Yes, it is that time of year again when I nag you, I mean remind you, that the year-end close is just around the corner. We will take a Christmas Carol style look at the close and I will be your Jacob Marley. We’ll cover some of the pieces that often get missed and lead to a scary year-end.

Ghosts of Year-end Closes Past

We will step back in time to last year’s close.

Don’t ignore your notes from last year. (You take notes, I hope) What went well? Were there any pain points? Were there any issues with the closing periods or the fiscal year? Were you able to easily provide all the analysis/reports that the auditors requested? Did all the tasks leave you unable to sleep? Any moments when you were reconsidering your career choice?

Ghosts of Year-end Close Current

We step now into the current time. What is going on this year? What can you do to remove some scary events?

- Get a start on your year-end close as possible. Remove some of that stress from last minute running around. Create a close checklist.

- Are there reports that need to be created based on last year’s close? Map out your requirements and line up your resources to create these reports. Business partners will be busy so be sure to reserve their time early.

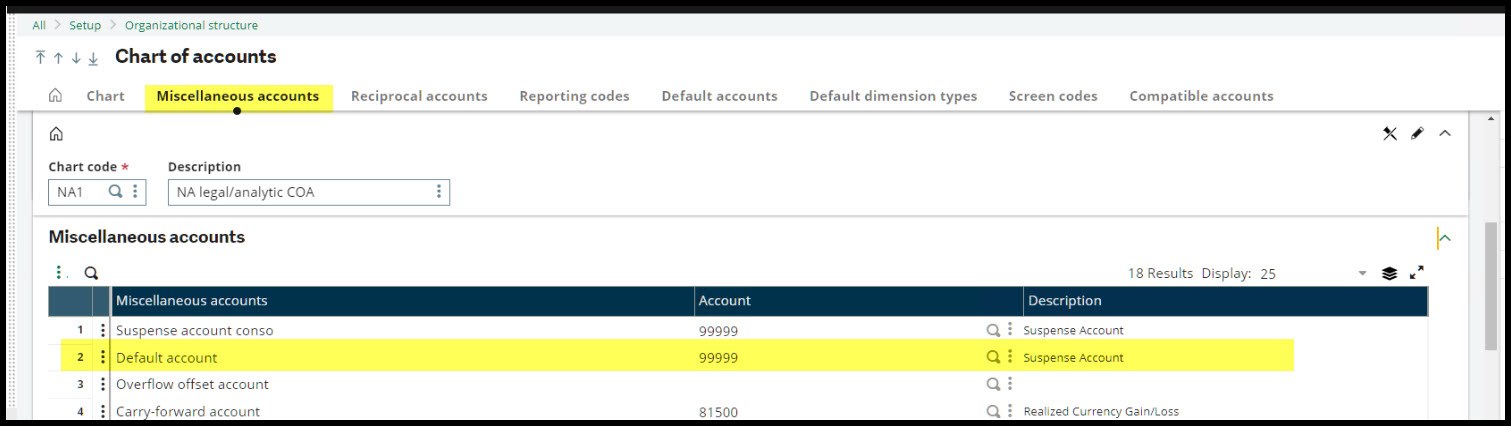

- Have you reconciled your Suspense account? This should be done regularly as entries could significantly impact your financials. Have you corrected transactions that continue to hit that account? Which account is my suspense account? The suspense account is assigned in the Chart of accounts on the Miscellaneous tab, Line 2 (Default). This is the account used by the Automatic journals. You may have established another suspense which is populated by manual entries and it will need to be cleared too.

- Are your bank reconciliations up-to-date? Have you recorded bank charges? Unrecorded cash receipts or checks may distort your agings.

- Speaking of A/P and A/R agings, have you reviewed yours? While there are no subledgers to reconcile to the general ledger (the G/L is the subledger), there are still items to review. Ensure payments, credits, and invoices have been matched. Are there overdue customer invoices that you want to address before the audit starts? Are there supplier balances or disputes to clear up?

- Remember to review the Accounting tasks under Usage, Batch server to ensure transactions have make their way to the General ledger. The Matching field should be zero as should the Journals on hold field. Transactions stuck here may impact your agings, cash and inventory as well as your revenue and expense numbers.

- Are your year-end physical inventories scheduled or completed? Have you reviewed your costing?

- Have you closed out the monthly periods? All the fiscal periods must be closed in sequential order before you can close the year. It’s better to clear up any issues as they come up than waiting until the last minute and trying to clean 12 months’ worth of them up in a panic. Also, it helps to resolve issues when they are still fresh in everyone’s mind.

- Remember that periods and fiscal years can be reopened! Reopen period (OPNPER) and Reopen fiscal year (OPNFIY) are found under Financials, Utilities, Closing.

- Have set up your next fiscal year? The next fiscal year must be setup and the first period opened before the current year can be closed. You will find the Fiscal years (GESYIY) or Periods (GESPER) under Common Data, General accounting tables.

