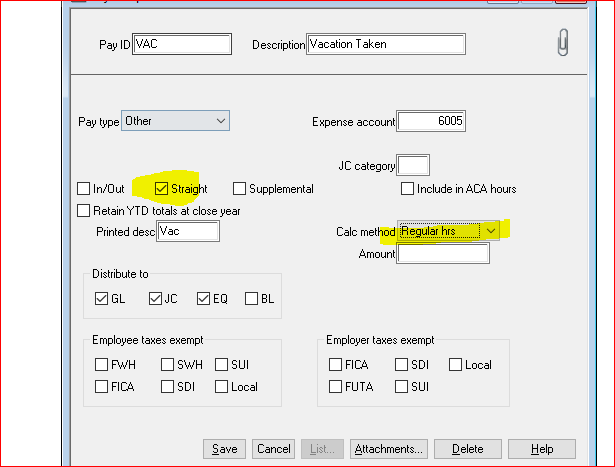

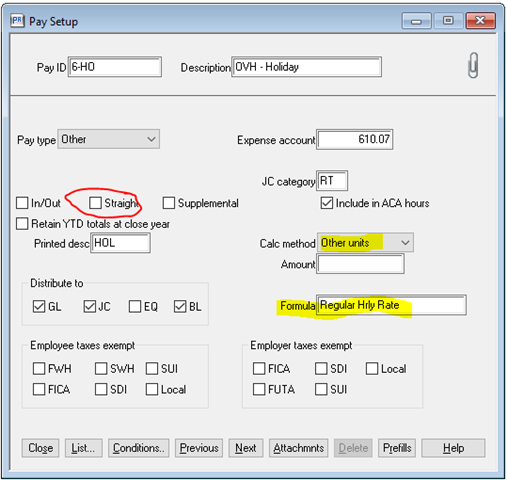

Im wondering if anybody knows the logic for setting up Sick, Holiday, & Vacation as "Other" Pay Type instead of Regular Time since those hours are actually part of the normal 2,080-hours per year (40 hours x 52 weeks).

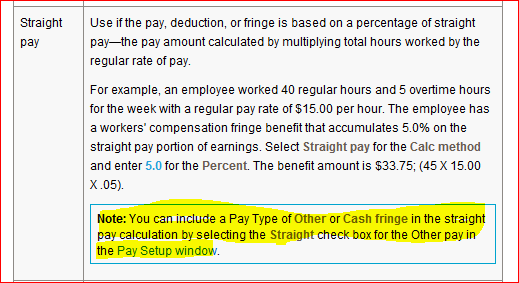

A couple reasons im bringging this up is (1) the pay-stub is calculating short on the total hours from this and (2) our Worker's Comp audit came back with a big bill because "other" pay type isnt part of the accrual calculations.