Hi All!

It’s time once again to start preparing for 1099 filings!

What’s a 1099 form?

Some of you may not be familiar with 1099s. For those, a 1099 form is used to report various types of wages, salaries and tips that aren’t reported on W-2s to the IRS. They are prepared by 3rd parties such as employers, banks, etc. The forms are sent to individuals to assist them in preparing their tax returns.

The 1099 amounts include only payments made within the calendar year.

1099 Forms for Sage X3

There are various types of 1099 forms, but Sage X3 only covers 1099-MISC (Miscellaneous Income), 1099-NEC (Non-employee compensation), 1099-DIV (Dividend income) and 1099-INT (Interest income) forms. Sage X3 provides the ability to track 1099-DIV and 1099-INT data, but not to print those forms. For 1099-MISC and 1099-NEC, data can be tracked, and the forms can be printed from X3. 1096 forms can be printed.

Electronic filing is not available for 1099s in Sage X3. Data can be extracted for use in 3rd party products. See your Sage business partner if assistance is required.

What’s new in 1099s for 2021?

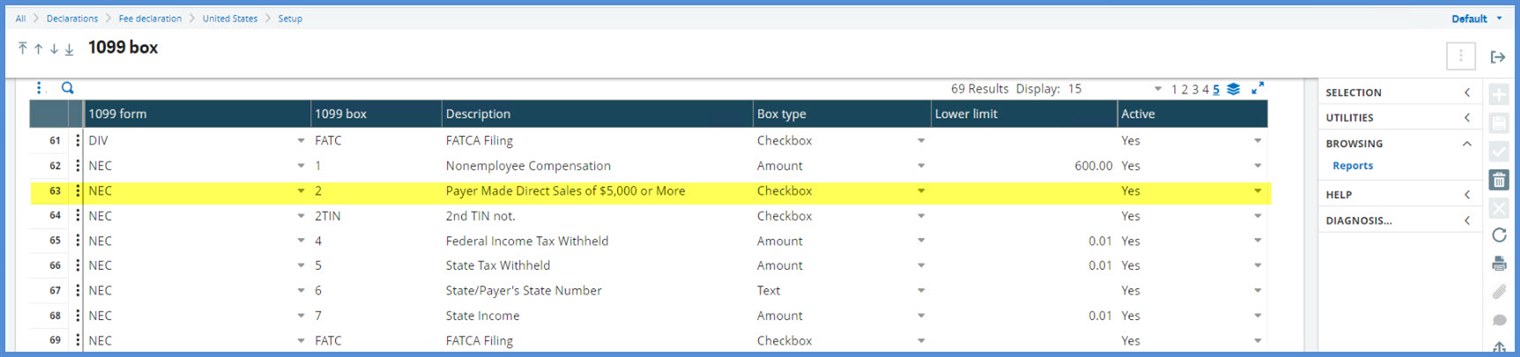

1099-NEC: A new checkbox 2 was added. This is for payers who made direct sales of $5,000 or more. The boxes have been repositioned and resized to accommodate the new 3 forms per page.

