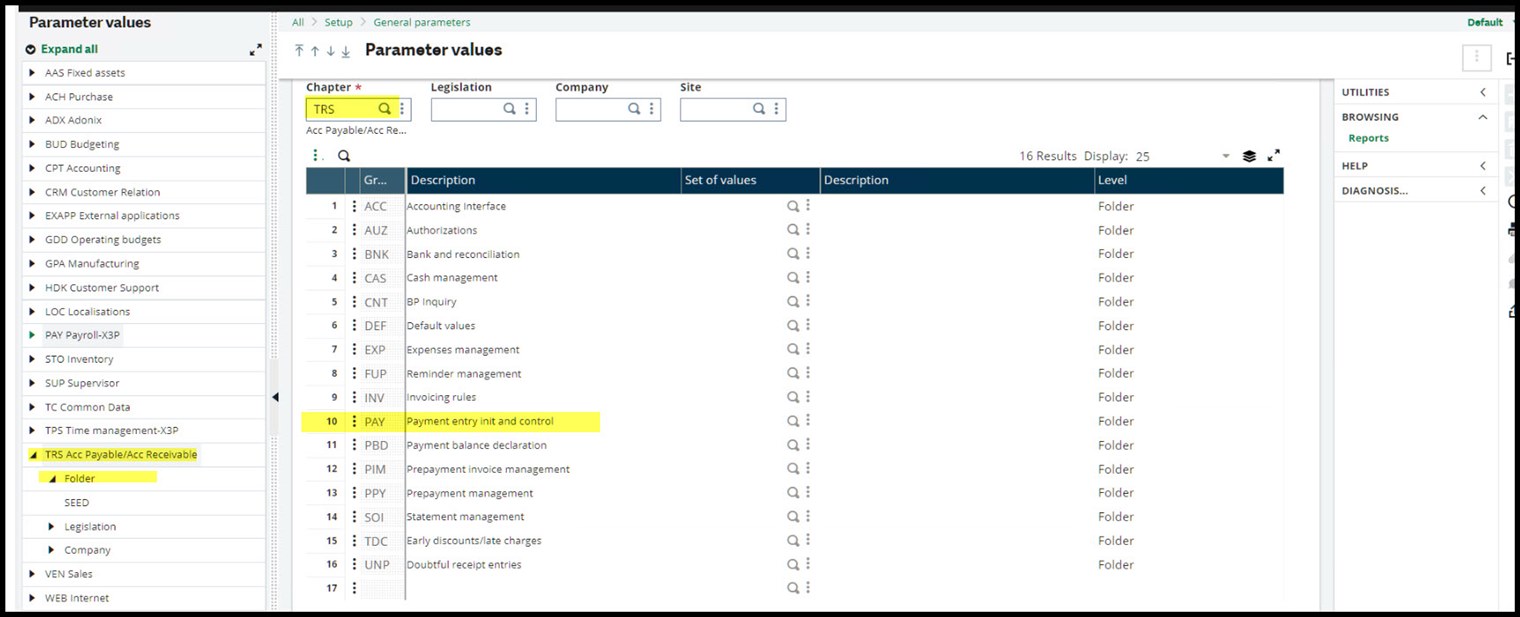

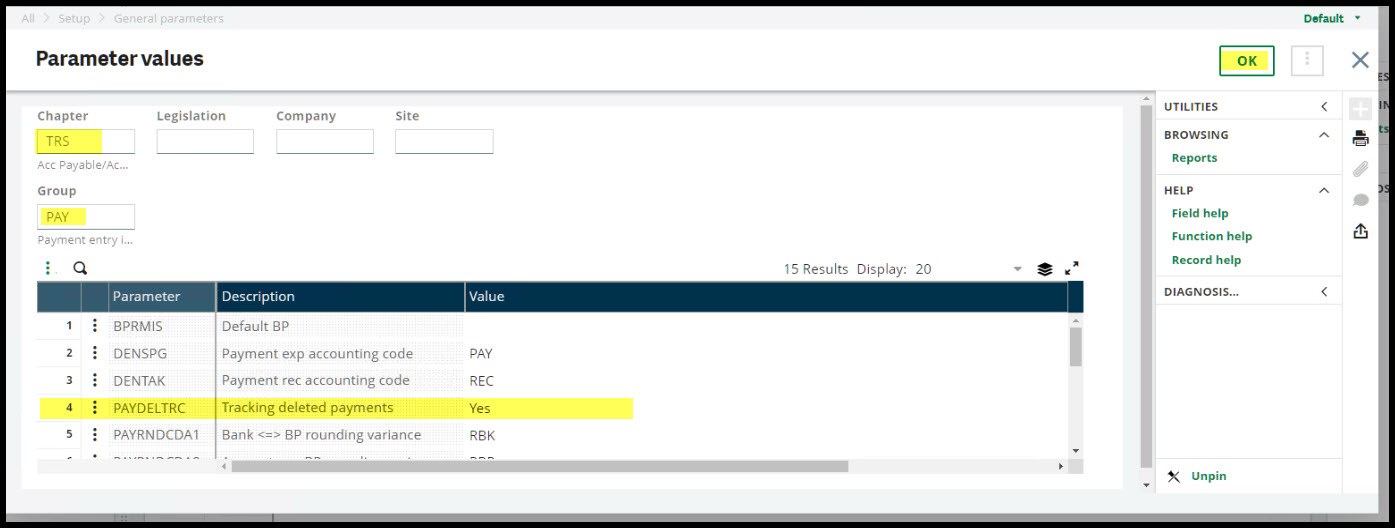

How do we turn on payment deletion tracking?

- Open Parameter values under Setup, General parameters.

- The parameter can be set on the Folder, Legislation, or Company In this example, we will set the parameter at the Folder level

- Select Chapter TRS, Group

- Set the value of PAYDETRC to Yes.

- Click OK.

