You've been pondering why your sales invoicing elements end up posting to suspense.

Let me start off by giving you double kudos! You have the suspense account setup for the Chart of accounts (GESCOA), and you are reconciling the suspense account.

Before we proceed, let’s look at what a suspense account is. A suspense account typically is where we code journal lines until we figure out where the amount should actually be coded. Examples:

- We may code our utility bills there until we can allocate the amount out to the appropriate departments or locations.

- We may have consulting or supply invoices coded to suspense until we determine what project they belong to.

In Sage X3, we have a suspense account for our auto journals called the Default account. It is Line 2 on the Miscellaneous accounts tab under Setup, Organizational structure, Chart of accounts. Per the Online Help: “This account is used in the automatic journal generation process when the account built from an accounting code is inconsistent or when the account has not been defined.”

We can select either a balance sheet or P&L account for suspense. Keep in mind that the P&L account balances will zero out at year end. This account doesn’t have to be just for the auto journal problems.

Don’t confuse this with Line 1 which is a suspense account to save the counterpart for the multigroup entries during the extraction for consolidation purposes.

How do we prevent our sale invoice elements from ending up in the Default account?

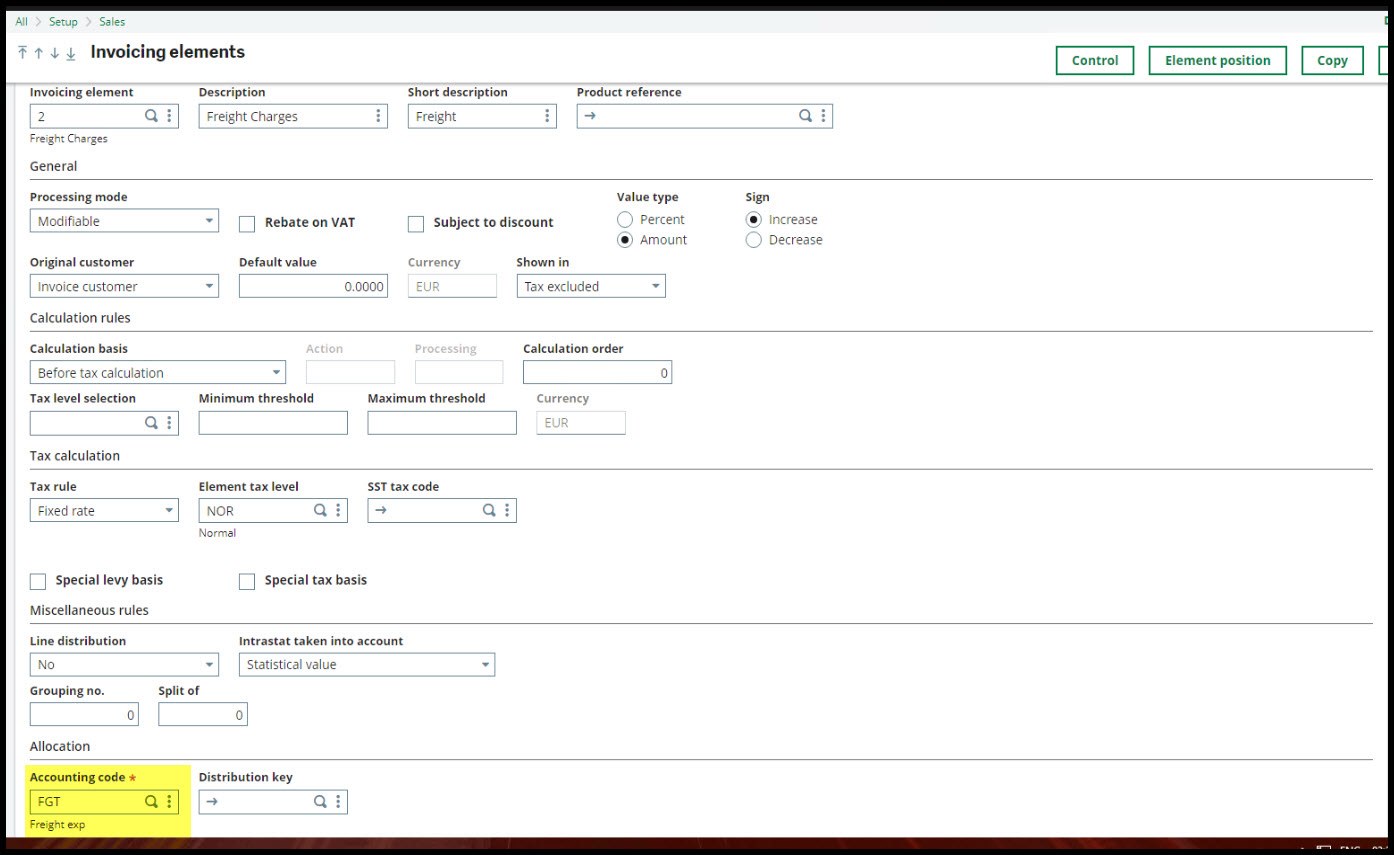

Sales invoicing elements are assigned an Accounting code under Setup, sales, Invoicing elements (GESSFI10). Each invoicing element can have its own Accounting code. In our example, we are using Invoicing Element 2 (Freight charges). Its Accounting code is FGT.

The Accounting code has to be assigned some General Ledger accounts. We can jump via the action dots on the field or go to Setup, Financials, Accounting interface ((GESCAC)). Note that the Type is Sales footer and the Code is FGT. In the left list, you can see there are Sales footer accounting codes for the different sales invoicing elements. There are G/L account lines for credits and debits.

If we need to create a new Accounting code for our Sales invoicing element, click the New icon (1) and select Type = Sales footer (2). This will populate the Details grid lines. You are left to add the G/L accounts (3), Code (4), Description (5) and Short description (6), and click Create (7).

We are set to gave the Sales invoicing elements post to our desired G/L account!

Continue to regularly reconcile the suspense account. It is easier to do it when the transactions are fresh in our minds.

As we reconcile the suspense account, don’t forget that the journal entries contain Source, Source document, Document date and Source module information. These fields will help you trace the origin of the transaction.

I hope this helps with your suspense account reconciliations and sales invoicing elements coding.

Take care my X3 friends. Stay safe!