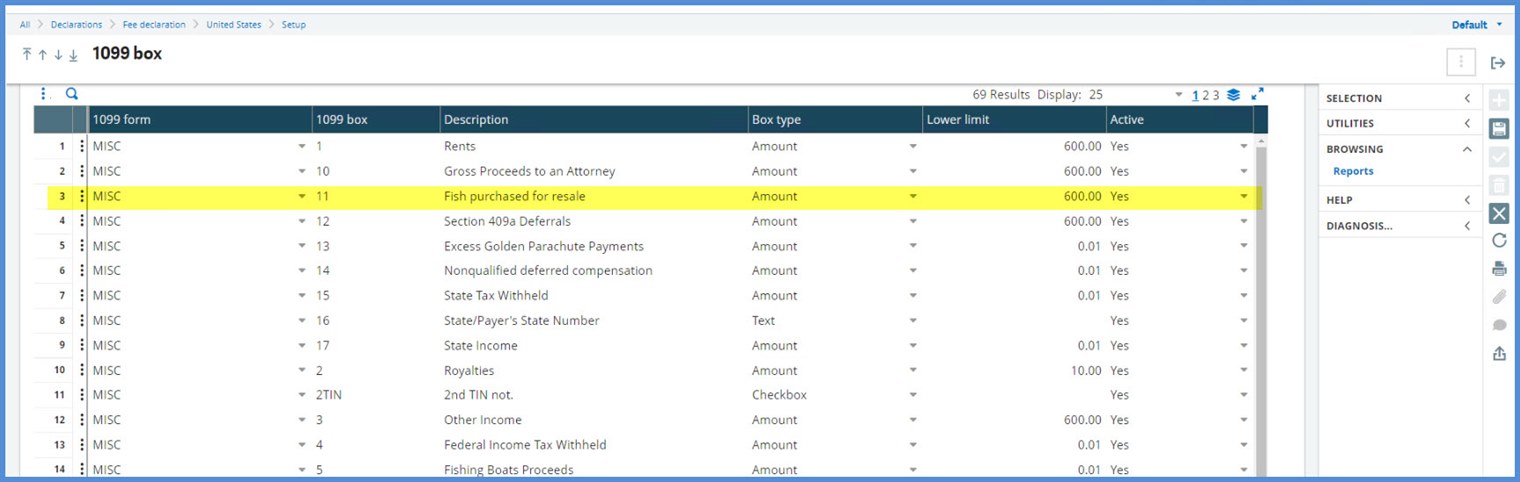

1099-MISC: A new box 11 was added. The box is for Section 6050R-Fish purchased for resale.

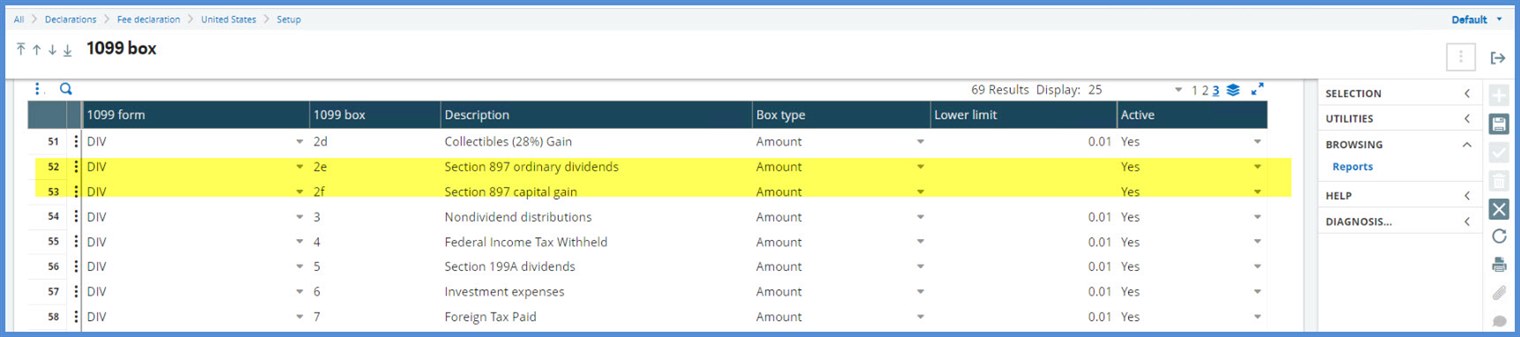

1099-DIV: New boxes 2e (Section 897 Ordinary Dividends) and 2f (Section 897 Capital Gain) were added.

1099-INT and 1096 (Annual Summary and Transmittal of U.S. Information Returns): No change.

Where can I get the Sage X3 1099 updates for 2021?

The update is available in the Sage knowledgebase via article 113691. To access this download, log into https://sagekb.com/ and in the search field type 113691. Click Search. Note that you must have an active maintenance agreement to login to the knowledgebase.

The Update is cumulative, so you don’t have to install 1099 updates for prior years.

Be sure to read the documents attached to the KB article, SageX3_2021_1099InstallationGuide.pdf and SageX3_ 2021_1099UpdateReleaseNotes.pdf, before beginning the installation process.

What versions are covered by the Sage X3 update?

The 1099 update for 2021 covers v11 and 2019R5 (v12p20) and higher. The update is included in v11p21 and 2022R1 (v12p29) and therefore doesn’t need to be installed on those two versions.

What if I’m on a version not covered by the Save X3 1099 update for 2021?

Please see your Sage business partner to discuss upgrading or alternative methods of extracting the data.

How do I know that the 1099 update for 2021 has been installed?

So, your IT person went on holiday and forgot to mention if the 1099 update was installed. You can tell if it was installed by going to Declarations, Fee declaration, United States, Setup, 1099 box. Search for the new boxes listed above.

1099-NEC: checkbox 2 (Payers Made Direct Sales of $5,000 or More)

1099-MISC: box 11 (Fish purchased for resale)

1099-DIV: boxes 2e (Section 897 Ordinary Dividends) and 2f (Section 897 Capital Gain)

Don’t forget that per the instructions, a dictionary validation for the Activity Code S1099 must be run after installation. The validation should be run on the child folder.

