When you have a 4-4-5 calendar that is divided into several periods, fiscal year charge will be distributed over these periods. When you look at the plan simulation screen you might question how it is calculating the monthly charges. The misunderstanding comes from the prorata “Month”. “Month” prorata option is expressed based on a calendar month, not on a fiscal period and the number of months in the depreciation context does not impact the calculation.

Please refer to the online help page for UL straight line depreciation method under Product help, Fixed assets, Fixed assets, Assets, Depreciation method, annex document, American legislation – USA and UL – straight line

If the fiscal year is divided into several periods, the fiscal year charge is distributed over these periods.

If the prorata temporis = ½ year or month, the holding period starts on the 1st day of the month of the depreciation start date.

In that case the period charge is calculated as follows.

Period charge = Fiscal year charge

* (Sum of p1 to pc (number of holding months in the period)

/ Sum of p1 to pf (number of holding months in the period))

- Depreciation total of previous periods

p1 to pc = from the 1st holding period in the fiscal year to the current period included [1]

p1 to pf = from the 1st holding period in the fiscal year to the last holding period in the fiscal year

[1] Unless the asset is issued in the fiscal year before this current period or if it is completely deprecated in the fiscal year before this current period…

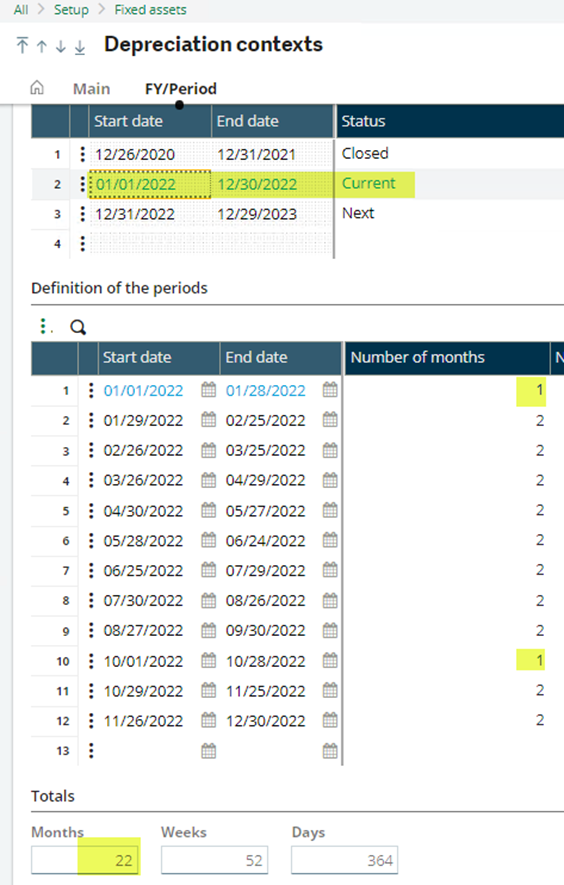

In this example, depreciation contexts fiscal periods are divided into several periods.

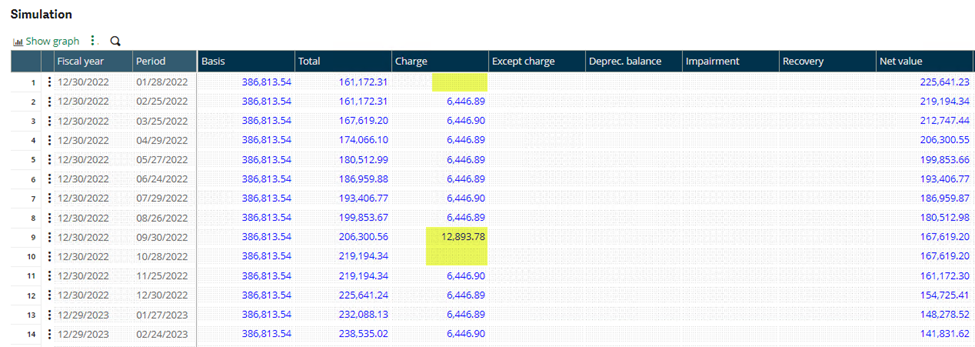

When the depreciation method = “UL” and the prorata = “Month” there are no charges for period 1 and 10 but it doubles on period 9.

