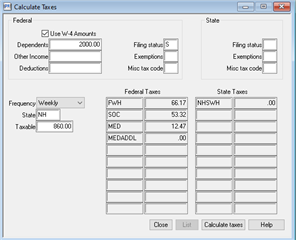

I’m processing my first new employee under the 2020 W-4 form, and I cannot reconcile using the IRS tables to verify Sage’s calculation. Anyone see where I am going wrong?

Single, $2000 for dependent, $860 taxable this week, state is NH (no income tax)

My manual calculations:

$860 x52 = $44,720 Annualized Salary

$795 x .22 (the amount over 43,925) = $174.90 + 4,417.50 = $4792.40 Est Annual Tax

$4792.40 / 52 = 92.16/week less 38.46 dependent credit (2000/52)

$92.16-$38.46 = $53.70 Tax Withheld

Sage says it is $66.17

I cannot reconcile that number – can anyone assist?