- This will return you to the main Parameter values screen, where you should click the Save icon before exiting. It is a common mistake to forget this step. After changing a parameter, it is a good idea to log out of X3 and back in to ensure that the change is passed throughout the system.

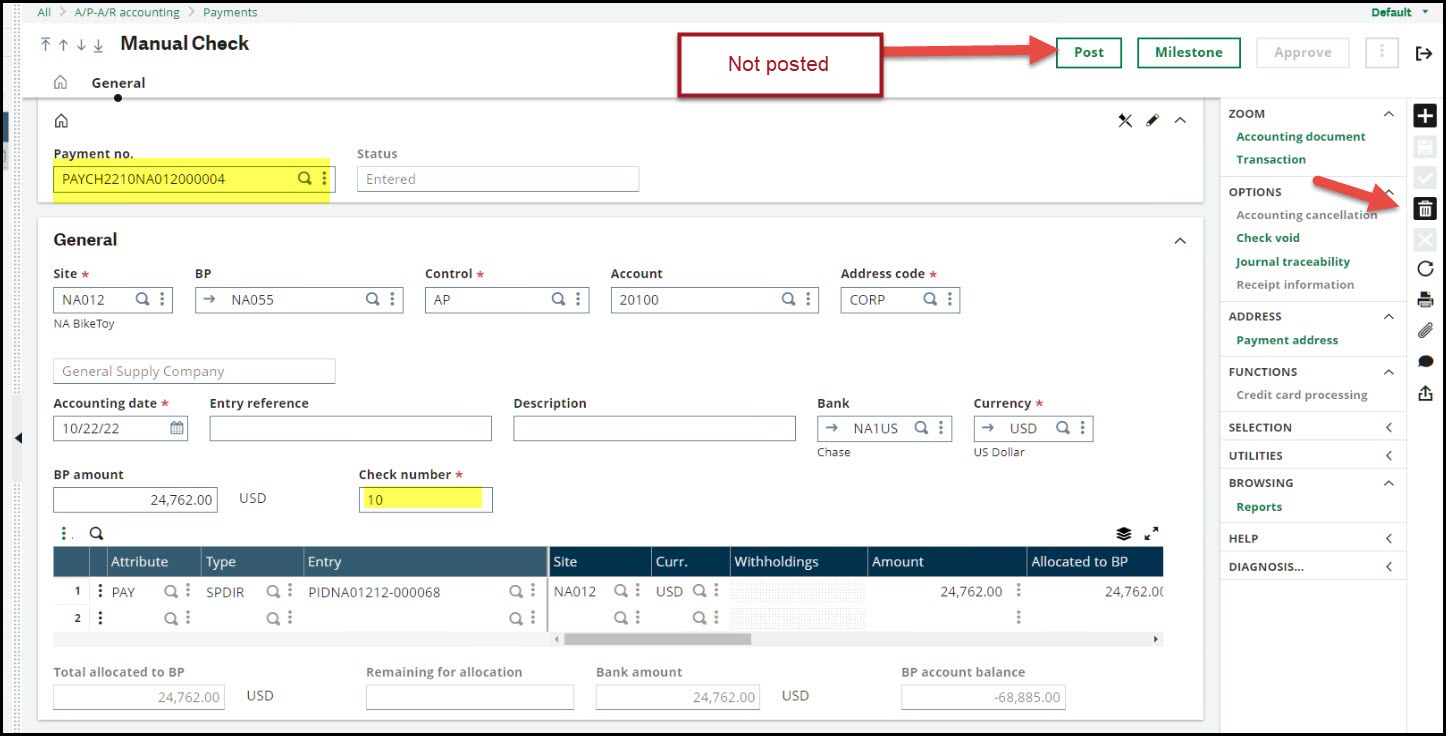

What happens when you delete a payment with PAYDELTRC set to Yes?