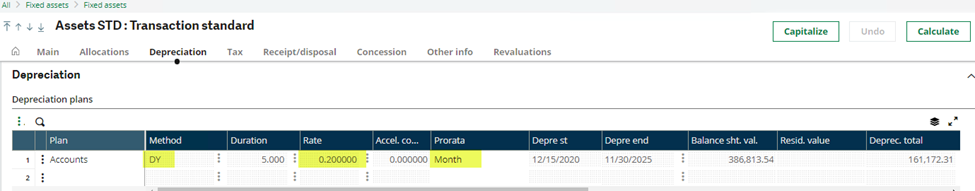

Fixed assets depreciation tab:

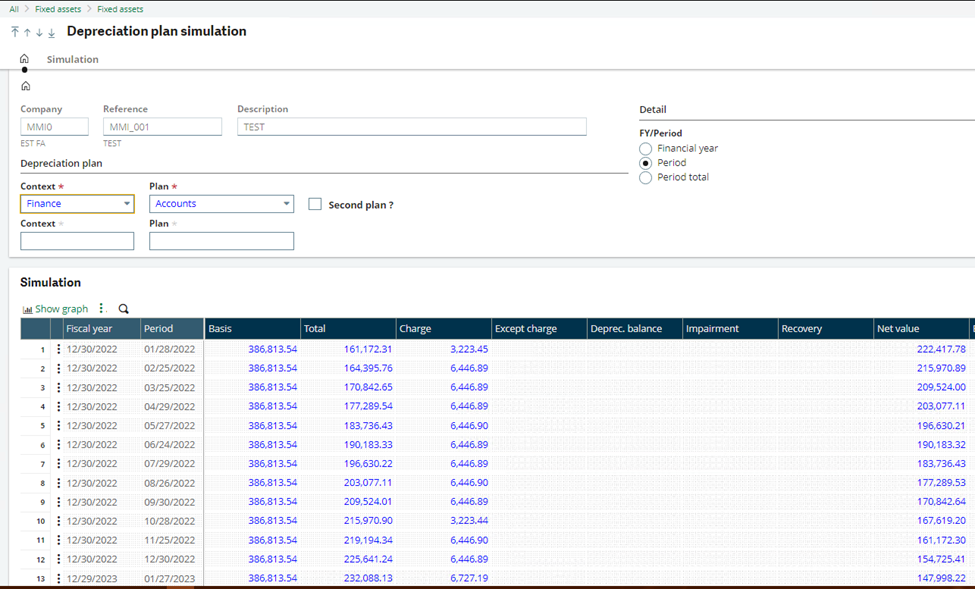

Plan simulation:

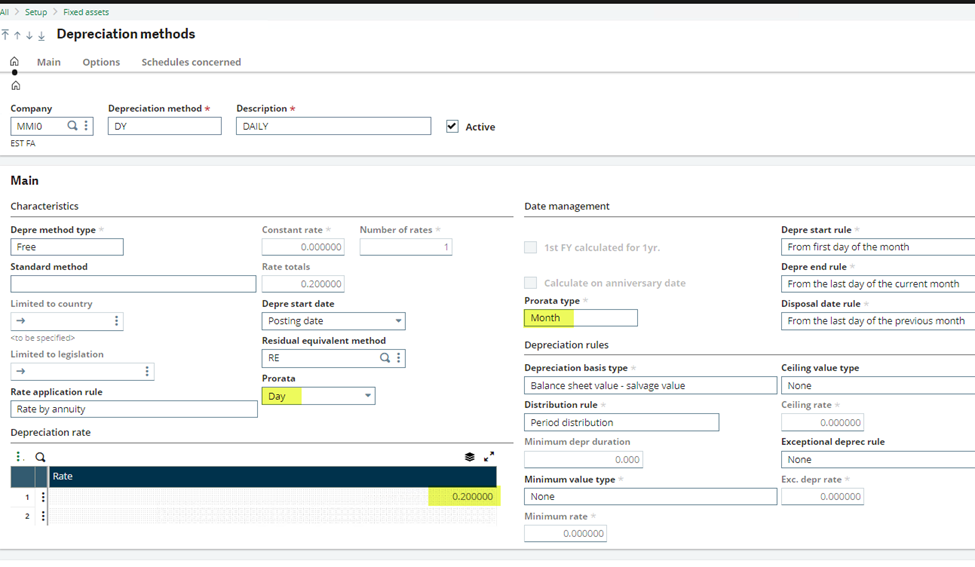

To understand the monthly charge better I used a free depreciation method with prorata “Day” and a single rate of 0.20.

Using the same duration and prorata = month.

The calculation will look like this where there are no zero charges for the periods.