Why is there no data when I generate 1099s or why am I’m missing payments?

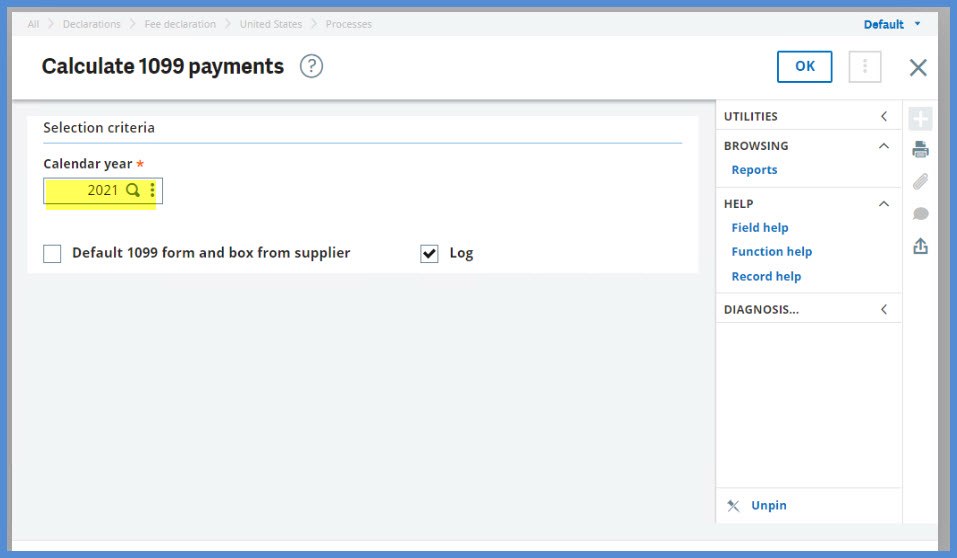

Have you run Calculate 1099 payments (BPS1099CLC) for the appropriate Calendar Year under Declarations, Fee declaration, United States, Processes? Per the Online help for the function:

“The Calculate 1099 payments function is a utility to create supplier 1099 payment records. At year end, the payment records generated during this processing and any supplier 1099 beginning balance amount will be used to determine the amount to report on the 1099.”

Were the lines on the invoices associated with the payments, assigned a 1099 code? Only “1099able” line items are included.

Were the payments made during the calendar year? Only payment dates matter in the 1099 calculation. Invoice dates and your fiscal year are not brought into the calculation.

How do I fix errors?

There are several ways to correct the data, but keep in mind that these changes should be documented in case of future audits or supplier questions!

- Enter amounts in 1099 beginning balance under Declarations, Fee declaration, United States, Processes.

- Correct amounts in Declarations, Fee declaration, United States, Processes, 1099 payment summary. Click the Edit 1099 data on the lines.

- If you have numerous invoice lines where the 1099 values weren’t completed, populate the default 1099 form and 1099 box values under Common data, BPs, Supplier on the Financial tab. Then rerun Calculate 1099 payments with Default 1099 form and box from supplier selected. Be cautious when doing this. From the Online help:

“If checked, the form and box from the supplier will default on the payment record, when the invoice 1099 form is none and the supplier has selected a default 1099 form type on the supplier record. This is useful when a supplier is initially not setup for 1099 tracking and invoices and payments have been processed against the supplier.”

Miscellaneous

- For information on what to include, verifying deadlines, etc. refer to your tax advisor or https://www.irs.gov/.

- If you have 1099 data from another system to bring in, import template B9B (1099 beginning balance) is available.

- Because there are so many different printers and drivers, you may have to adjust your Crystal reports. See your Sage business partner if you are not familiar with adjusting Crystal reports.

- You can purchase forms by calling Sage Checks and Forms at 800-617-3224 or go to https://www.sagechecks.com/estore/ and request the generic preprinted 1099-MISC or 1099-NEC/ 3 per page forms.

- See KB 18346 1099 FAQ for additional 1099 information. This is updated as information becomes available.

- To be notified of releases like the 1099 updates, patches and other important announcements, be sure to subscribe to the Forum Sage X3 Announcements, News and Alerts https://www.sagecity.com/us/sage_erp_x3/f/sage-x3-announcements-news-and-alerts. Just click on Turn forum notifications on.

- So you don’t miss any blogs like this one, go to Sage City and Sage X3 Support Blogs https://www.sagecity.com/us/sage_erp_x3/b/sageerp_x3_product_support_blog. Click on Turn Blog notifications on. (Be sure to Like the blog on your way out)

I hope this helps you with your 1099 adventures.

Take care my X3 friends. Stay safe!