- Created payment under A/P-AR accounting, Payments, Manual check: Payment no. PAYCH2210NA012000004, Check number It paid Invoice document number PIDNA01212-000068.

- We will delete the payment by click on the Delete icon (garbage can)

- Payments can only be deleted if they haven’t been posted.

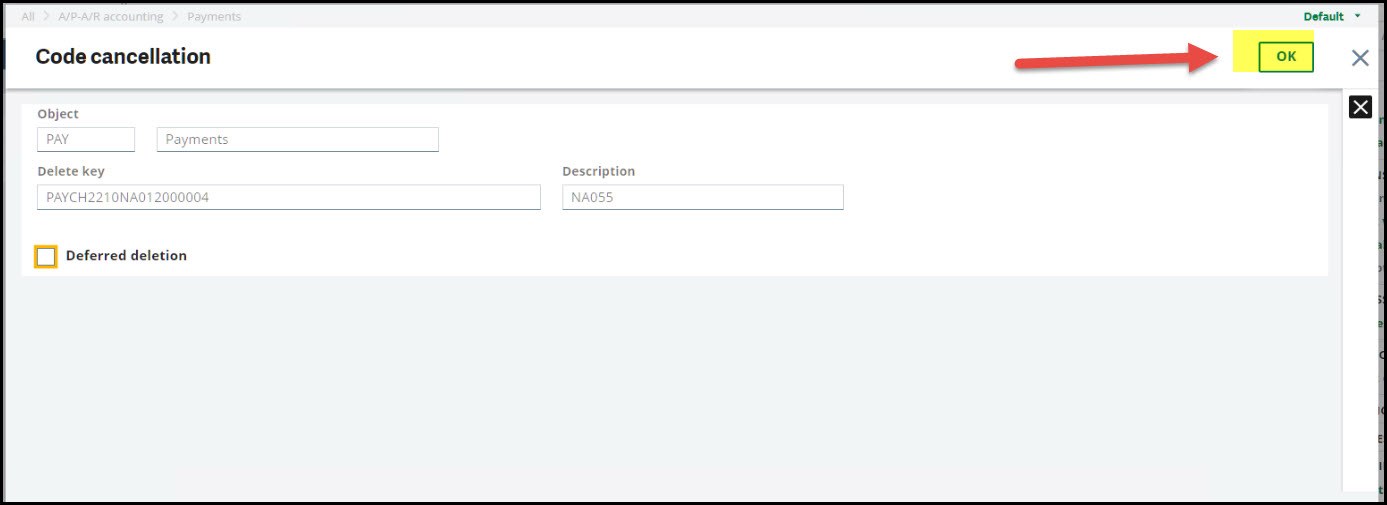

- First, Code cancellation Click OK

- If at this point you realize that you don’t want to delete the payment, click “X” to cancel.

- Click OK on the Information message which tells you what Payment no that will be deleted.