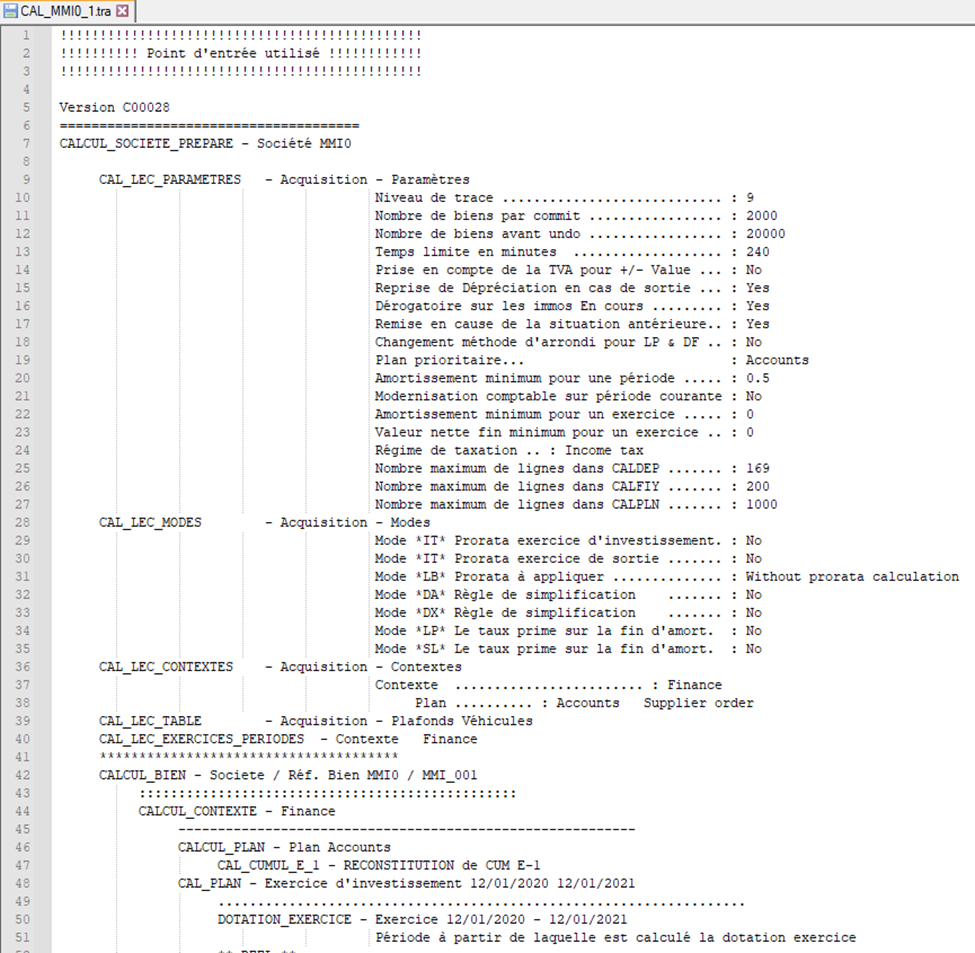

Finally, to check the calculation, we need to set the CALTRACE (calculation log parameter level) to 9.

Note once you are done with the analysis set it back to what it was (0).

This parameter is located under Setup, General parameters, AAS chapter and CLC group.

Log file can be retrieved under TRA directory of the solution (folder) with the name “CAL_Company code”.

Each time when you click the calculation button this file will get overwritten.

I've extracted part of log to show you the depreciation calculation for the current period 1 and 2.

Period 1 [current]

01/01/2022 - 01/28/2022 [n=1]

Fiscal year charge = 70,915.82 (386,813.54 [B/S value] x 0.2 [rate] x 11 [holding duration]/12 [exercise duration])

Number of holding months in a period p1 to pc = 1

Number of holding months in the fiscal year p1 to pf = 22 (total periods in FY 2 [n=..])

Depreciation for the period P-1 + Pc = 3,223.45 (70,915.82 x1 /22)

Cumulative depreciation P-1 = 0

Period charge = 3,223.45

Period 2

01/29/2022 - 02/25/2022 [n=2]

Fiscal year charge = 70,915.82

Number of holding months in a period p1 to pc = 3 (n=1 + n=2)

Number of holding months in the fiscal year p1 to pf = 22

Depreciation for the period P-1 + Pc = 9,670.34 (70,915.82 x 3/22)

Cumulative depreciation P-1 = 3,223.45

Period charge = 6,446.89 (9,670.34 – 3,223.45)

I hope this log file will come handy when you have questions on how the system is calculating the depreciations for non-calendar fiscal years.