- Also, there are the handy functions Multi-company period opening (TRTPERMC ) and Multi-company period closing (FUNPMCCL). These functions can potentially save you time if you have a number of companies to process.

- Gather the team together to discuss those notes and memories from last year’s close. Assign out the review of last year's pain points.

- Update your test environment with current data and run through the close. This will reveal potential issues that can be cleared up before the last minute. You can make sure that account balances appropriately roll forward to the new year.

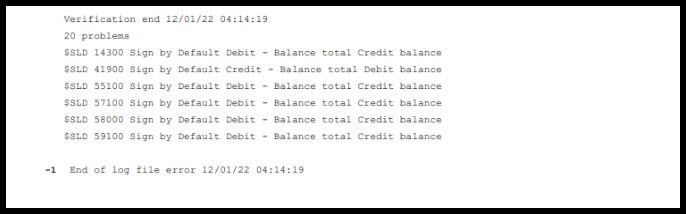

- One part of the close is running the Cloper (Pre-closing verification report). Note how you resolved errors in the test enviornment. Don’t get overwhelmed with the errors. Typically, the most error messages on a Cloper report start out with “$VERF_HAE Temporary Journal.” The error means you have journals with a temporary status and this prevents the closing. The journals can be changed to Final either manually on the journal (GESGAS) itself or in mass under Financials, Current processes, Final validation (CPTVAL). Once those temporary journals are moved to Final status, the “true” errors will be easier to discover.

- While we are on the subject of the Cloper report, there is a Verification section at its end. This tells you if an account balance is a debit when it should be a credit or visa versa. It won’t stop you from closing, but it is worth investigating. (Have I over amortized a prepaid or not accrued a liability? Have transactions been going to the wrong account?)

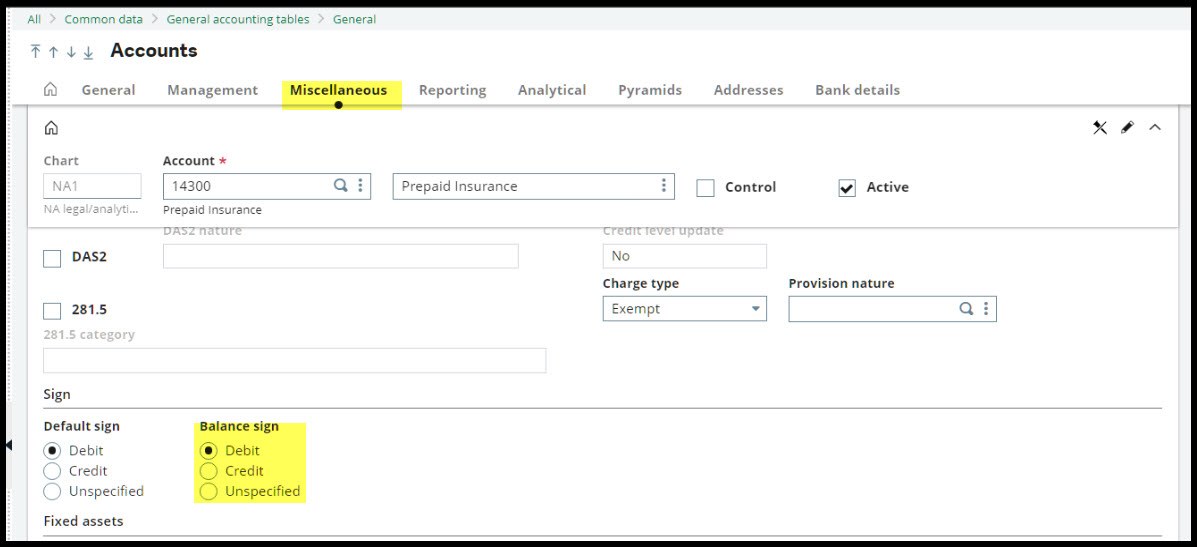

- How did the system know that the account should have been a debit or credit? This is set on the Miscellaneous tab for Accounts (GESGAC), under Common data, General accounting table, General.

- When the close is over, get the team together to gather everyone’s thoughts. Add these to your close notes. Update your year-end close checklist with your discoveries

Ghost of Year-end Yet to Come

Let us journal into the future.

- Learn from previous closes! Keep your notes on the closes.

- Add to your close checklist throughout the year.

- Keep current with period closes and reconciliations of the suspense and bank accounts.

- Have a test environment that is updated with current data for testing, training and ready for the next year-end close run through.

- Plan a pre-close meeting to plan for the close.

- Start the process early.

- Don’t forget to check out What’s new in the Online help center. There may be a new feature that you can utilize to make your life easier.

Hopefully, this will make your year-end closes less scary.

Take care my X3 friends. Stay safe!