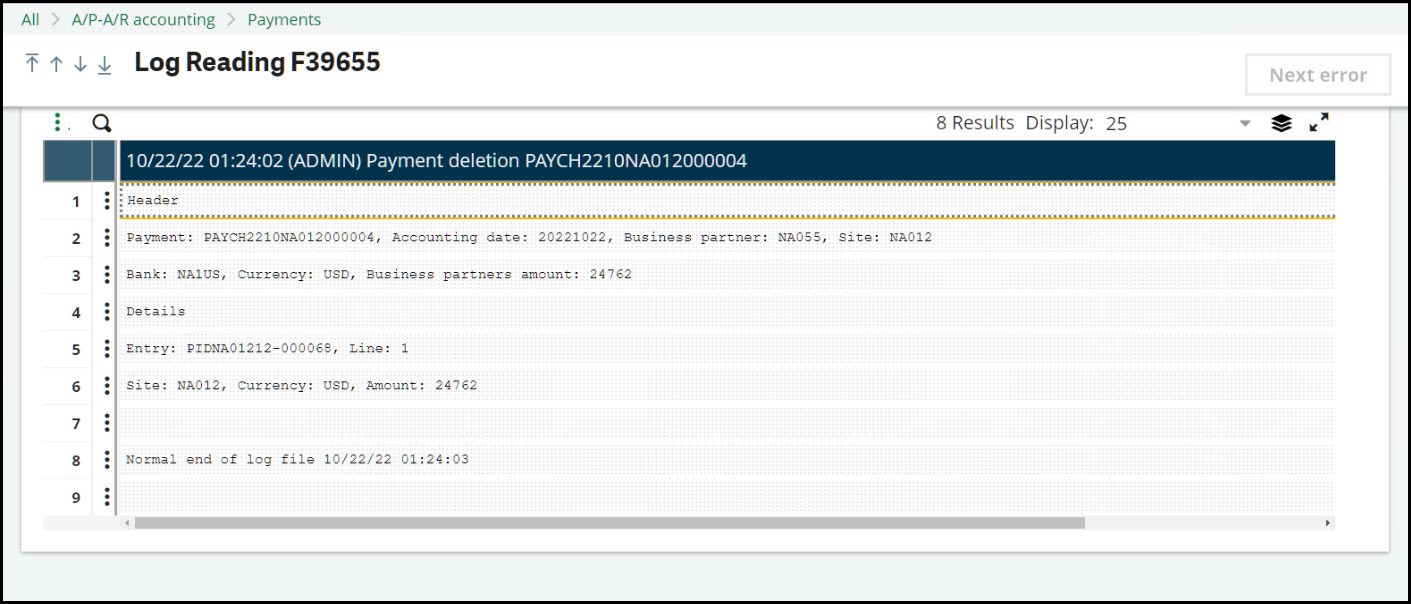

- Next, we have the deletion Log which displays data such as payment number, check number, payee, invoice document number (PIDNA01212-000068) from check, check amount and site.

- There is no log if the PAYDELTRC parameter is set to No.

- If you close the Log and want to view it again, go to Reports, Reports, Log reading.

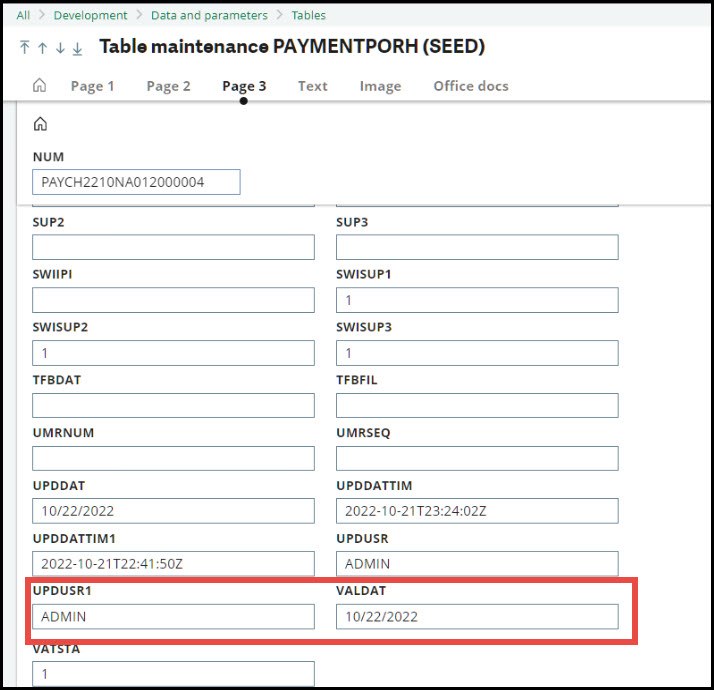

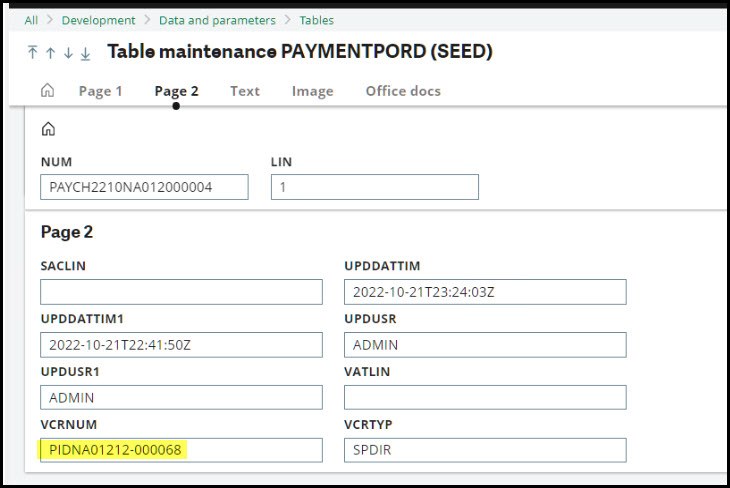

- The deleted data has been captured in the PAYMENTPORH (header) and PAYMENTPORD (lines) tables

- Using GMAINT to view PAYMENTPORH table, we see the UPDUSR1 was the user that deleted the record. (I was signed in as ADMIN). VALDAT is the day it was deleted.

- A quick look at the PAYMENTPORD table shows the VCRNUM which is the invoice document number from the deleted check.

How do I monitor the deletions?

- Here are a few suggestions:

- Set up a Workflow to notify you when there are new entries to the tables (the auditors will probably like this option).

- Create a Query Tool report and run this periodically.

- Create a recurring Sage Enterprise Intelligence report.

I hope you find this information on tracking deleted payments interesting and useful in your day-to-day processing.

Take care my X3 friends. Stay safe!